Should Abivax's Positive Phase 3 Obefazimod Results Prompt a Closer Look From ENXTPA:ABVX Investors?

Reviewed by Sasha Jovanovic

- Earlier this week, Abivax SA announced additional late-breaking Phase 3 clinical data for its investigational therapy obefazimod in moderate-to-severely active ulcerative colitis at the United European Gastroenterology Meeting in Berlin, confirming the 50 mg once-daily dose met all primary and key secondary efficacy endpoints with a favorable safety profile.

- Importantly, the results showed clinically meaningful improvements in patients who had previously not responded to advanced therapies, suggesting obefazimod could expand treatment options for a challenging patient population.

- We'll explore how obefazimod's efficacy in refractory ulcerative colitis patients reinforces Abivax's overall investment thesis in the biotech sector.

Find companies with promising cash flow potential yet trading below their fair value.

What Is ABIVAX Société Anonyme's Investment Narrative?

For me, the long-term belief behind owning ABIVAX hinges on the chance that its lead drug, obefazimod, can achieve regulatory approval and commercial success in treating moderate-to-severely active ulcerative colitis, a patient population with limited options, especially after failure of advanced therapies. This week’s positive late-breaking Phase 3 data on obefazimod meaningfully shifts the near-term outlook: it reduces scientific and clinical risks tied to efficacy and safety, and likely strengthens ABIVAX’s position ahead of regulatory filings. These results could accelerate the timeline to market and attract partners or investors, making upcoming milestones more impactful compared to earlier expectations. However, the company remains unprofitable with substantial losses, and continued R&D spending, dilution from recent equity offerings, and competitive pressures remain in focus. Funding sustainability and regulatory hurdles are still the main questions, but the risk-reward profile has evolved with these encouraging data.

On the flip side, funding and dilution concerns remain important for anyone considering the shares.

Exploring Other Perspectives

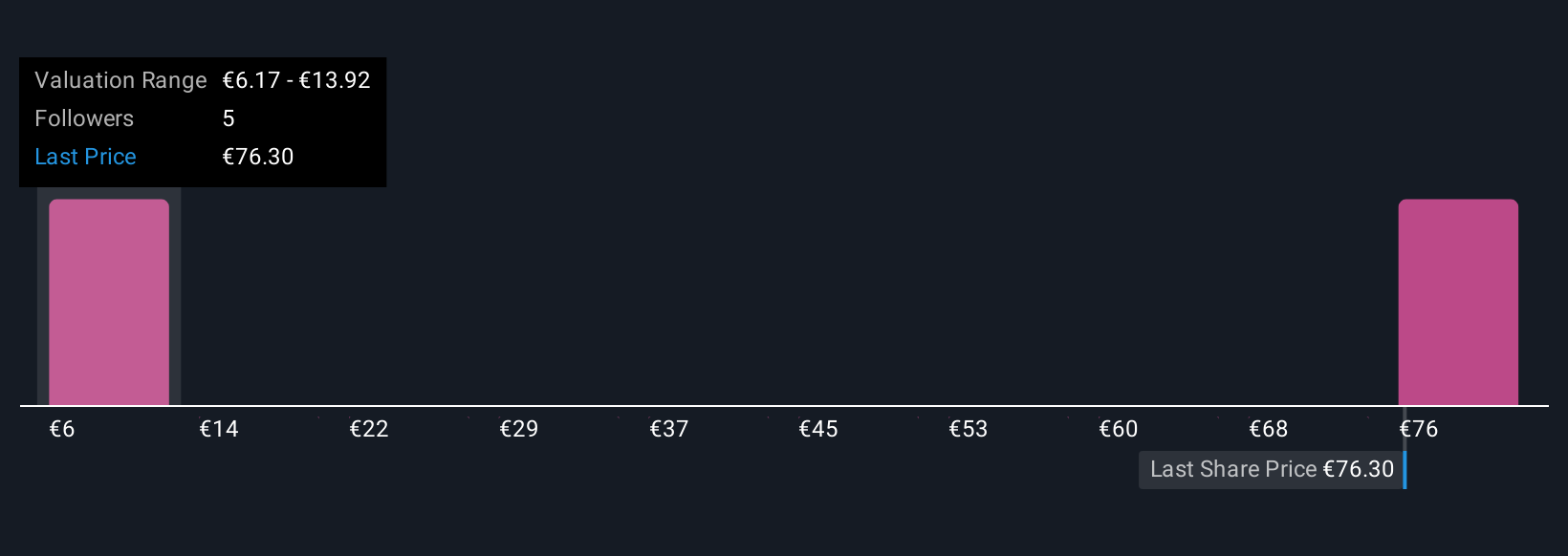

Explore 4 other fair value estimates on ABIVAX Société Anonyme - why the stock might be worth less than half the current price!

Build Your Own ABIVAX Société Anonyme Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ABIVAX Société Anonyme research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free ABIVAX Société Anonyme research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ABIVAX Société Anonyme's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ABVX

ABIVAX Société Anonyme

A clinical-stage biotechnology company, focuses on developing therapeutics that harness the body’s natural regulatory mechanisms to stabilize the immune response in patients with chronic inflammatory diseases.

Slight risk with limited growth.

Market Insights

Community Narratives