- France

- /

- Interactive Media and Services

- /

- ENXTPA:ALDNX

DNXCorp SE's (EPA:ALDNX) 34% Dip In Price Shows Sentiment Is Matching Earnings

DNXCorp SE (EPA:ALDNX) shareholders won't be pleased to see that the share price has had a very rough month, dropping 34% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 25% in that time.

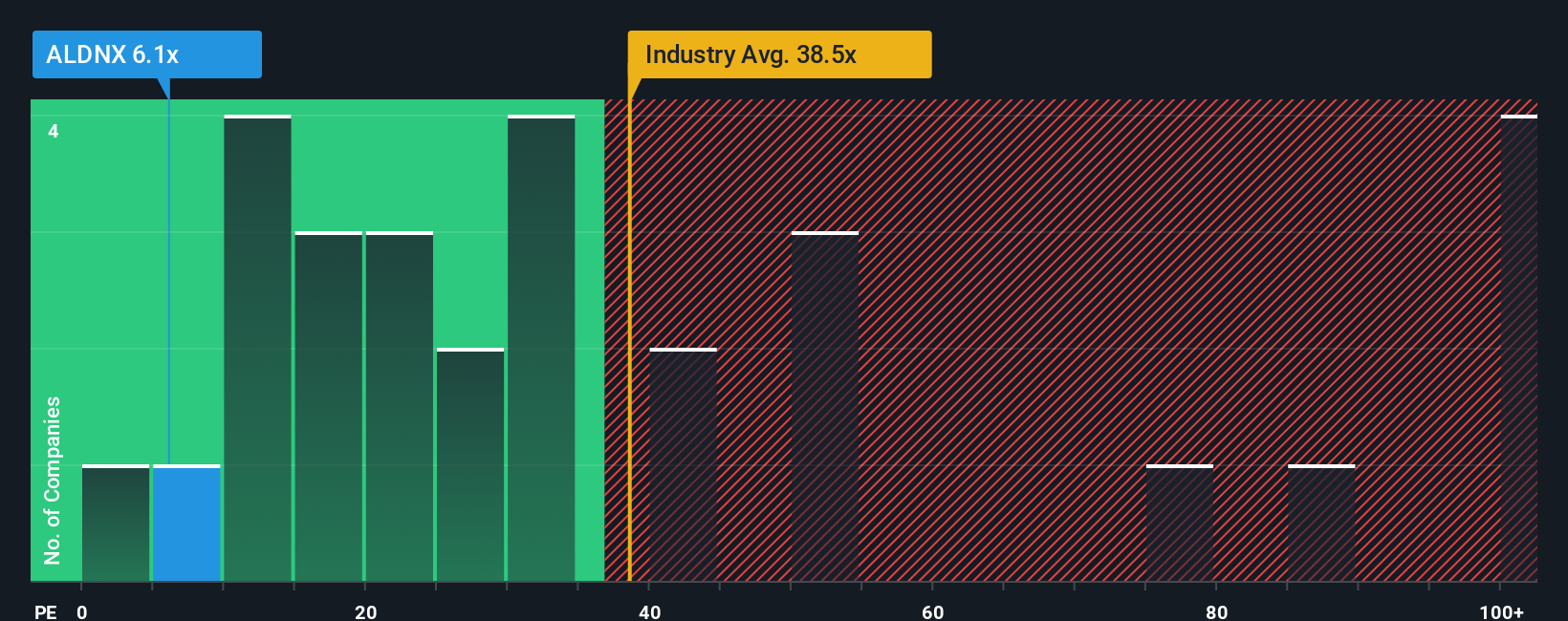

Although its price has dipped substantially, DNXCorp may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 6.1x, since almost half of all companies in France have P/E ratios greater than 17x and even P/E's higher than 30x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

As an illustration, earnings have deteriorated at DNXCorp over the last year, which is not ideal at all. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Check out our latest analysis for DNXCorp

Is There Any Growth For DNXCorp?

DNXCorp's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 19%. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

This is in contrast to the rest of the market, which is expected to grow by 14% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that DNXCorp's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Bottom Line On DNXCorp's P/E

DNXCorp's P/E looks about as weak as its stock price lately. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that DNXCorp maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for DNXCorp that you should be aware of.

You might be able to find a better investment than DNXCorp. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALDNX

DNXCorp

Engages in the development and promotion of internet-based audience in Luxembourg and internationally.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026