As European markets face challenges from proposed U.S. tariffs and a contraction in eurozone business activity, investors are keenly observing how these developments influence smaller stocks. Penny stocks, though an older term, remain relevant as they represent smaller or newer companies that might offer unique opportunities amidst market volatility. This article explores three European penny stocks that exhibit financial strength and potential resilience, making them noteworthy for those interested in tapping into emerging opportunities within the market landscape.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.315 | SEK2.22B | ✅ 4 ⚠️ 1 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.00 | SEK196.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.71 | SEK278.19M | ✅ 4 ⚠️ 2 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.66 | SEK222.67M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.88 | PLN131.51M | ✅ 4 ⚠️ 2 View Analysis > |

| Abak (WSE:ABK) | PLN4.60 | PLN12.4M | ✅ 2 ⚠️ 4 View Analysis > |

| Cellularline (BIT:CELL) | €2.87 | €60.53M | ✅ 3 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.956 | €32.01M | ✅ 3 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.69 | €17.54M | ✅ 2 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.185 | €301.67M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 445 stocks from our European Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Don't Nod Entertainment (ENXTPA:ALDNE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Don't Nod Entertainment S.A. is a company that develops and publishes video games globally, with a market cap of €12.35 million.

Operations: The company generates revenue primarily from the development of video games, totaling €23.94 million.

Market Cap: €12.35M

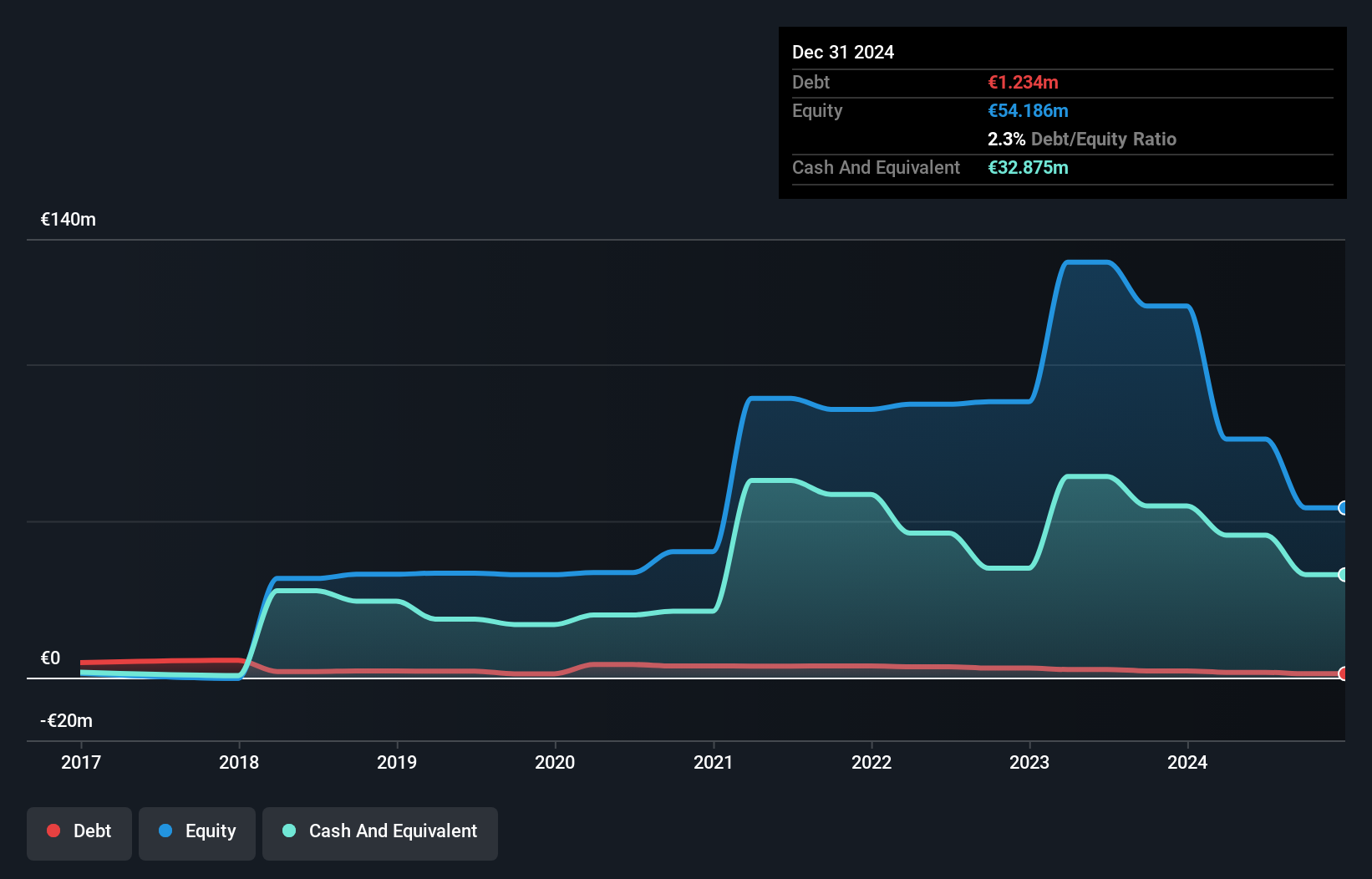

Don't Nod Entertainment S.A., with a market cap of €12.35 million, reported a decrease in revenue to €23.94 million for 2024, down from €32.07 million the previous year, alongside an increased net loss of €64.32 million. Despite its unprofitability and volatile share price, the company maintains financial stability through short-term assets exceeding liabilities and sufficient cash runway for nearly two years if current cash flow trends continue. The board's experience is notable with an average tenure of 3.9 years, though the company faces challenges in achieving profitability within the next three years amidst high volatility compared to French stocks.

- Get an in-depth perspective on Don't Nod Entertainment's performance by reading our balance sheet health report here.

- Assess Don't Nod Entertainment's future earnings estimates with our detailed growth reports.

Vo2 Cap Holding (OM:VO2)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Vo2 Cap Holding AB (publ) operates in the media tech industry and has a market cap of SEK108.65 million.

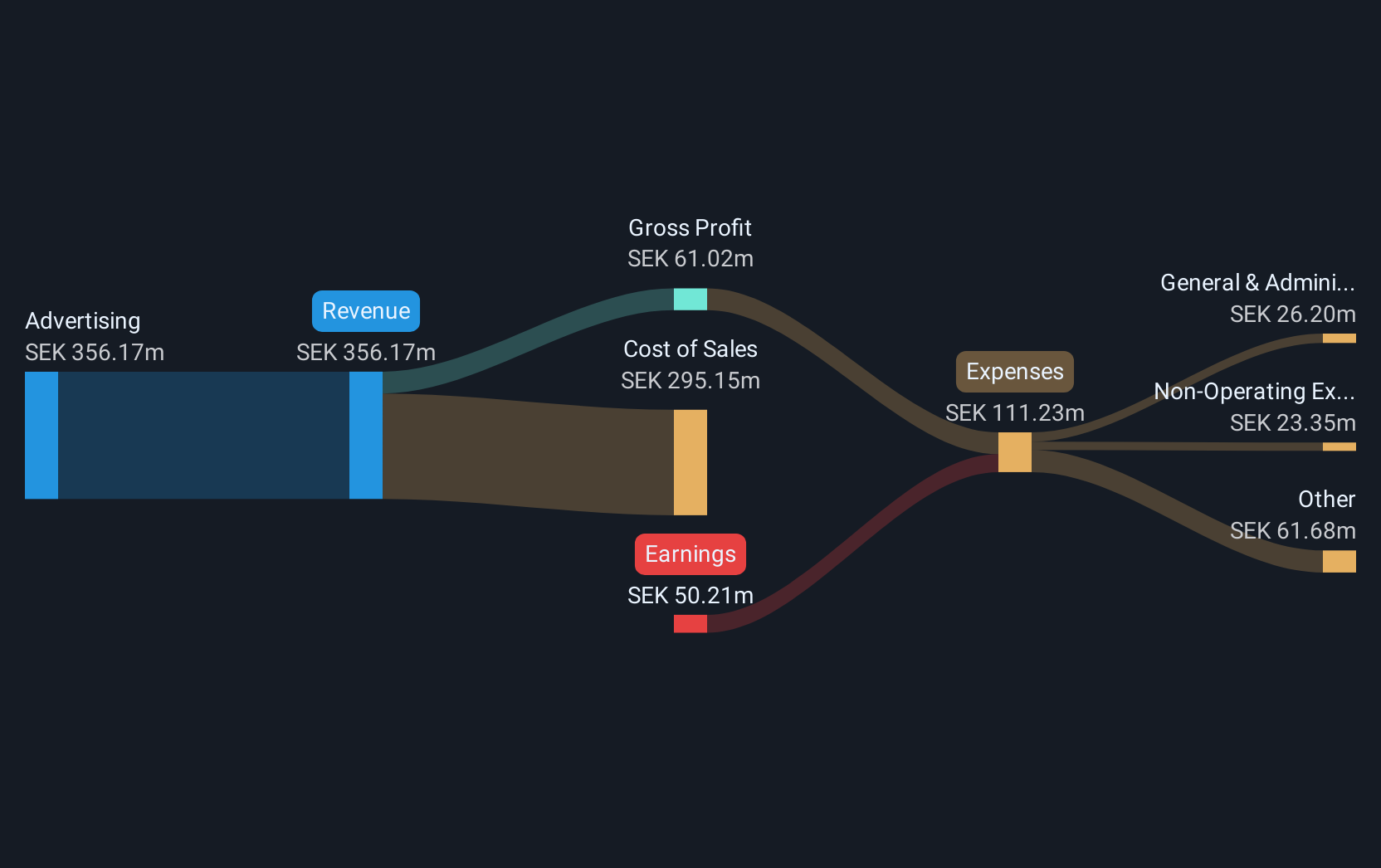

Operations: The company generates SEK356.17 million from its advertising segment.

Market Cap: SEK108.65M

Vo2 Cap Holding AB, with a market cap of SEK108.65 million, reported first-quarter sales of SEK75.49 million, slightly down from the previous year. Despite its unprofitability and increased losses over five years, the company benefits from sufficient cash reserves to cover more than three years of operations at current free cash flow levels. Short-term assets do not cover liabilities; however, long-term liabilities are adequately covered. The management team is experienced with an average tenure of 3.3 years. Vo2's share price remains highly volatile but trades at a good value compared to industry peers in the media tech sector.

- Click here and access our complete financial health analysis report to understand the dynamics of Vo2 Cap Holding.

- Explore Vo2 Cap Holding's analyst forecasts in our growth report.

Energoinstal (WSE:ENI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Energoinstal S.A. manufactures and sells power boilers in Poland and internationally, with a market cap of PLN49.50 million.

Operations: Energoinstal S.A. does not report specific revenue segments.

Market Cap: PLN49.5M

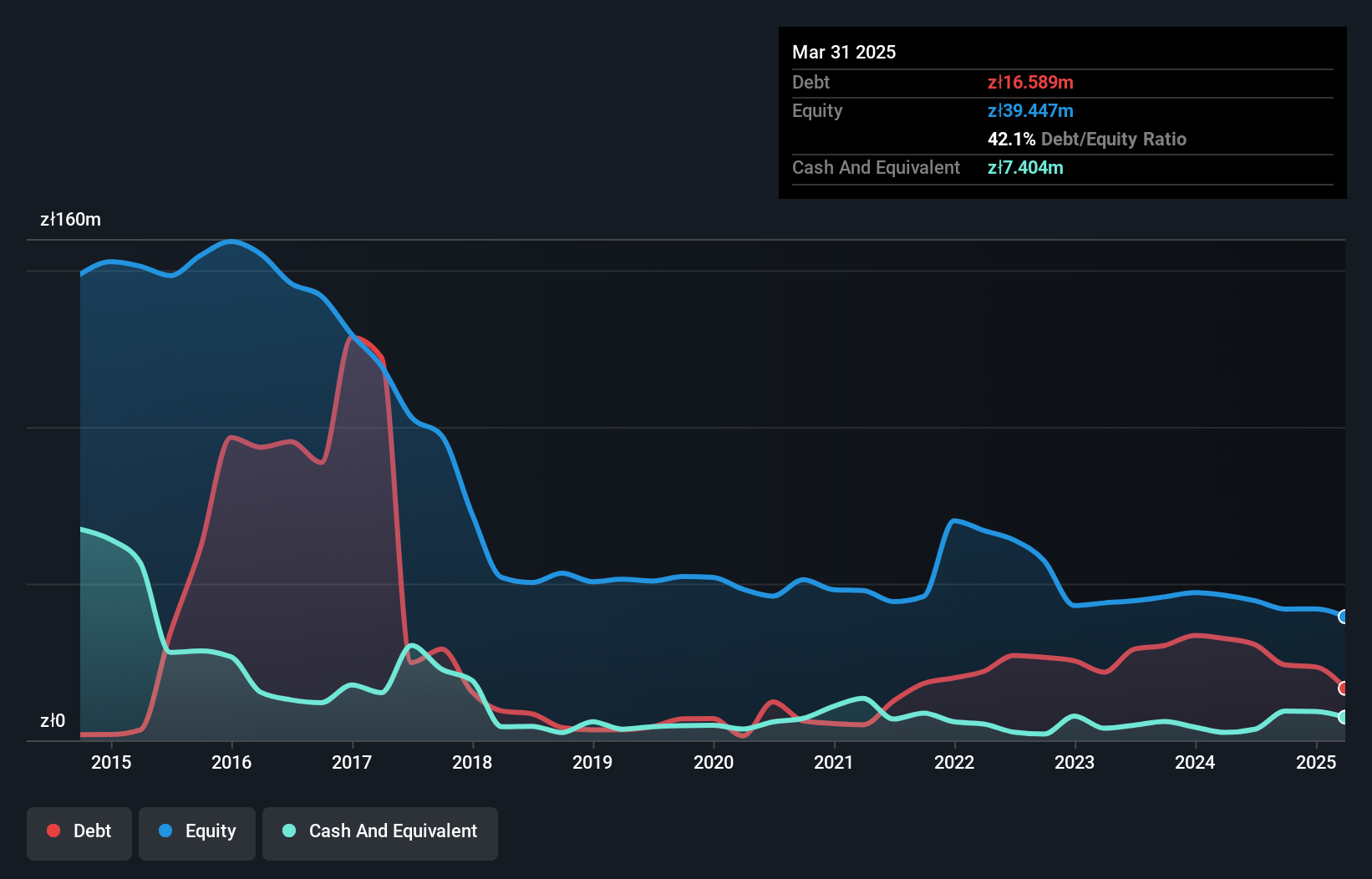

Energoinstal S.A., with a market cap of PLN49.50 million, is currently unprofitable and reported a net loss of PLN 2.45 million for Q1 2025, an increase from the previous year. The company faces challenges with short-term assets (PLN19.8M) not covering its liabilities (PLN27.9M), and long-term liabilities also exceed short-term assets at PLN48.8M. Despite these issues, it benefits from being debt-free and having sufficient cash runway for over three years due to positive free cash flow growth of 15% annually. Its share price is highly volatile but trades significantly below estimated fair value, offering potential investment appeal amidst its financial hurdles.

- Click here to discover the nuances of Energoinstal with our detailed analytical financial health report.

- Assess Energoinstal's previous results with our detailed historical performance reports.

Taking Advantage

- Click this link to deep-dive into the 445 companies within our European Penny Stocks screener.

- Contemplating Other Strategies? Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Energoinstal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:ENI

Energoinstal

Engages in the manufacture and sale of power boilers in Poland and internationally.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives