We Think Some Shareholders May Hesitate To Increase Cellectis S.A.'s (EPA:ALCLS) CEO Compensation

The underwhelming share price performance of Cellectis S.A. (EPA:ALCLS) in the past three years would have disappointed many shareholders. What is concerning is that despite positive EPS growth, the share price has not tracked the trend in fundamentals. Shareholders may want to question the board on the future direction of the company at the upcoming AGM on 01 June 2021. Voting on resolutions such as executive remuneration and other matters could also be a way to influence management. We discuss below why we think shareholders should be cautious of approving a raise for the CEO at the moment.

View our latest analysis for Cellectis

How Does Total Compensation For Andre Choulika Compare With Other Companies In The Industry?

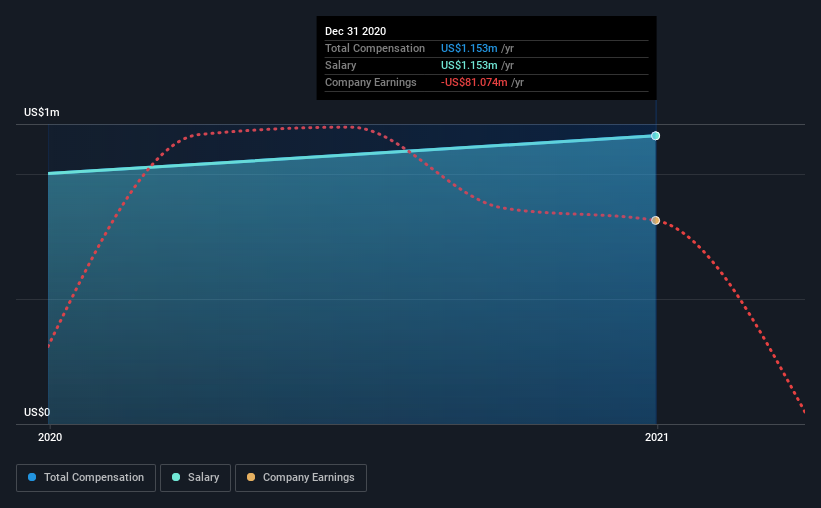

Our data indicates that Cellectis S.A. has a market capitalization of €586m, and total annual CEO compensation was reported as US$1.2m for the year to December 2020. That's a notable increase of 15% on last year. It is worth noting that the CEO compensation consists entirely of the salary, worth US$1.2m.

On examining similar-sized companies in the industry with market capitalizations between €327m and €1.3b, we discovered that the median CEO total compensation of that group was US$1.2m. From this we gather that Andre Choulika is paid around the median for CEOs in the industry. Furthermore, Andre Choulika directly owns €13m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$1.2m | US$1.0m | 100% |

| Other | - | - | - |

| Total Compensation | US$1.2m | US$1.0m | 100% |

On an industry level, around 53% of total compensation represents salary and 47% is other remuneration. At the company level, Cellectis pays Andre Choulika solely through a salary, preferring to go down a conventional route. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Cellectis S.A.'s Growth Numbers

Cellectis S.A.'s earnings per share (EPS) grew 5.9% per year over the last three years. Its revenue is down 18% over the previous year.

We would prefer it if there was revenue growth, but the modest EPS growth gives us some relief. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Cellectis S.A. Been A Good Investment?

With a total shareholder return of -51% over three years, Cellectis S.A. shareholders would by and large be disappointed. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Cellectis pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. Despite the growth in its earnings, the share price decline in the past three years is certainly concerning. The stock's movement is disjointed with the company's earnings growth, which ideally should move in the same direction. Shareholders would probably be keen to find out what are the other factors could be weighing down the stock. At the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 3 warning signs for Cellectis that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading Cellectis or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:ALCLS

Cellectis

A clinical stage biotechnological company, develops products based on gene-editing with a portfolio of allogeneic chimeric antigen receptor T-cells product candidates.

Excellent balance sheet with limited growth.