These 4 Measures Indicate That TF1 (EPA:TFI) Is Using Debt Reasonably Well

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that TF1 SA (EPA:TFI) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for TF1

What Is TF1's Debt?

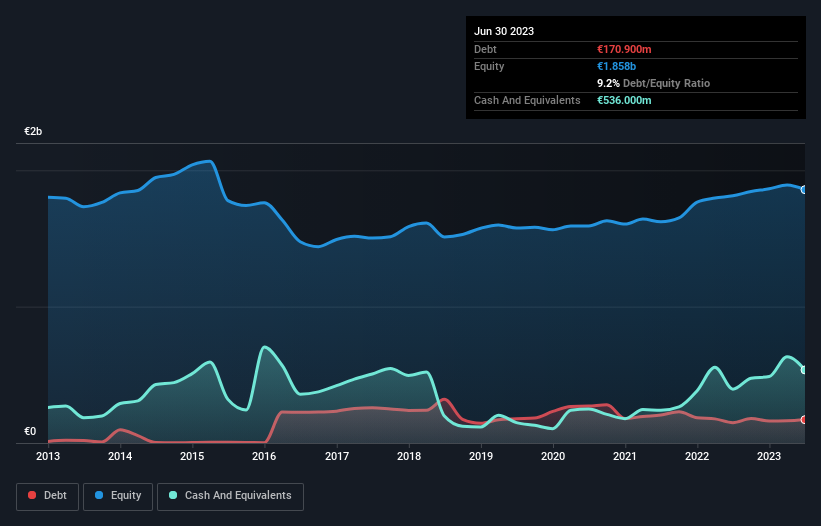

As you can see below, at the end of June 2023, TF1 had €170.9m of debt, up from €149.4m a year ago. Click the image for more detail. But on the other hand it also has €536.0m in cash, leading to a €365.1m net cash position.

A Look At TF1's Liabilities

According to the last reported balance sheet, TF1 had liabilities of €1.42b due within 12 months, and liabilities of €213.0m due beyond 12 months. On the other hand, it had cash of €536.0m and €1.09b worth of receivables due within a year. So its total liabilities are just about perfectly matched by its shorter-term, liquid assets.

Having regard to TF1's size, it seems that its liquid assets are well balanced with its total liabilities. So while it's hard to imagine that the €1.38b company is struggling for cash, we still think it's worth monitoring its balance sheet. While it does have liabilities worth noting, TF1 also has more cash than debt, so we're pretty confident it can manage its debt safely.

On the other hand, TF1's EBIT dived 19%, over the last year. We think hat kind of performance, if repeated frequently, could well lead to difficulties for the stock. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine TF1's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While TF1 has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, TF1 produced sturdy free cash flow equating to 75% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Summing Up

We could understand if investors are concerned about TF1's liabilities, but we can be reassured by the fact it has has net cash of €365.1m. And it impressed us with free cash flow of €188m, being 75% of its EBIT. So we don't have any problem with TF1's use of debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 2 warning signs for TF1 that you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if TF1 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:TFI

TF1

Engages in the broadcasting, studios and entertainment, and digital businesses in France and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026