- France

- /

- Entertainment

- /

- ENXTPA:VIV

Exploring Three High Growth Tech Stocks In France

Reviewed by Simply Wall St

With the European Central Bank recently cutting interest rates amid signs of weakening economic growth, France's CAC 40 Index has shown resilience, gaining 1.54% over the past week. This backdrop sets an intriguing stage for exploring three high-growth tech stocks in France, especially as technology shares continue to outperform in a volatile market environment. In such conditions, a good stock typically demonstrates strong fundamentals and innovative potential that align well with current market trends and investor sentiment.

Top 10 High Growth Tech Companies In France

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Icape Holding | 14.08% | 28.13% | ★★★★★☆ |

| Cogelec | 11.33% | 23.96% | ★★★★★☆ |

| Valneva | 23.46% | 25.74% | ★★★★★☆ |

| Munic | 26.68% | 149.10% | ★★★★★☆ |

| VusionGroup | 28.35% | 82.32% | ★★★★★★ |

| Adocia | 59.08% | 63.00% | ★★★★★★ |

| Oncodesign Société Anonyme | 14.68% | 101.18% | ★★★★★☆ |

| beaconsmind | 28.59% | 133.36% | ★★★★★★ |

| Pherecydes Pharma Société anonyme | 63.30% | 78.85% | ★★★★★☆ |

| OSE Immunotherapeutics | 30.02% | 5.91% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

Bolloré (ENXTPA:BOL)

Simply Wall St Growth Rating: ★★★★☆☆

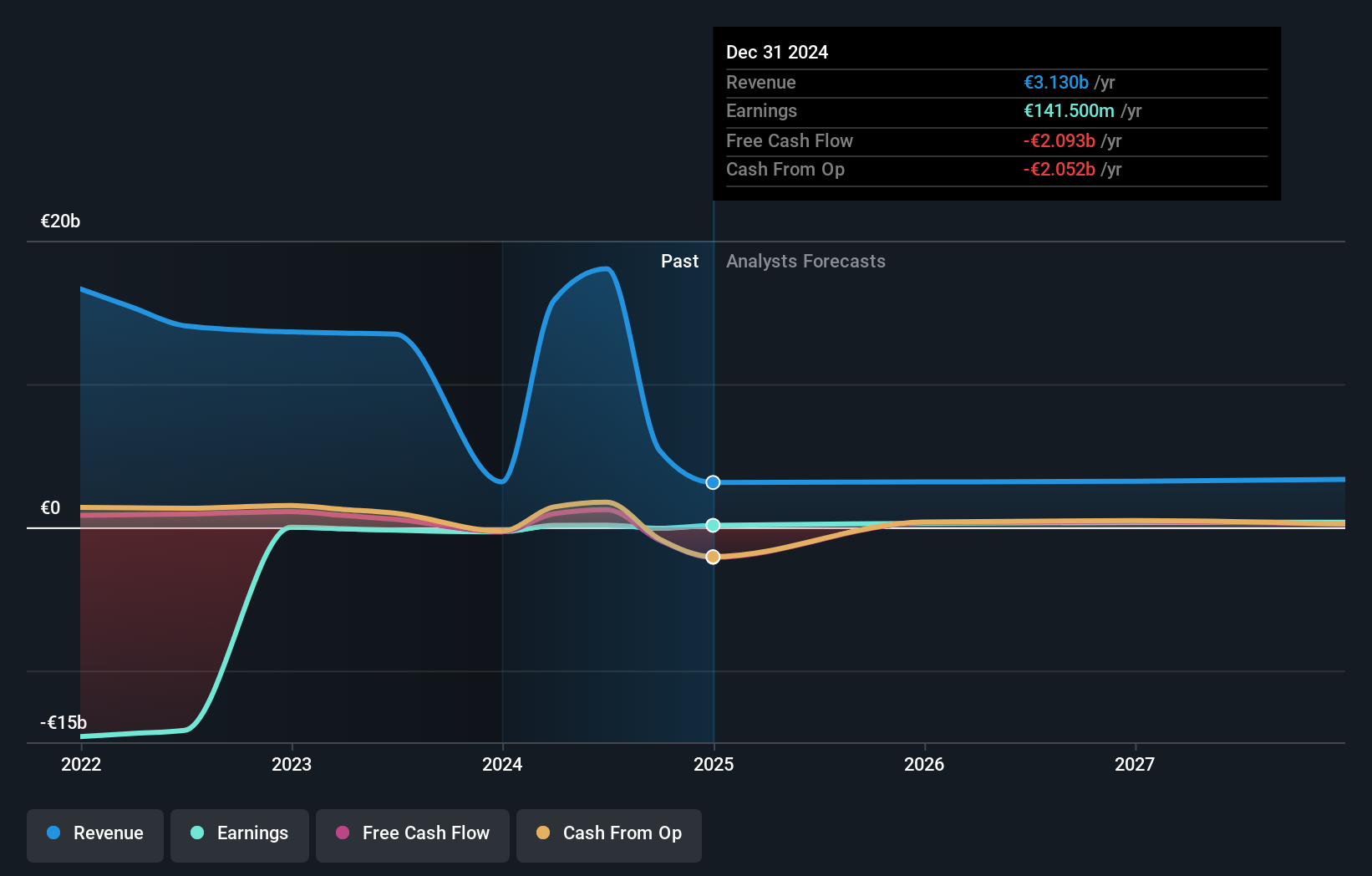

Overview: Bolloré SE operates in transportation and logistics, communications, and industry sectors across various regions including France, Europe, the Americas, Asia, Oceania, and Africa with a market cap of approximately €17.11 billion.

Operations: Bolloré SE generates revenue primarily from its communications segment (€14.86 billion), followed by Bolloré Energy (€2.75 billion) and industry activities (€353 million). The company operates across multiple regions including France, Europe, the Americas, Asia, Oceania, and Africa.

Bolloré SE has demonstrated a robust financial trajectory, with an expected earnings growth of 32.7% annually, outpacing the French market's forecast of 12.3%. This growth is bolstered by a significant increase in half-year sales from €6.23 billion to €10.59 billion, reflecting a strategic expansion in its operations that could reshape its industry standing. Despite this rapid growth, Bolloré maintains an R&D commitment that aligns with these ambitions, ensuring sustained innovation and competitiveness in high-growth sectors. The company's recent decision to uphold its interim dividend at €0.02 per share underscores a stable shareholder return policy amidst substantial financial gains. Looking ahead, Bolloré’s investment in research and development not only supports future technological advancements but also positions it favorably within France’s tech landscape where annual revenue growth is projected at 8.3%, significantly higher than the national average of 5.7%. This strategic focus on both profit generation and foundational R&D spending suggests potential for continued market leadership and investor interest.

- Click here to discover the nuances of Bolloré with our detailed analytical health report.

Assess Bolloré's past performance with our detailed historical performance reports.

Planisware SAS (ENXTPA:PLNW)

Simply Wall St Growth Rating: ★★★★☆☆

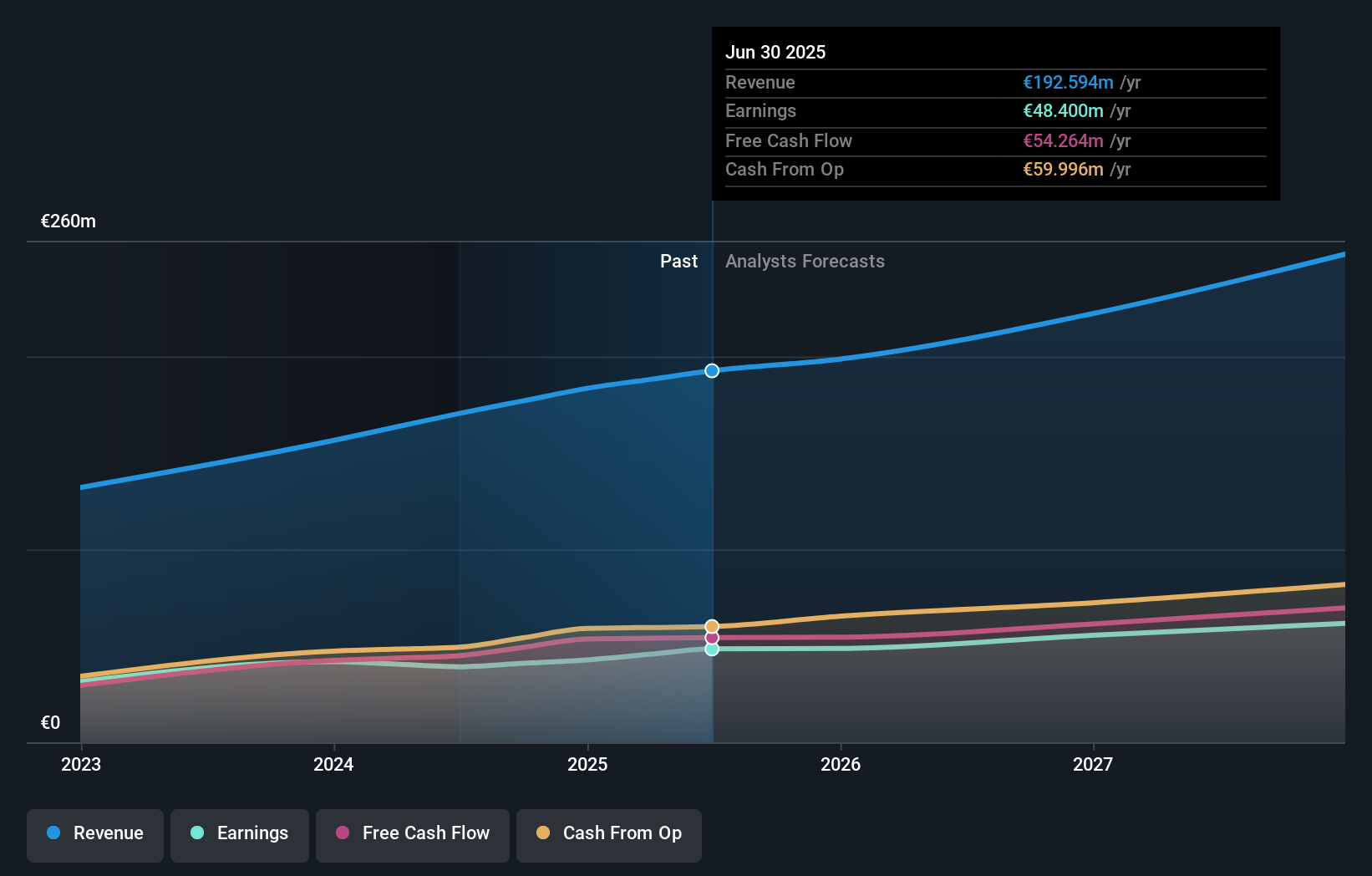

Overview: Planisware SAS is a global business-to-business software-as-a-service provider with a market cap of €1.93 billion.

Operations: Planisware SAS generates revenue primarily from its software and programming services, totaling €156.44 million. The company operates across Europe, the Americas, and the Asia-Pacific regions.

Planisware SAS is navigating the competitive tech landscape in France with a strategic focus on R&D, investing 15.2% of its revenue back into research and development. This commitment has fueled innovations that are essential for staying ahead in the software sector, particularly as the company's earnings have surged by 32.6% over the past year, outstripping industry growth of 10.6%. Despite facing challenges like slower revenue growth at 16.1% annually compared to a more aggressive market benchmark, Planisware's robust investment in R&D could drive future technological advancements and market share expansion within France’s vibrant tech scene.

- Delve into the full analysis health report here for a deeper understanding of Planisware SAS.

Gain insights into Planisware SAS' past trends and performance with our Past report.

Vivendi (ENXTPA:VIV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vivendi SE is an entertainment, media, and communication company with operations spanning France, Europe, the Americas, Asia/Oceania, and Africa; it has a market cap of approximately €10.41 billion.

Operations: Vivendi SE generates revenue primarily through its Canal+ Group (€6.20 billion), Havas Group (€2.92 billion), and Gameloft (€304 million). The company's diverse operations also include Prisma Media (€303 million) and Vivendi Village (€151 million).

Vivendi SE is distinguishing itself in the French tech sector with a notable 9.3% annual revenue growth, outpacing the national market average of 5.7%. This growth is complemented by an impressive projected earnings increase of 30.6% per year, significantly higher than the broader market's 12.3%. The company has strategically repurchased shares worth €184 million, enhancing shareholder value and reflecting confidence in its financial health. Moreover, Vivendi's investment in R&D remains robust, aligning with its forward-looking initiatives like the potential London Stock Exchange listing for Canal+, which could further catalyze its business transformation and market position.

- Unlock comprehensive insights into our analysis of Vivendi stock in this health report.

Examine Vivendi's past performance report to understand how it has performed in the past.

Seize The Opportunity

- Unlock our comprehensive list of 45 Euronext Paris High Growth Tech and AI Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VIV

Vivendi

Operates as an entertainment, media, and communication company in France, the rest of Europe, the Americas, Asia/Oceania, and Africa.

Undervalued with excellent balance sheet and pays a dividend.