In the current global market landscape, investors are navigating a complex environment marked by cautious Federal Reserve commentary and political uncertainties, such as looming government shutdown fears in the U.S. Despite these challenges, dividend stocks remain a compelling option for income-focused investors seeking stability and potential returns in turbulent times. A good dividend stock often combines consistent yield with resilient financial health, making it an attractive choice amid fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.15% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.74% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.06% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.28% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.36% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.87% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.20% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.48% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

Click here to see the full list of 1937 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

TF1 (ENXTPA:TFI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TF1 SA operates in broadcasting, studios and entertainment, and digital sectors both in France and internationally, with a market cap of €1.52 billion.

Operations: TF1 SA generates revenue primarily from its Media segment, including digital (€2.02 billion), and Newen Studios (€385.70 million).

Dividend Yield: 7.6%

TF1 offers a dividend yield of 7.62%, placing it in the top quartile among French dividend payers. The company's dividends are well-covered by both earnings and cash flows, with payout ratios of 58.7% and 56.6%, respectively, indicating sustainability despite past volatility in payments over the last decade. Recent earnings growth is notable, with net income rising to €49.4 million for Q3 2024 from €37.7 million a year ago, supporting its current dividend strategy.

- Get an in-depth perspective on TF1's performance by reading our dividend report here.

- The analysis detailed in our TF1 valuation report hints at an deflated share price compared to its estimated value.

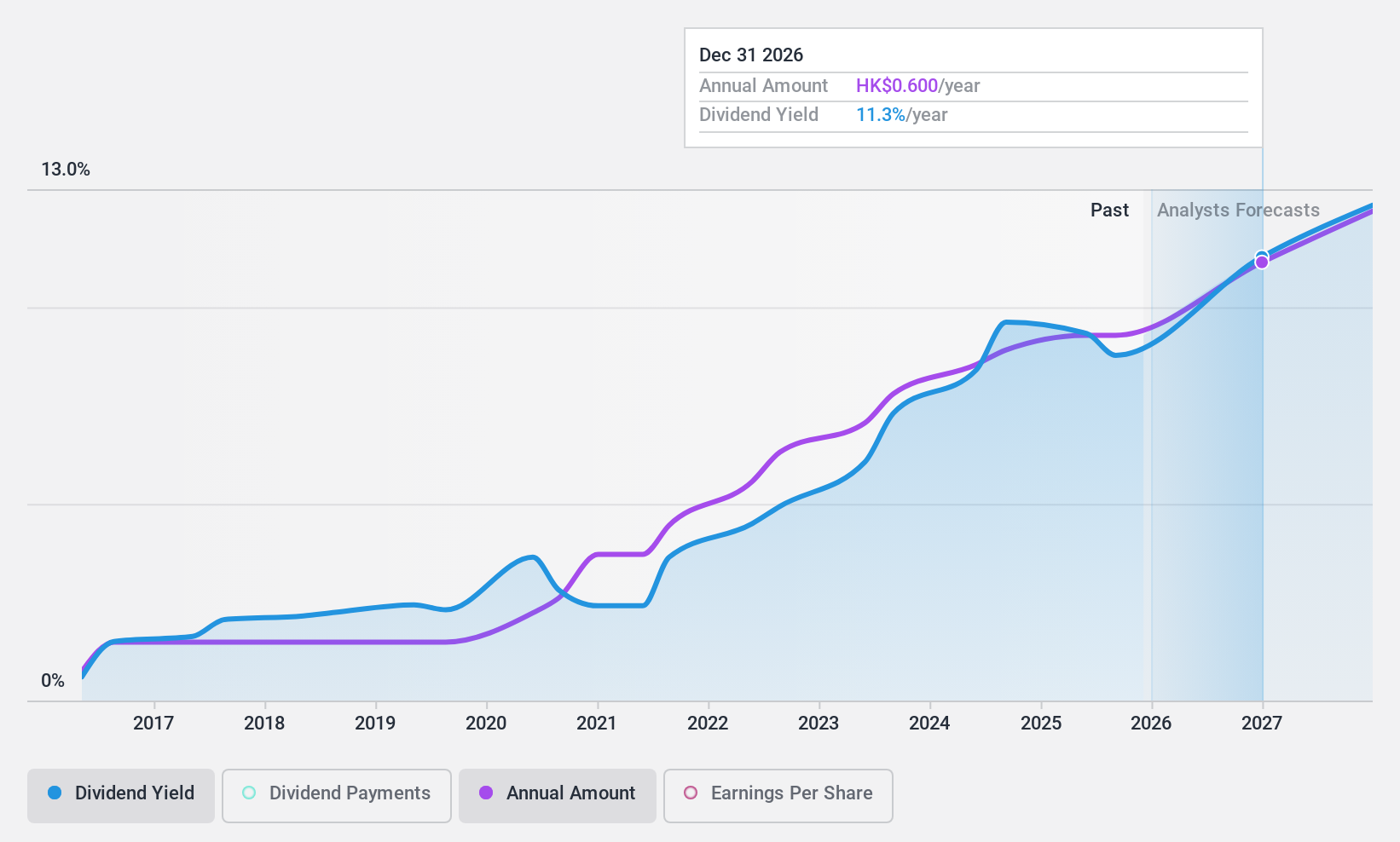

PAX Global Technology (SEHK:327)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PAX Global Technology Limited is an investment holding company that develops and sells electronic funds transfer point-of-sale products in Hong Kong, the People’s Republic of China, the United States, and Italy, with a market cap of HK$5.43 billion.

Operations: The company's revenue primarily comes from its e-Payment Terminal Solutions Business, which generated HK$6.15 billion.

Dividend Yield: 9.4%

PAX Global Technology offers a robust dividend yield of 9.39%, ranking in the top 25% among Hong Kong dividend payers. The company's dividends are supported by earnings, with a payout ratio of 52.5%, and cash flows, with an 84.5% cash payout ratio, indicating sustainability despite its relatively short nine-year dividend history. Trading slightly below estimated fair value enhances its attractiveness for investors seeking reliable income growth alongside potential capital appreciation.

- Delve into the full analysis dividend report here for a deeper understanding of PAX Global Technology.

- According our valuation report, there's an indication that PAX Global Technology's share price might be on the cheaper side.

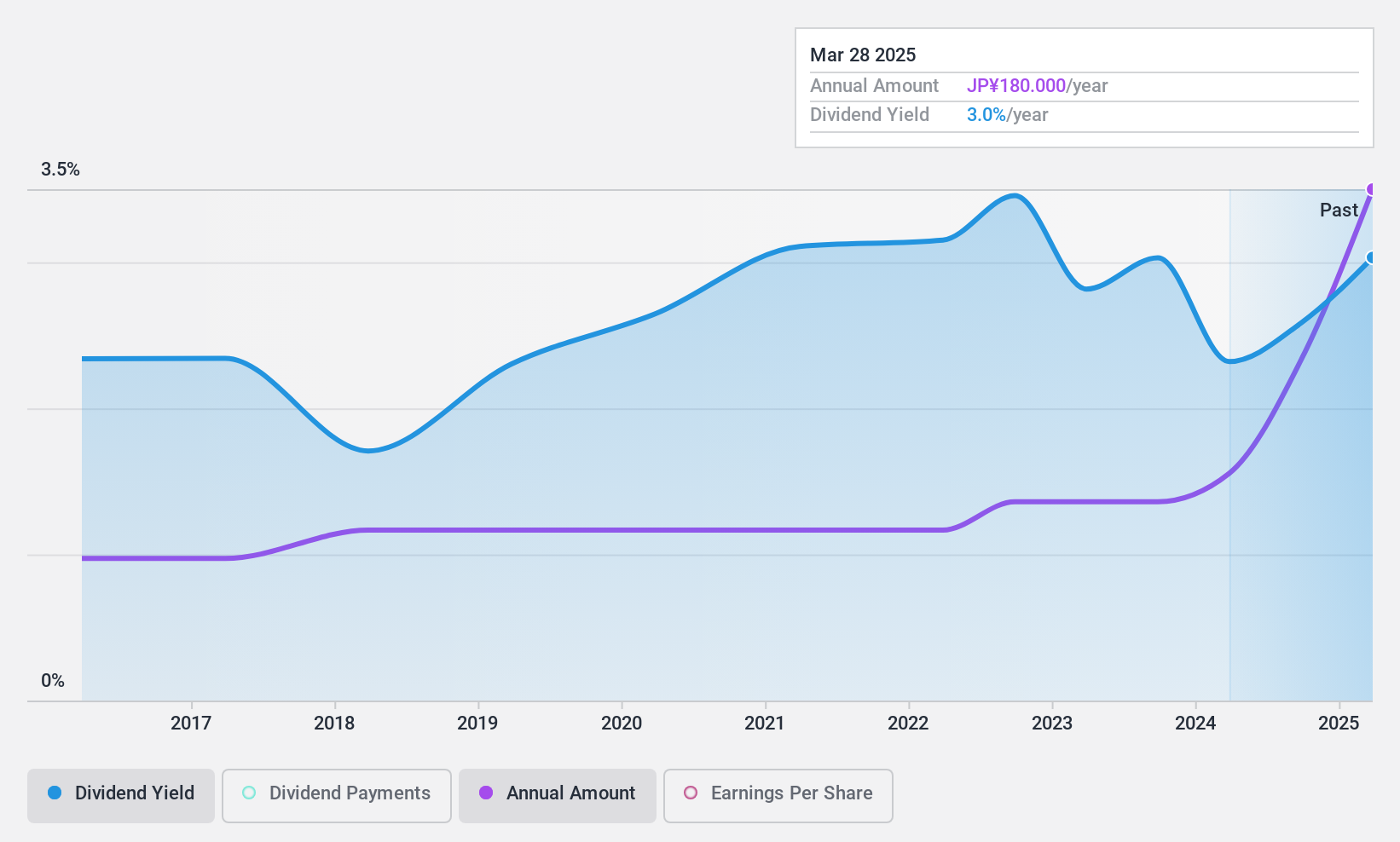

Kurabo Industries (TSE:3106)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kurabo Industries Ltd. operates in textile, chemical, technology, food and service, and real estate sectors both in Japan and internationally with a market cap of ¥96.02 billion.

Operations: Kurabo Industries Ltd.'s revenue is derived from its operations in the textile, chemical, technology, food and service, and real estate sectors.

Dividend Yield: 3.2%

Kurabo Industries maintains a reliable dividend, recently increasing it to ¥60.00 per share for Q2 of FY 2025, with expectations of ¥90.00 annually. Despite a lower yield compared to top Japanese payers, its dividends are well-covered by earnings (14.2% payout ratio) and cash flows (44.4% cash payout ratio). The company's robust earnings growth and strategic share buyback program further bolster shareholder returns and enhance capital efficiency amidst recent market volatility.

- Click here to discover the nuances of Kurabo Industries with our detailed analytical dividend report.

- Our valuation report unveils the possibility Kurabo Industries' shares may be trading at a discount.

Taking Advantage

- Delve into our full catalog of 1937 Top Dividend Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kurabo Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3106

Kurabo Industries

Engages in textile, chemical, technology, food and service, and real estate businesses in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives