- France

- /

- Construction

- /

- ENXTPA:DG

3 Euronext Paris Dividend Stocks Yielding Up To 8%

Reviewed by Simply Wall St

As global economic concerns weigh on markets, the French CAC 40 Index has not been immune, reflecting a 3.65% decline amidst renewed fears of a global slowdown. Despite this downturn, dividend stocks remain an attractive option for investors seeking steady income in uncertain times. A good dividend stock typically offers a reliable payout and demonstrates resilience amid market volatility, making it particularly appealing in today's fluctuating economic landscape.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Vicat (ENXTPA:VCT) | 6.69% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.83% | ★★★★★★ |

| CBo Territoria (ENXTPA:CBOT) | 6.82% | ★★★★★★ |

| Arkema (ENXTPA:AKE) | 4.43% | ★★★★★☆ |

| VIEL & Cie société anonyme (ENXTPA:VIL) | 3.59% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA) | 6.11% | ★★★★★☆ |

| Samse (ENXTPA:SAMS) | 6.71% | ★★★★★☆ |

| Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.72% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 8.06% | ★★★★★☆ |

| Trigano (ENXTPA:TRI) | 3.50% | ★★★★☆☆ |

Click here to see the full list of 36 stocks from our Top Euronext Paris Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Piscines Desjoyaux (ENXTPA:ALPDX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Piscines Desjoyaux SA designs, manufactures, and markets swimming pools and related products in France and internationally, with a market cap of €111.29 million.

Operations: Piscines Desjoyaux SA generates revenue through the design, manufacture, and marketing of swimming pools and related products both domestically and internationally.

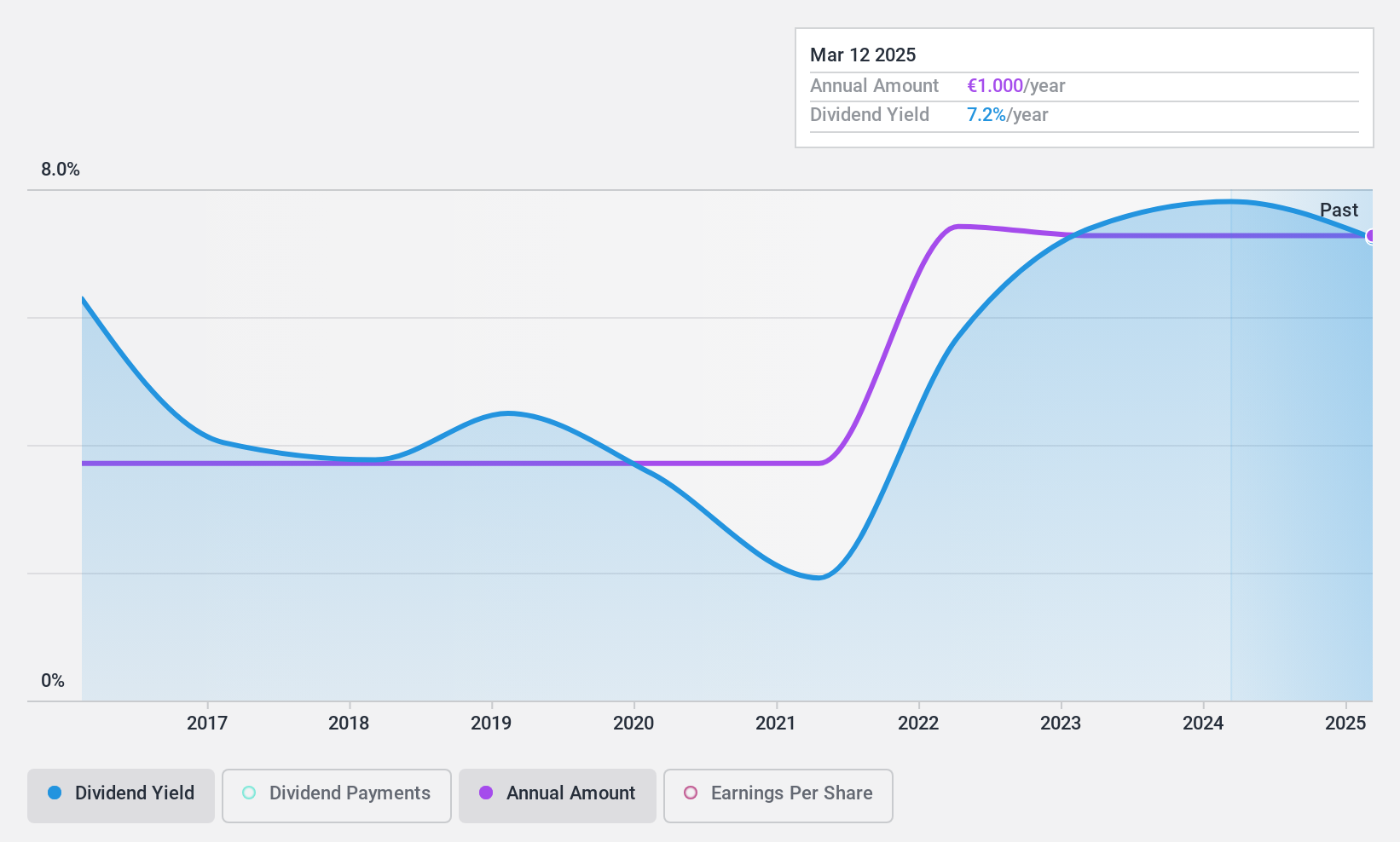

Dividend Yield: 8.1%

Piscines Desjoyaux offers an 8.06% dividend yield, placing it in the top 25% of French dividend payers. However, its dividends are not well covered by free cash flows, with a high cash payout ratio of 486.2%. Despite this, the company maintains a reasonable payout ratio of 72.5%, and its dividends have been stable and growing over the past decade. Recent earnings show a decline in net income to €2.51 million from €6.28 million year-over-year, which could impact future payouts.

- Unlock comprehensive insights into our analysis of Piscines Desjoyaux stock in this dividend report.

- Our expertly prepared valuation report Piscines Desjoyaux implies its share price may be lower than expected.

Vinci (ENXTPA:DG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vinci SA, with a market cap of €62.30 billion, operates in concessions, energy, and construction sectors both in France and internationally through its subsidiaries.

Operations: Vinci SA generates revenue from several segments, including Cobra IS (€6.74 billion), VINCI Energies (€19.76 billion), Concessions - VINCI Airports (€4.57 billion), Concessions - VINCI Autoroutes (€6.98 billion), and VINCI Construction (Including Eurovia) (€31.83 billion).

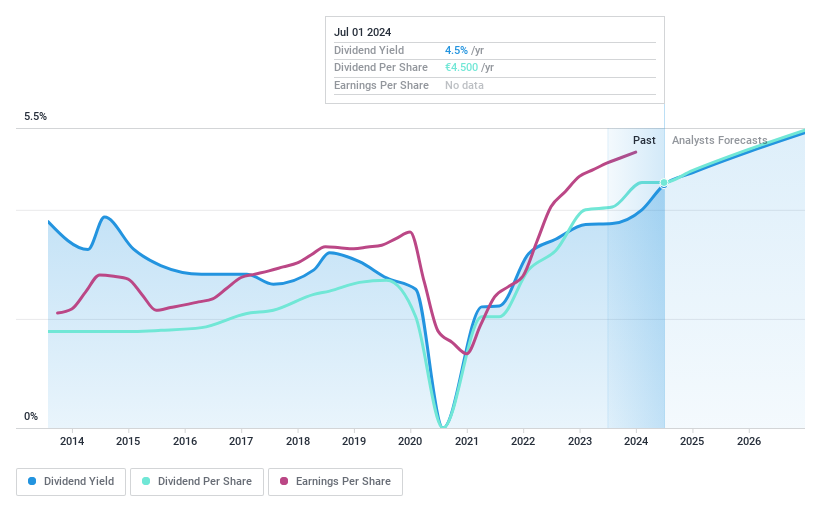

Dividend Yield: 4.1%

Vinci SA recently reported half-year sales of €34.25 billion, up from €32.73 billion last year, though net income fell to €1.99 billion from €2.09 billion. The company approved a 2024 interim dividend of €1.05 per share, payable on 17 October 2024, indicating a commitment to shareholder returns despite earnings volatility and high debt levels. Vinci's dividends have grown over the past decade but have shown instability at times, raising questions about long-term reliability for dividend investors.

- Get an in-depth perspective on Vinci's performance by reading our dividend report here.

- Our valuation report unveils the possibility Vinci's shares may be trading at a discount.

Ipsos (ENXTPA:IPS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ipsos SA, with a market cap of €2.26 billion, offers survey-based research services to companies and institutions across Europe, the Middle East, Africa, the Americas, and the Asia-Pacific through its subsidiaries.

Operations: Ipsos SA generates €2.44 billion from its survey-based research services provided to companies and institutions globally.

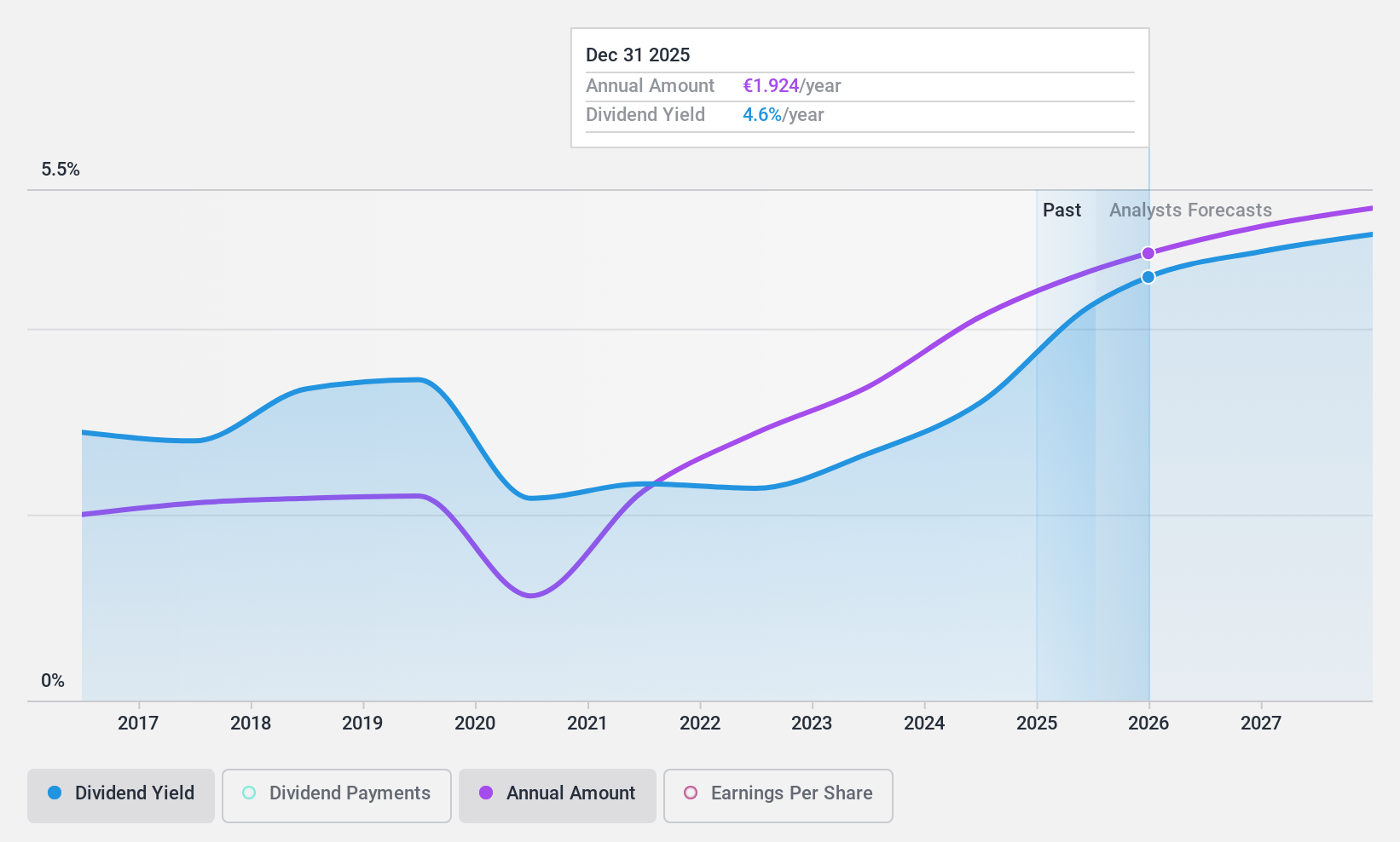

Dividend Yield: 3.1%

Ipsos's dividend payments are well covered by both earnings (39.3% payout ratio) and cash flows (25.3% cash payout ratio), though the dividends have been volatile over the past decade. Recent half-year results showed improved sales (€1.14 billion) and net income (€77.95 million). Despite these positive financials, Ipsos's dividend yield of 3.14% is lower than the top 25% of French dividend payers, making it less attractive for high-yield-focused investors.

- Click here to discover the nuances of Ipsos with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Ipsos shares in the market.

Summing It All Up

- Gain an insight into the universe of 36 Top Euronext Paris Dividend Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:DG

Vinci

Engages in concessions, energy, and construction businesses in France and internationally.

Very undervalued with adequate balance sheet and pays a dividend.