The French stock market, like much of Europe, has recently experienced a downturn as escalating tensions in the Middle East have made investors cautious, leading to a notable decline in major indices such as France's CAC 40. Amidst these uncertainties, dividend stocks can offer a measure of stability and income potential for investors seeking resilience in their portfolios. Selecting strong dividend stocks often involves looking for companies with solid financial health and consistent payout histories, which can be particularly appealing during times of market volatility.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Vicat (ENXTPA:VCT) | 5.57% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.82% | ★★★★★★ |

| Électricite de Strasbourg Société Anonyme (ENXTPA:ELEC) | 8.04% | ★★★★★☆ |

| Arkema (ENXTPA:AKE) | 4.06% | ★★★★★☆ |

| VIEL & Cie société anonyme (ENXTPA:VIL) | 3.69% | ★★★★★☆ |

| Samse (ENXTPA:SAMS) | 6.80% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA) | 6.04% | ★★★★★☆ |

| Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.82% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 8.00% | ★★★★★☆ |

| Infotel (ENXTPA:INF) | 4.65% | ★★★★☆☆ |

Click here to see the full list of 32 stocks from our Top Euronext Paris Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

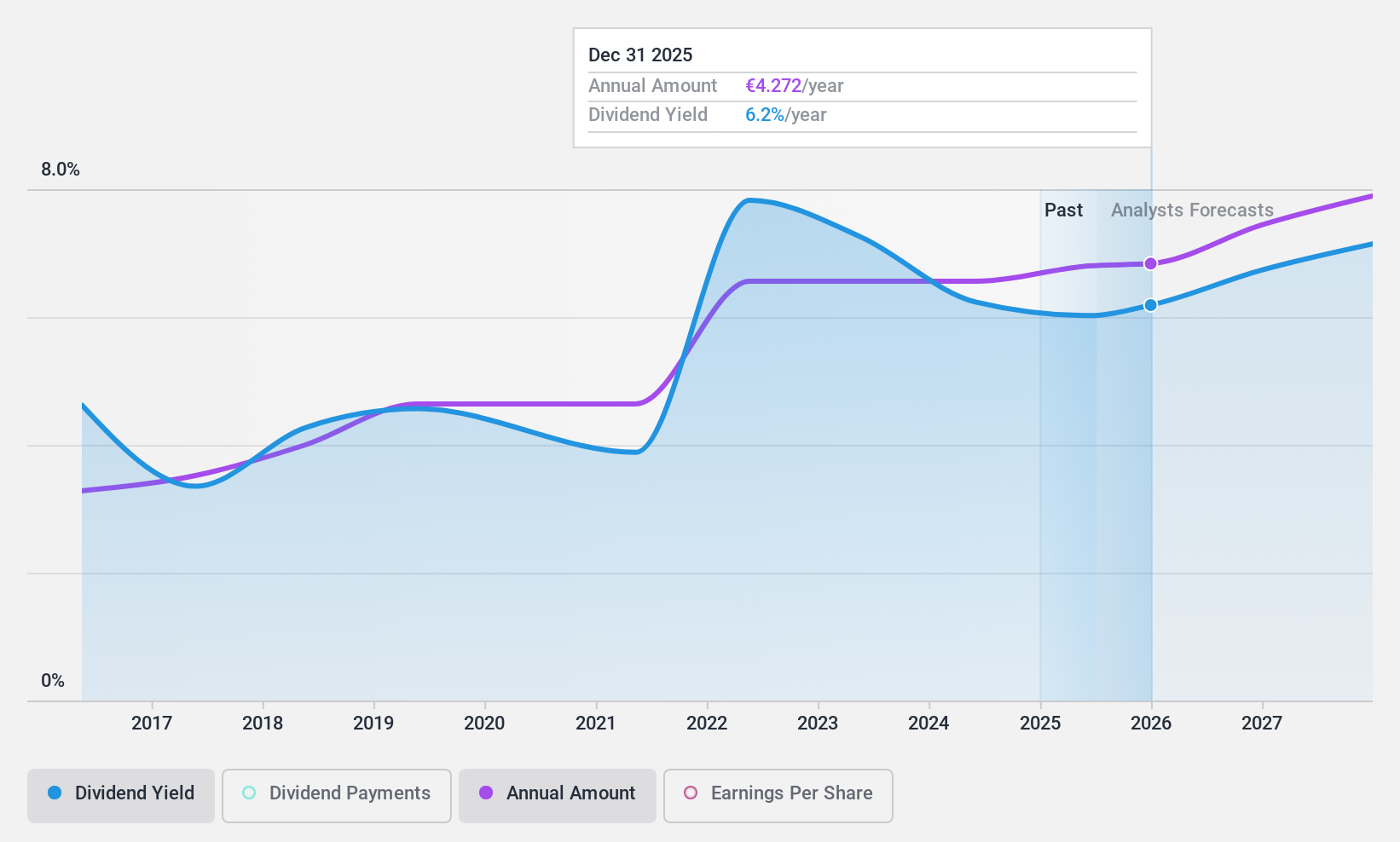

Amundi (ENXTPA:AMUN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Amundi is a publicly owned investment manager with a market cap of approximately €13.67 billion.

Operations: Amundi generates its revenue primarily from its Asset Management segment, which accounted for €6.18 billion.

Dividend Yield: 6.1%

Amundi's dividend yield ranks in the top 25% of French dividend payers, though its track record is unstable with volatile payments over the past nine years. Despite this, dividends are covered by both earnings and cash flows, with payout ratios at 69.3% and 59.6%, respectively. Recent earnings reports show growth, with a net income increase to €333 million for Q2 2024, supporting its capacity to maintain dividends amidst executive changes.

- Get an in-depth perspective on Amundi's performance by reading our dividend report here.

- Our expertly prepared valuation report Amundi implies its share price may be lower than expected.

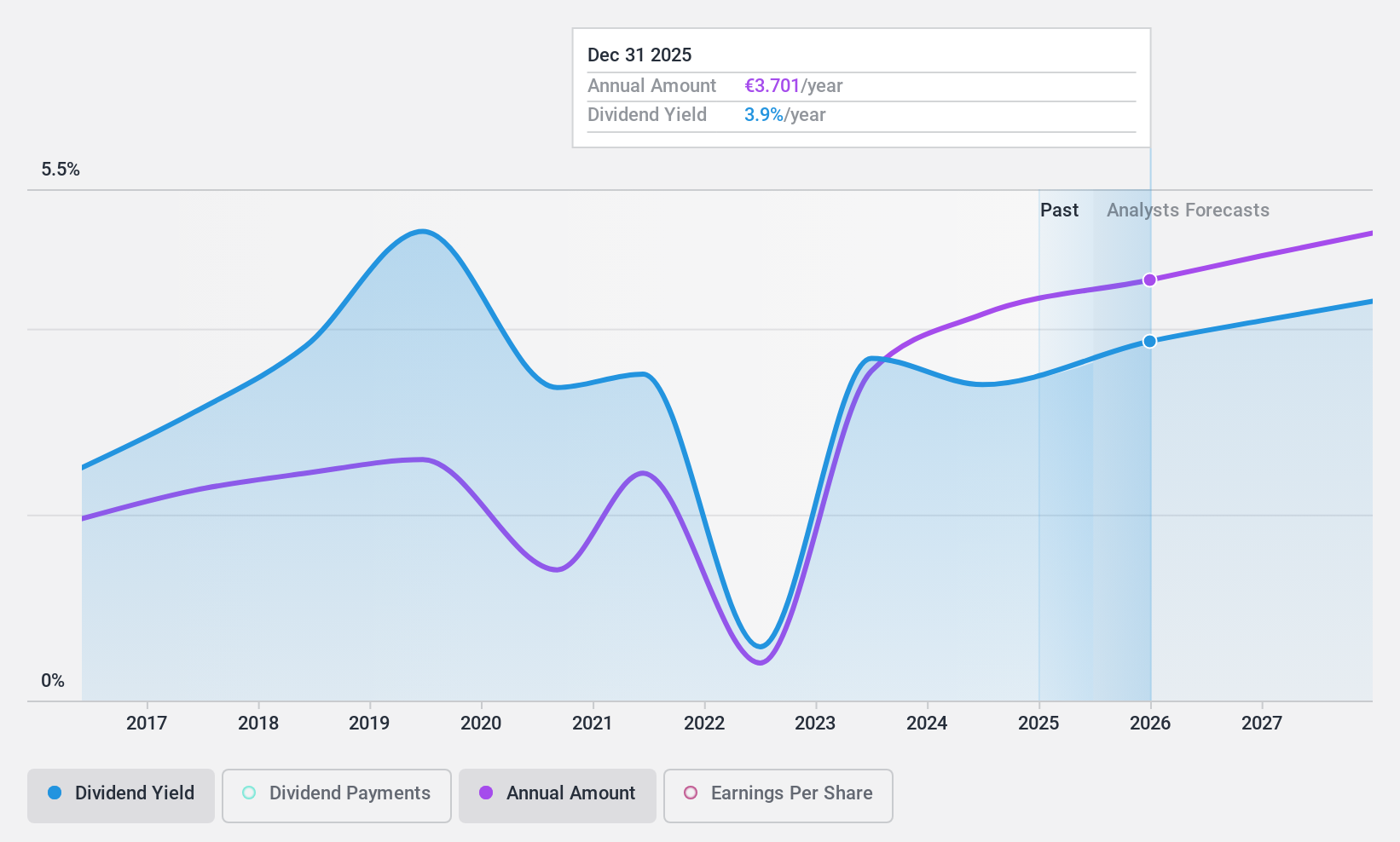

Publicis Groupe (ENXTPA:PUB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Publicis Groupe S.A. is a global company offering marketing, communications, and digital business transformation services across multiple regions, with a market cap of €24.56 billion.

Operations: Publicis Groupe S.A. generates revenue from its Advertising and Communication Services segment, amounting to €15.35 billion.

Dividend Yield: 3.5%

Publicis Groupe's dividend payments, while covered by earnings (54.7% payout ratio) and cash flows (64.2% cash payout ratio), have been unreliable over the past decade due to volatility. Despite a lower-than-top-tier yield of 3.48%, dividends have grown over ten years, supported by strong financial performance, including a recent revenue increase to €7.65 billion for H1 2024. Publicis is actively involved in innovative projects like Mondelez's AI platform, potentially enhancing future growth prospects amidst macroeconomic uncertainties.

- Navigate through the intricacies of Publicis Groupe with our comprehensive dividend report here.

- Our valuation report unveils the possibility Publicis Groupe's shares may be trading at a discount.

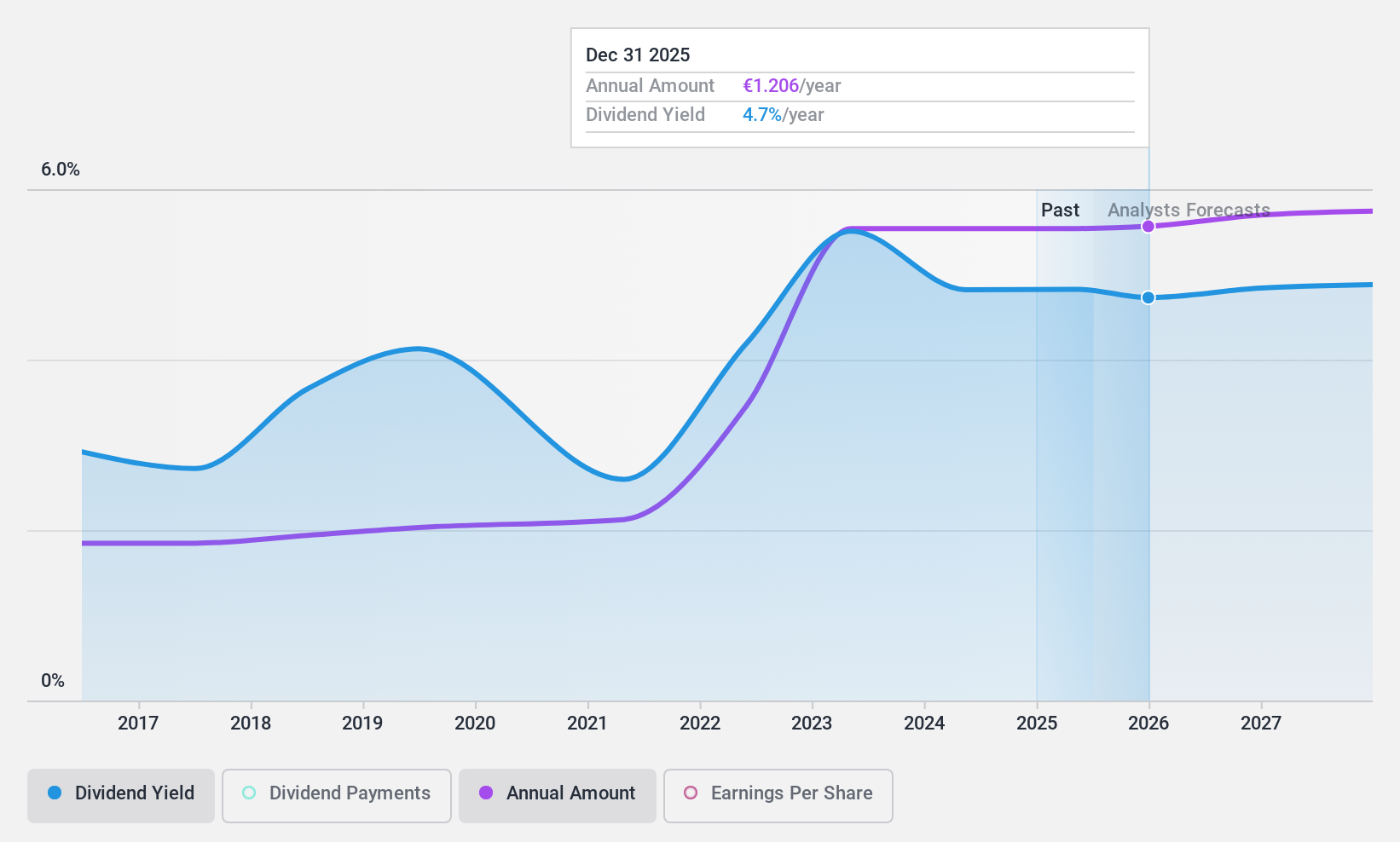

Rexel (ENXTPA:RXL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Rexel S.A. is a company that, along with its subsidiaries, distributes low and ultra-low voltage electrical products and services across residential, commercial, and industrial markets in France, Europe, North America, and Asia-Pacific with a market cap of €7.61 billion.

Operations: Rexel S.A. generates revenue of €19.02 billion from its wholesale electronics segment, focusing on low and ultra-low voltage electrical products and services across multiple regions.

Dividend Yield: 4.7%

Rexel's dividend payments, though covered by earnings (51.6% payout ratio) and cash flows (39.9% cash payout ratio), have been volatile over the past decade. The yield of 4.7% is below the top 25% in France, yet dividends have grown over ten years. Recent financials show a decline in net income to €351.9 million for H1 2024 from €428.4 million a year ago, alongside strategic M&A pursuits and share buybacks totaling €169.33 million since April 2023.

- Click here and access our complete dividend analysis report to understand the dynamics of Rexel.

- In light of our recent valuation report, it seems possible that Rexel is trading behind its estimated value.

Key Takeaways

- Click this link to deep-dive into the 32 companies within our Top Euronext Paris Dividend Stocks screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:PUB

Publicis Groupe

Provides marketing, communications, and digital business transformation services in North America, Europe, the Asia Pacific, Latin America, Africa, and the Middle East.

Excellent balance sheet average dividend payer.