With Eutelsat Group (EPA:ETL) It Looks Like You'll Get What You Pay For

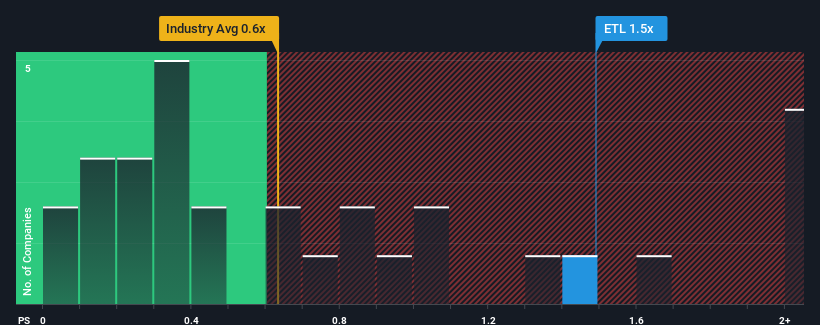

When close to half the companies in the Media industry in France have price-to-sales ratios (or "P/S") below 0.6x, you may consider Eutelsat Group (EPA:ETL) as a stock to potentially avoid with its 1.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Eutelsat Group

What Does Eutelsat Group's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Eutelsat Group has been relatively sluggish. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Eutelsat Group.How Is Eutelsat Group's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Eutelsat Group's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 7.2% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 1.7% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the eleven analysts covering the company suggest revenue should grow by 7.9% per annum over the next three years. That's shaping up to be materially higher than the 5.1% each year growth forecast for the broader industry.

With this in mind, it's not hard to understand why Eutelsat Group's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Eutelsat Group maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Media industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

Having said that, be aware Eutelsat Group is showing 1 warning sign in our investment analysis, you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Eutelsat Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ETL

Fair value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives