Some Confidence Is Lacking In Aelis Farma SA (EPA:AELIS) As Shares Slide 49%

The Aelis Farma SA (EPA:AELIS) share price has fared very poorly over the last month, falling by a substantial 49%. For any long-term shareholders, the last month ends a year to forget by locking in a 57% share price decline.

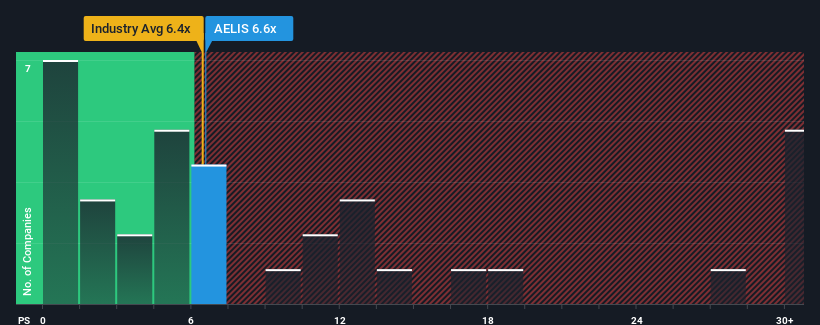

In spite of the heavy fall in price, it's still not a stretch to say that Aelis Farma's price-to-sales (or "P/S") ratio of 6.6x right now seems quite "middle-of-the-road" compared to the Biotechs industry in France, where the median P/S ratio is around 6.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Aelis Farma

What Does Aelis Farma's P/S Mean For Shareholders?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Aelis Farma has been doing quite well of late. One possibility is that the P/S ratio is moderate because investors think the company's revenue will be less resilient moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think Aelis Farma's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Aelis Farma?

In order to justify its P/S ratio, Aelis Farma would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 48% gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue growth is heading into negative territory, declining 27% per annum over the next three years. That's not great when the rest of the industry is expected to grow by 37% per year.

With this information, we find it concerning that Aelis Farma is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What Does Aelis Farma's P/S Mean For Investors?

Aelis Farma's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It appears that Aelis Farma currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Aelis Farma (1 is a bit unpleasant) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:AELIS

Aelis Farma

A clinical-stage biopharmaceutical company, focuses on discovering and developing drug candidates for the treatment of central nervous system disorders in France.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives