- France

- /

- Trade Distributors

- /

- ENXTPA:RXL

3 Euronext Paris Dividend Stocks Yielding Up To 6%

Reviewed by Simply Wall St

As the European economy sees a boost from the Paris Olympics, France's CAC 40 Index has gained 1.71%, reflecting investor optimism amid expectations of upcoming interest rate cuts by both the Federal Reserve and the European Central Bank. With this backdrop, dividend stocks on Euronext Paris present an attractive option for investors seeking steady income streams. In light of current market conditions, a good dividend stock typically offers a reliable payout, strong financial health, and resilience in diverse economic climates.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Vicat (ENXTPA:VCT) | 6.38% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 6.87% | ★★★★★★ |

| CBo Territoria (ENXTPA:CBOT) | 6.82% | ★★★★★★ |

| Samse (ENXTPA:SAMS) | 6.21% | ★★★★★☆ |

| Arkema (ENXTPA:AKE) | 4.28% | ★★★★★☆ |

| VIEL & Cie société anonyme (ENXTPA:VIL) | 4.01% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA) | 5.71% | ★★★★★☆ |

| Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.65% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 8.26% | ★★★★★☆ |

| Rexel (ENXTPA:RXL) | 5.23% | ★★★★☆☆ |

Click here to see the full list of 35 stocks from our Top Euronext Paris Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

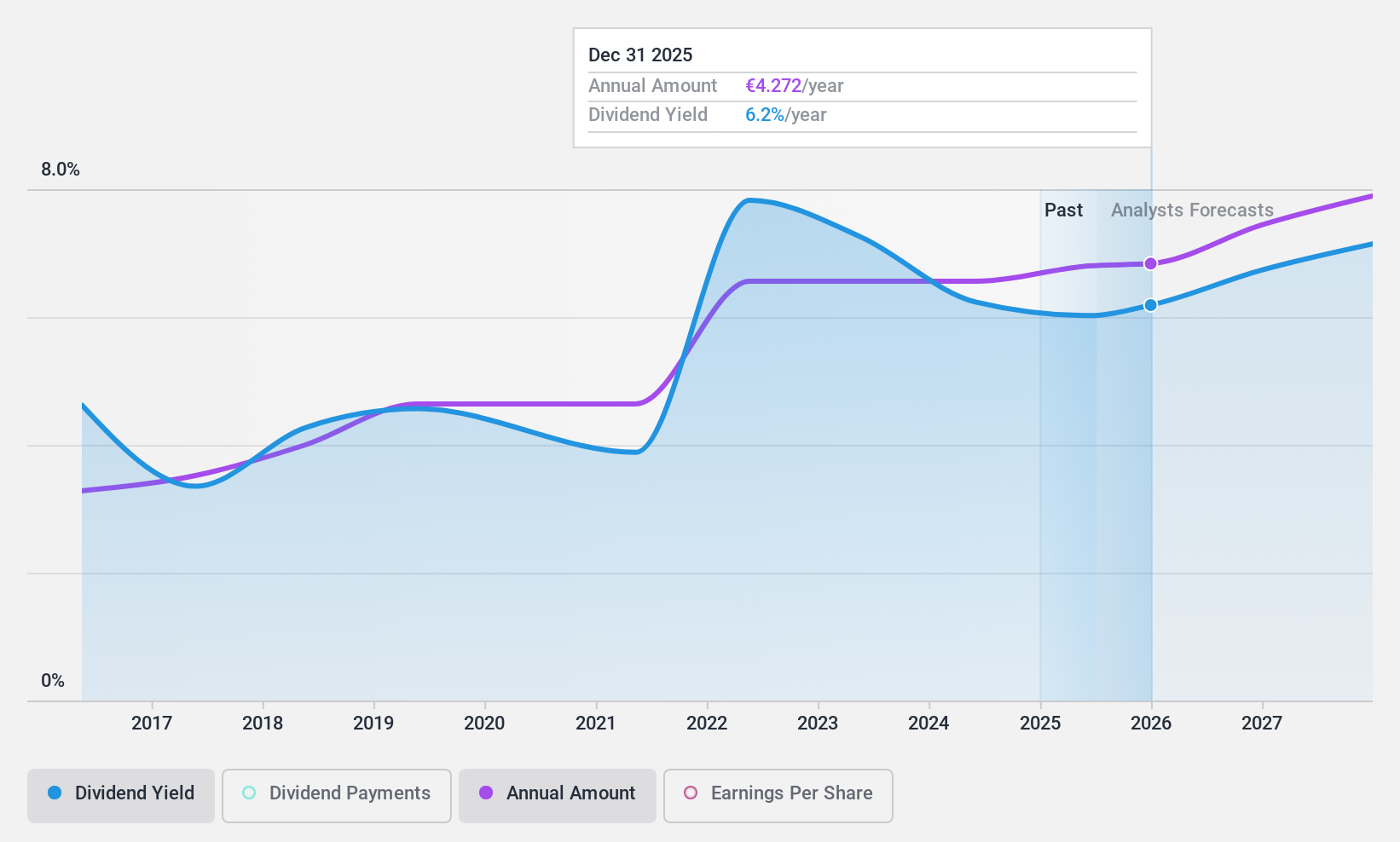

Amundi (ENXTPA:AMUN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Amundi is a publicly owned investment manager with operations focused on managing assets and a market cap of €13.73 billion.

Operations: Amundi generates €6.09 billion in revenue from its Asset Management segment.

Dividend Yield: 6.1%

Amundi S.A. reported strong earnings for the second quarter and first half of 2024, with revenue reaching €887 million and €1.71 billion respectively, while net income was €333 million and €636 million. The company offers a high dividend yield (6.08%), ranking in the top 25% of French dividend payers, with dividends covered by both earnings (69.3%) and cash flows (56%). However, its dividend history is less stable, showing volatility over nine years of payments.

- Take a closer look at Amundi's potential here in our dividend report.

- The analysis detailed in our Amundi valuation report hints at an deflated share price compared to its estimated value.

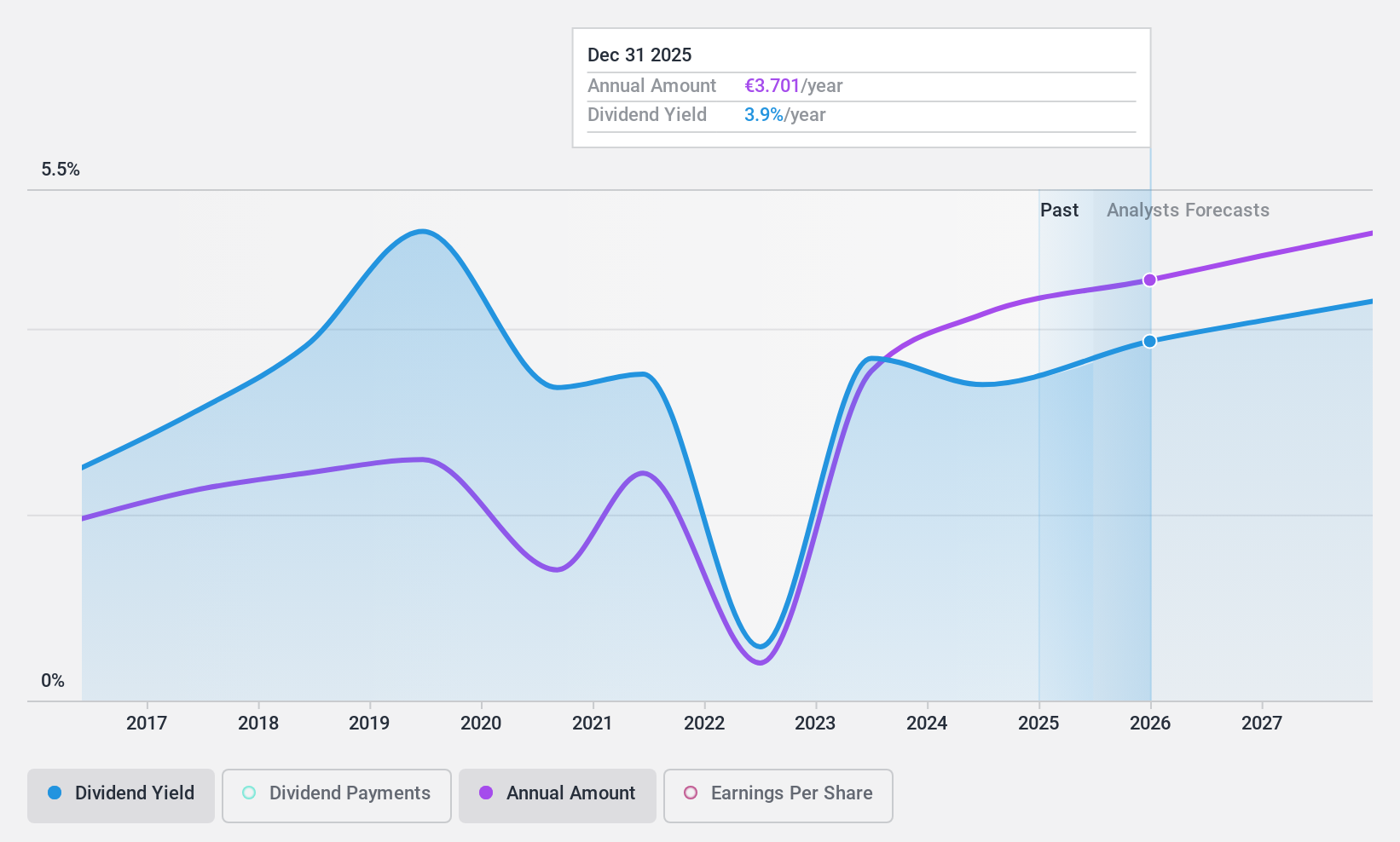

Publicis Groupe (ENXTPA:PUB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Publicis Groupe S.A. offers marketing, communications, and digital business transformation services across various regions globally and has a market cap of approximately €24.33 billion.

Operations: Publicis Groupe S.A.'s revenue from advertising and communication services amounts to €15.35 billion.

Dividend Yield: 3.5%

Publicis Groupe's dividend payments are covered by earnings (54.7%) and cash flows (64.2%), though its dividend history has been volatile over the past decade. The company recently increased its dividend by 17% to €3.40 per share, reflecting strong financial performance, with H1 2024 net income at €773 million on revenue of €7.65 billion. Despite a lower yield compared to top French payers, Publicis upgraded its annual revenue guidance amid robust growth prospects.

- Delve into the full analysis dividend report here for a deeper understanding of Publicis Groupe.

- Upon reviewing our latest valuation report, Publicis Groupe's share price might be too pessimistic.

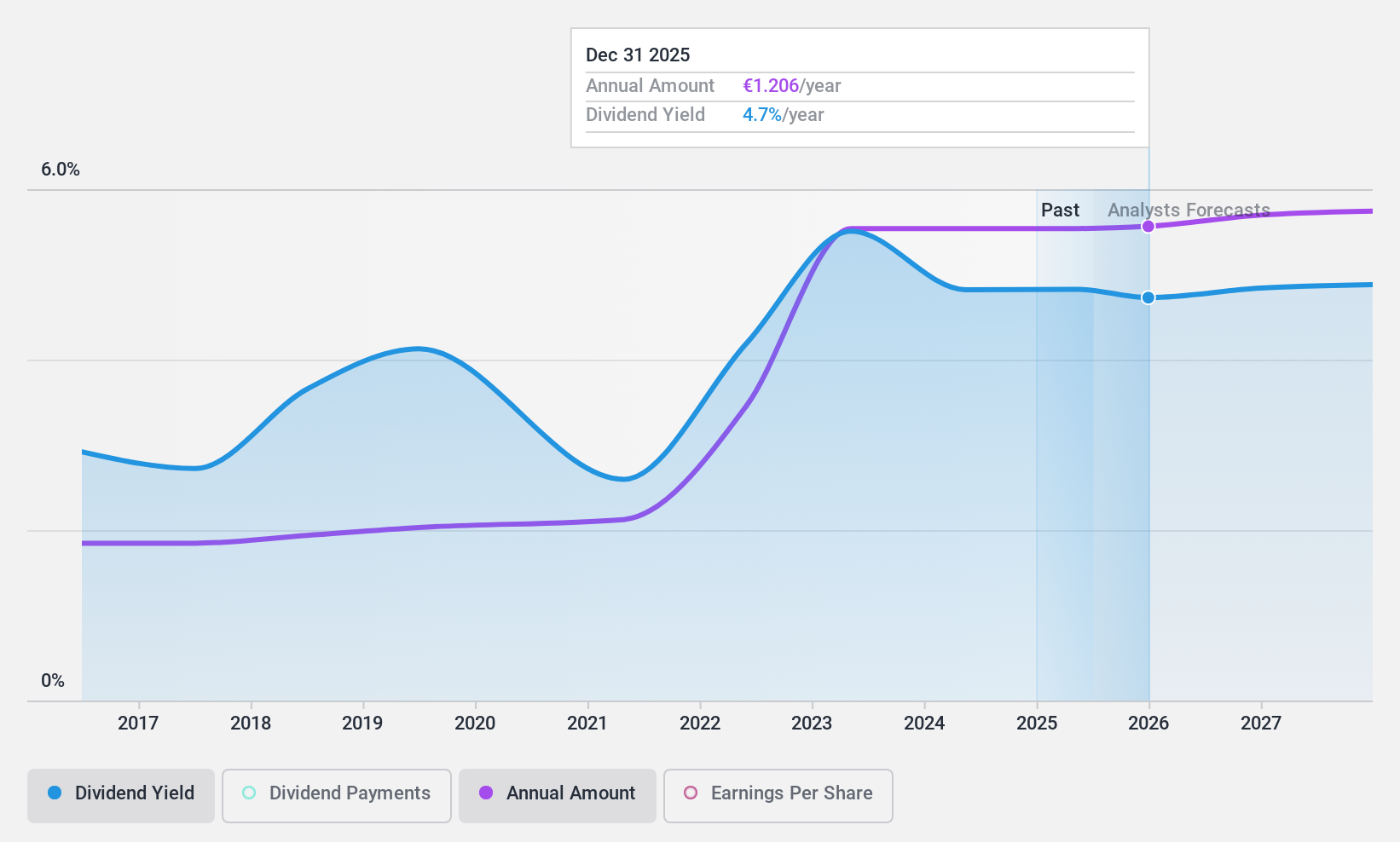

Rexel (ENXTPA:RXL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Rexel S.A., with a market cap of €6.83 billion, distributes low and ultra-low voltage electrical products and services across residential, commercial, and industrial markets in France, Europe, North America, and Asia-Pacific.

Operations: Rexel S.A. generates €19.02 billion in revenue from its wholesale electronics segment, distributing low and ultra-low voltage electrical products and services across various markets.

Dividend Yield: 5.2%

Rexel's dividend payments are covered by earnings (51.6%) and cash flows (39.8%), though its dividend history has been volatile over the past decade. Despite a lower yield compared to top French payers, Rexel’s dividends have increased over 10 years. Recent H1 2024 results showed a decline in net income to €351.9 million on sales of €9.63 billion, while the company continues disciplined M&A activities and share buybacks (€50 million for 0.67%).

- Navigate through the intricacies of Rexel with our comprehensive dividend report here.

- Our valuation report unveils the possibility Rexel's shares may be trading at a discount.

Key Takeaways

- Reveal the 35 hidden gems among our Top Euronext Paris Dividend Stocks screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:RXL

Rexel

Engages in the distribution of low and ultra-low voltage electrical products for the residential, commercial, and industrial markets in France, rest of Europe, North America, and the Asia-Pacific.

Excellent balance sheet slight.

Similar Companies

Market Insights

Community Narratives