- France

- /

- Entertainment

- /

- ENXTPA:ALPUL

Downgrade: Here's How Analysts See Focus Home Interactive Société anonyme (EPA:ALFOC) Performing In The Near Term

One thing we could say about the analysts on Focus Home Interactive Société anonyme (EPA:ALFOC) - they aren't optimistic, having just made a major negative revision to their near-term (statutory) forecasts for the organization. Both revenue and earnings per share (EPS) estimates were cut sharply as the analysts factored in the latest outlook for the business, concluding that they were too optimistic previously.

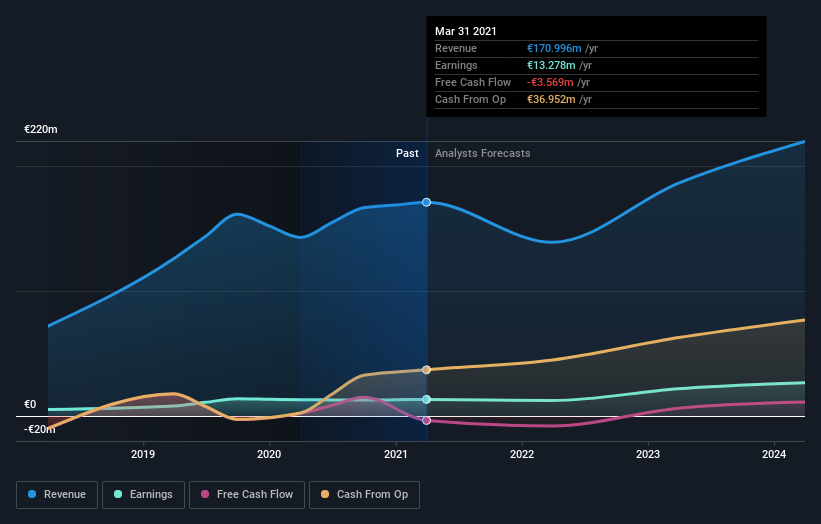

Following the downgrade, the consensus from five analysts covering Focus Home Interactive Société anonyme is for revenues of €139m in 2022, implying an uneasy 19% decline in sales compared to the last 12 months. Statutory earnings per share are supposed to fall 14% to €2.13 in the same period. Previously, the analysts had been modelling revenues of €173m and earnings per share (EPS) of €3.04 in 2022. Indeed, we can see that the analysts are a lot more bearish about Focus Home Interactive Société anonyme's prospects, administering a measurable cut to revenue estimates and slashing their EPS estimates to boot.

See our latest analysis for Focus Home Interactive Société anonyme

The consensus price target fell 8.2% to €77.78, with the weaker earnings outlook clearly leading analyst valuation estimates. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. The most optimistic Focus Home Interactive Société anonyme analyst has a price target of €99.00 per share, while the most pessimistic values it at €52.70. This shows there is still some diversity in estimates, but analysts don't appear to be totally split on the stock as though it might be a success or failure situation.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 24% by the end of 2022. This indicates a significant reduction from annual growth of 20% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 6.1% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Focus Home Interactive Société anonyme is expected to lag the wider industry.

The Bottom Line

The biggest issue in the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds lay ahead for Focus Home Interactive Société anonyme. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that Focus Home Interactive Société anonyme's revenues are expected to grow slower than the wider market. With a serious cut to this year's expectations and a falling price target, we wouldn't be surprised if investors were becoming wary of Focus Home Interactive Société anonyme.

So things certainly aren't looking great, and you should also know that we've spotted some potential warning signs with Focus Home Interactive Société anonyme, including dilutive stock issuance over the past year. Learn more, and discover the 2 other warning signs we've identified, for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you decide to trade Focus Home Interactive Société anonyme, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:ALPUL

Pullup Entertainment Société anonyme

Develops, publishes, and distributes games in France, the United States, Europe, the Middle East, Africa, Asia, and internationally.

Undervalued average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026