- France

- /

- Entertainment

- /

- ENXTPA:ALPUL

Is Focus Entertainment Société anonyme (EPA:ALFOC) A Risky Investment?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Focus Entertainment Société anonyme (EPA:ALFOC) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Focus Entertainment Société anonyme

How Much Debt Does Focus Entertainment Société anonyme Carry?

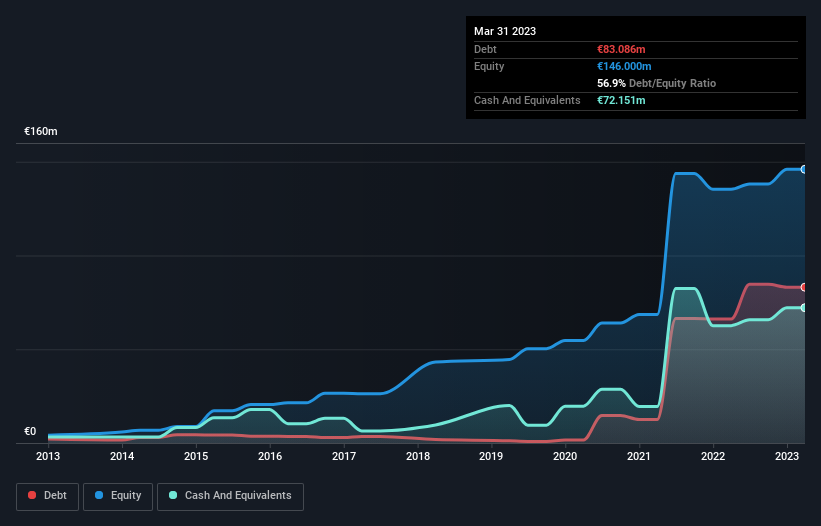

As you can see below, at the end of March 2023, Focus Entertainment Société anonyme had €83.1m of debt, up from €66.1m a year ago. Click the image for more detail. However, because it has a cash reserve of €72.2m, its net debt is less, at about €10.9m.

How Strong Is Focus Entertainment Société anonyme's Balance Sheet?

The latest balance sheet data shows that Focus Entertainment Société anonyme had liabilities of €50.4m due within a year, and liabilities of €110.7m falling due after that. On the other hand, it had cash of €72.2m and €32.9m worth of receivables due within a year. So it has liabilities totalling €56.0m more than its cash and near-term receivables, combined.

While this might seem like a lot, it is not so bad since Focus Entertainment Société anonyme has a market capitalization of €210.9m, and so it could probably strengthen its balance sheet by raising capital if it needed to. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While Focus Entertainment Société anonyme's low debt to EBITDA ratio of 0.18 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 6.5 times last year does give us pause. So we'd recommend keeping a close eye on the impact financing costs are having on the business. On top of that, Focus Entertainment Société anonyme grew its EBIT by 100% over the last twelve months, and that growth will make it easier to handle its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Focus Entertainment Société anonyme can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Focus Entertainment Société anonyme burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Focus Entertainment Société anonyme's conversion of EBIT to free cash flow was a real negative on this analysis, although the other factors we considered were considerably better. In particular, we are dazzled with its EBIT growth rate. When we consider all the elements mentioned above, it seems to us that Focus Entertainment Société anonyme is managing its debt quite well. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Focus Entertainment Société anonyme's earnings per share history for free.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALPUL

Pullup Entertainment Société anonyme

Develops, publishes, and distributes games in France, the United States, Europe, the Middle East, Africa, Asia, and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A buy recommendation

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026