Subdued Growth No Barrier To Adocia SA (EPA:ADOC) With Shares Advancing 30%

Adocia SA (EPA:ADOC) shares have continued their recent momentum with a 30% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 95% in the last year.

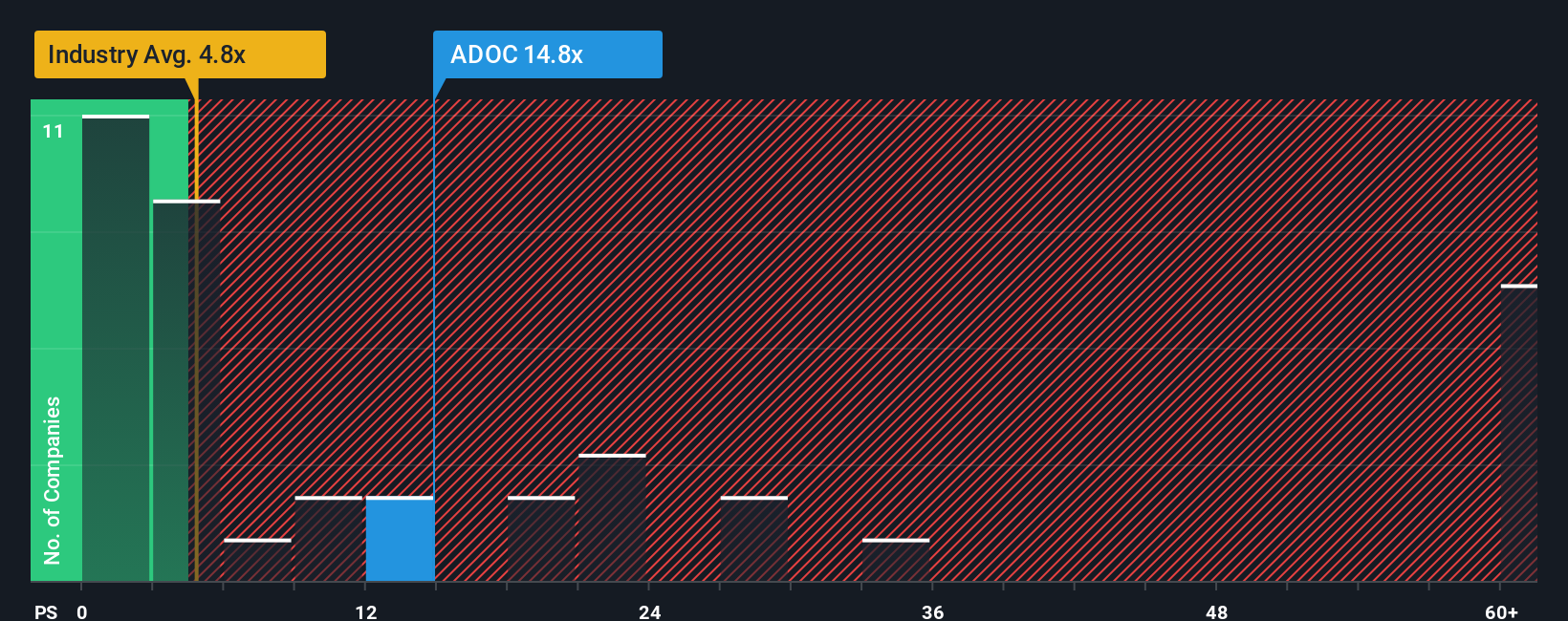

After such a large jump in price, Adocia may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 14.8x, since almost half of all companies in the Biotechs industry in France have P/S ratios under 4.8x and even P/S lower than 1.9x are not unusual. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Adocia

How Adocia Has Been Performing

Adocia certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Adocia will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Adocia?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Adocia's to be considered reasonable.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 7.7% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 4.6% per annum during the coming three years according to the lone analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 94% per year, which is noticeably more attractive.

In light of this, it's alarming that Adocia's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Adocia's P/S

Adocia's P/S has grown nicely over the last month thanks to a handy boost in the share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've concluded that Adocia currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Don't forget that there may be other risks. For instance, we've identified 5 warning signs for Adocia (2 make us uncomfortable) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ADOC

Adocia

A clinical-stage biotechnology company, researches and develops formulations of pre-approved therapeutic proteins and peptides for the treatment of diabetes and other metabolic diseases.

Moderate risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.