- Sweden

- /

- Aerospace & Defense

- /

- OM:GOMX

Cemat Leads The Charge In European Penny Stocks

Reviewed by Simply Wall St

As the European markets display cautious optimism amid ongoing geopolitical developments and trade policy changes, investors are keenly observing potential opportunities. Penny stocks, often seen as a niche investment area, continue to offer intriguing prospects for those willing to explore smaller or newer companies. Despite being an outdated term, penny stocks can provide growth potential when they boast strong financial health and fundamentals.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Financial Health Rating |

| Angler Gaming (NGM:ANGL) | SEK3.95 | SEK296.19M | ★★★★★★ |

| Netgem (ENXTPA:ALNTG) | €0.952 | €31.88M | ★★★★★★ |

| Transferator (NGM:TRAN A) | SEK2.86 | SEK255.53M | ★★★★★★ |

| High (ENXTPA:HCO) | €2.70 | €53.03M | ★★★★★★ |

| Hifab Group (OM:HIFA B) | SEK3.68 | SEK223.89M | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.07 | SEK1.98B | ★★★★☆☆ |

| I.M.D. International Medical Devices (BIT:IMD) | €1.47 | €25.46M | ★★★★★☆ |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €1.16 | €93.44M | ★★★★★☆ |

| Deceuninck (ENXTBR:DECB) | €2.485 | €343.91M | ★★★★★☆ |

| IMS (WSE:IMS) | PLN3.79 | PLN128.46M | ★★★★☆☆ |

Click here to see the full list of 420 stocks from our European Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Cemat (CPSE:CEMAT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cemat A/S operates in the real estate sector, focusing on the development and sale of properties in Warsaw, with a market capitalization of DKK267.34 million.

Operations: The company generates revenue primarily from its Property Management & Holding segment, amounting to DKK36.30 million.

Market Cap: DKK267.34M

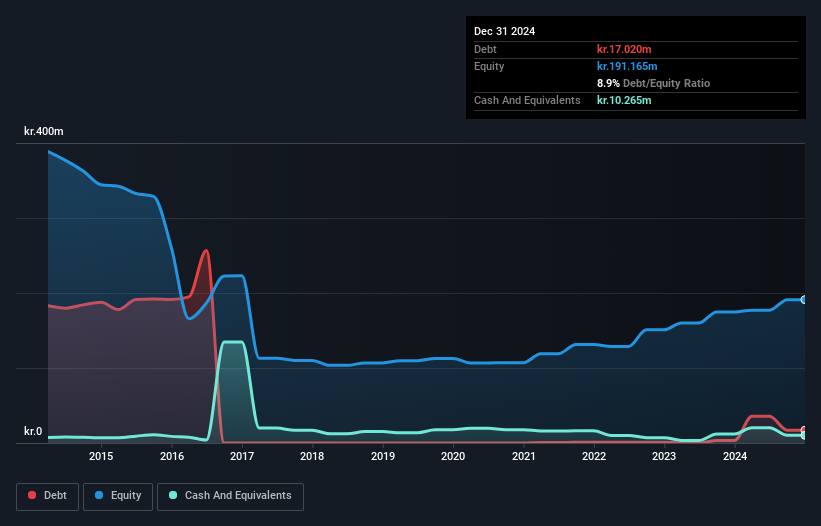

Cemat A/S, operating in the real estate sector, has demonstrated a stable financial position with short-term assets exceeding both short and long-term liabilities. The company reported an increase in sales to DKK39.4 million for the year ending December 31, 2024, with net income rising to DKK12.21 million. Despite a low Return on Equity of 6.2%, Cemat maintains satisfactory debt levels with a net debt to equity ratio of 8.8%. However, earnings growth was negative over the past year at -54%, influenced by large one-off gains impacting recent financial results.

- Navigate through the intricacies of Cemat with our comprehensive balance sheet health report here.

- Learn about Cemat's historical performance here.

ABIONYX Pharma (ENXTPA:ABNX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ABIONYX Pharma SA is a biotech company focused on discovering and developing therapies for renal and ophthalmological diseases, with a market cap of €47.51 million.

Operations: The company generates revenue from its Research and Development in Developing Innovative Medicines segment, which reported €4.86 million.

Market Cap: €47.51M

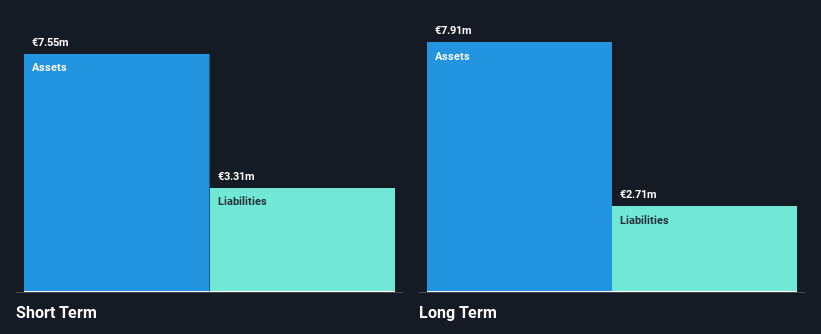

ABIONYX Pharma, a biotech firm with a market cap of €47.51 million, remains pre-revenue despite generating €4.86 million from its R&D segment in developing innovative medicines. The company is currently unprofitable and not expected to achieve profitability over the next three years. ABIONYX has managed to reduce its debt-to-equity ratio slightly over the past five years and maintains more cash than total debt, reflecting prudent financial management. While short-term assets cover both short and long-term liabilities, earnings are forecasted to decline by 23.4% annually over the next three years despite projected revenue growth of 40.7%.

- Take a closer look at ABIONYX Pharma's potential here in our financial health report.

- Gain insights into ABIONYX Pharma's future direction by reviewing our growth report.

GomSpace Group (OM:GOMX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: GomSpace Group AB (publ) specializes in designing, developing, integrating, and manufacturing nanosatellites for academic, government, and commercial markets with a market cap of SEK594.33 million.

Operations: GomSpace Group's revenue is primarily derived from its Program segment at SEK147.52 million, followed by Product sales at SEK90.36 million and North American operations contributing SEK19.16 million.

Market Cap: SEK594.33M

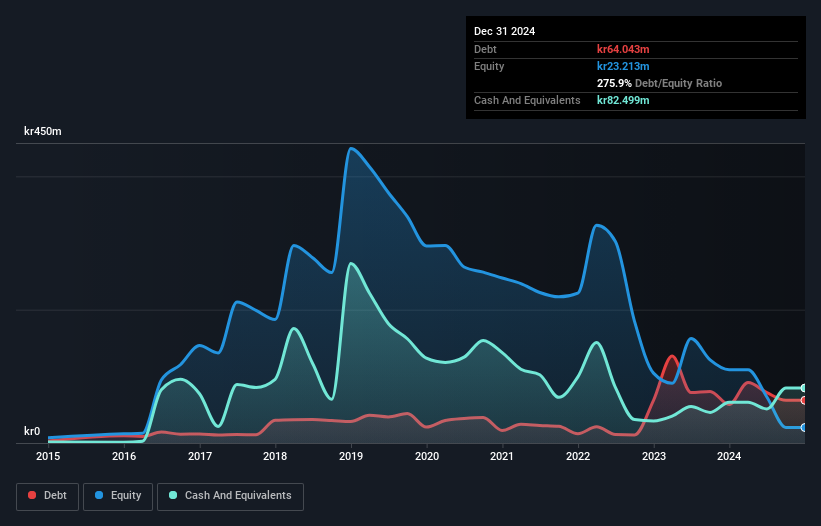

GomSpace Group AB, with a market cap of SEK594.33 million, is navigating the penny stock landscape by leveraging its expertise in nanosatellites for diverse markets. Despite being unprofitable and experiencing a 7.9% annual decline in earnings over five years, GomSpace maintains a strong cash runway exceeding three years due to positive free cash flow. Recent sales growth is evident with fourth-quarter revenue reaching SEK83.25 million, up from SEK38.4 million the previous year, although net losses persist at SEK29.57 million for Q4 2024. The company continues securing significant contracts across Europe and Southeast Asia, enhancing its position in the space industry.

- Click to explore a detailed breakdown of our findings in GomSpace Group's financial health report.

- Gain insights into GomSpace Group's historical outcomes by reviewing our past performance report.

Make It Happen

- Explore the 420 names from our European Penny Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:GOMX

GomSpace Group

Through its subsidiaries, designs, develops, integrates, and manufactures nanosatellites for the academic, government, and commercial markets.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives