- France

- /

- Entertainment

- /

- ENXTPA:ALPUL

Market Cool On Focus Entertainment Société anonyme's (EPA:ALFOC) Earnings Pushing Shares 45% Lower

Unfortunately for some shareholders, the Focus Entertainment Société anonyme (EPA:ALFOC) share price has dived 45% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 73% loss during that time.

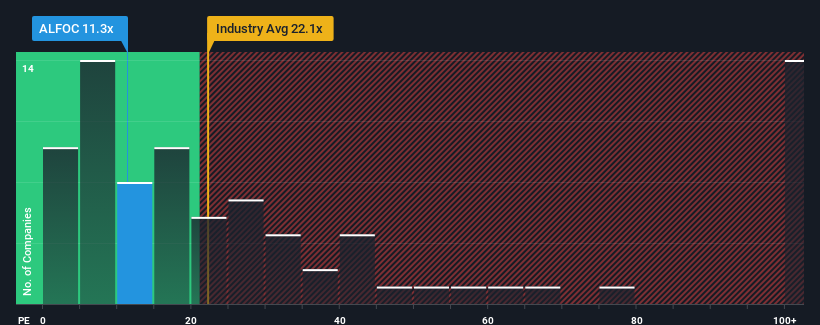

Since its price has dipped substantially, Focus Entertainment Société anonyme's price-to-earnings (or "P/E") ratio of 11.3x might make it look like a buy right now compared to the market in France, where around half of the companies have P/E ratios above 15x and even P/E's above 28x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been advantageous for Focus Entertainment Société anonyme as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Focus Entertainment Société anonyme

How Is Focus Entertainment Société anonyme's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Focus Entertainment Société anonyme's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered an exceptional 146% gain to the company's bottom line. Still, incredibly EPS has fallen 52% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 41% each year during the coming three years according to the five analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 11% per year, which is noticeably less attractive.

With this information, we find it odd that Focus Entertainment Société anonyme is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Focus Entertainment Société anonyme's P/E?

Focus Entertainment Société anonyme's P/E has taken a tumble along with its share price. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Focus Entertainment Société anonyme's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Focus Entertainment Société anonyme (of which 1 is potentially serious!) you should know about.

You might be able to find a better investment than Focus Entertainment Société anonyme. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALPUL

Pullup Entertainment Société anonyme

Develops, publishes, and distributes games in France, the United States, Europe, the Middle East, Africa, Asia, and internationally.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026