European Penny Stocks: Don't Nod Entertainment Leads Our Top 3 Picks

Reviewed by Simply Wall St

The European stock market has shown resilience, with major indices like Italy's FTSE MIB and Germany's DAX posting gains amid a climate of cautious optimism regarding interest rate policies and trade dynamics. In this context, penny stocks—often overlooked yet full of potential—represent an intriguing investment opportunity. Though the term 'penny stock' might seem outdated, these smaller or newer companies can offer significant growth prospects when supported by solid financials.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.20 | €1.45B | ✅ 5 ⚠️ 2 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.12 | €16.64M | ✅ 3 ⚠️ 4 View Analysis > |

| Maps (BIT:MAPS) | €3.38 | €44.89M | ✅ 5 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €227.2M | ✅ 2 ⚠️ 2 View Analysis > |

| Siili Solutions Oyj (HLSE:SIILI) | €4.85 | €39.33M | ✅ 3 ⚠️ 3 View Analysis > |

| IAMBA Arad (BVB:FERO) | RON0.494 | RON16.71M | ✅ 2 ⚠️ 4 View Analysis > |

| Euroland Société anonyme (ENXTPA:ALERO) | €2.98 | €9.46M | ✅ 2 ⚠️ 5 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.535 | €400.83M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.055 | €284.04M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 326 stocks from our European Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Don't Nod Entertainment (ENXTPA:ALDNE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Don't Nod Entertainment S.A. is a global developer and publisher of video games, with a market cap of €11.28 million.

Operations: The company generates revenue primarily from the development of video games, amounting to €23.94 million.

Market Cap: €11.28M

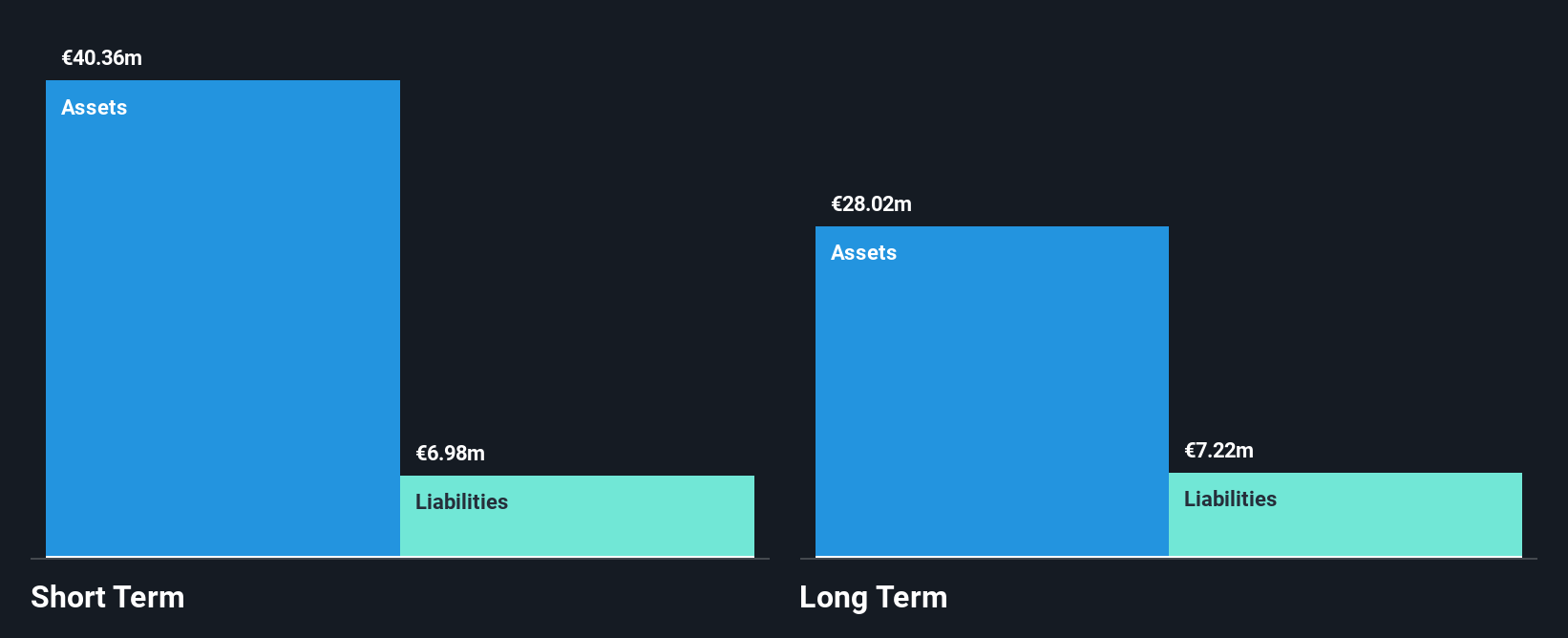

Don't Nod Entertainment S.A., with a market cap of €11.28 million, is currently unprofitable and not expected to achieve profitability within the next three years. Despite its negative return on equity, the company maintains a strong liquidity position, as its short-term assets (€40.4M) surpass both short-term (€7.0M) and long-term liabilities (€7.2M). The company has more cash than debt and hasn't meaningfully diluted shareholders recently. While past losses have increased significantly, Don't Nod possesses a sufficient cash runway for 2.5 years if free cash flow continues to decline at historical rates, providing some financial stability amidst volatility in earnings growth.

- Navigate through the intricacies of Don't Nod Entertainment with our comprehensive balance sheet health report here.

- Gain insights into Don't Nod Entertainment's outlook and expected performance with our report on the company's earnings estimates.

Ovaro Kiinteistösijoitus Oyj (HLSE:OVARO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ovaro Kiinteistösijoitus Oyj focuses on investing in apartments and commercial premises in Finland with a market capitalization of €26.84 million.

Operations: The company generates revenue from its REIT - Residential segment, amounting to €6.19 million.

Market Cap: €26.84M

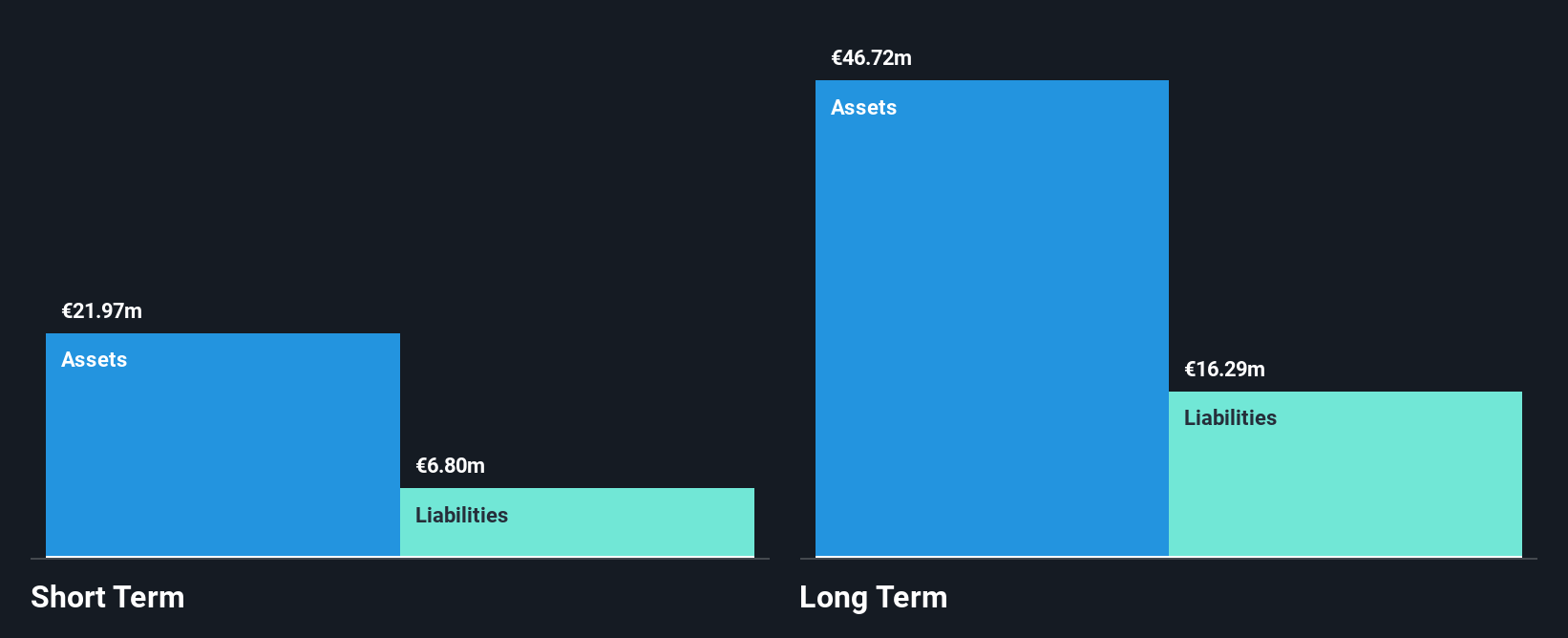

Ovaro Kiinteistösijoitus Oyj, with a market cap of €26.84 million, has shown significant profitability improvements despite a decline in sales to €1.01 million for the recent quarter. Net income rose to €1.85 million, highlighting operational efficiency amidst revenue challenges. The company's financial health is supported by cash reserves exceeding total debt and short-term assets covering both short and long-term liabilities effectively. While operating cash flow remains negative, interest payments are well covered by EBIT at 3.3 times coverage, indicating manageable debt levels despite low return on equity and recent one-off losses impacting earnings quality.

- Dive into the specifics of Ovaro Kiinteistösijoitus Oyj here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Ovaro Kiinteistösijoitus Oyj's future.

QPR Software Oyj (HLSE:QPR1V)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: QPR Software Oyj offers services and software tools for business process development and enterprise architecture across Finland, Europe, Russia, Turkey, and internationally, with a market cap of €12.15 million.

Operations: QPR Software Oyj's revenue primarily comes from the operational development of organizations, amounting to €6.27 million.

Market Cap: €12.15M

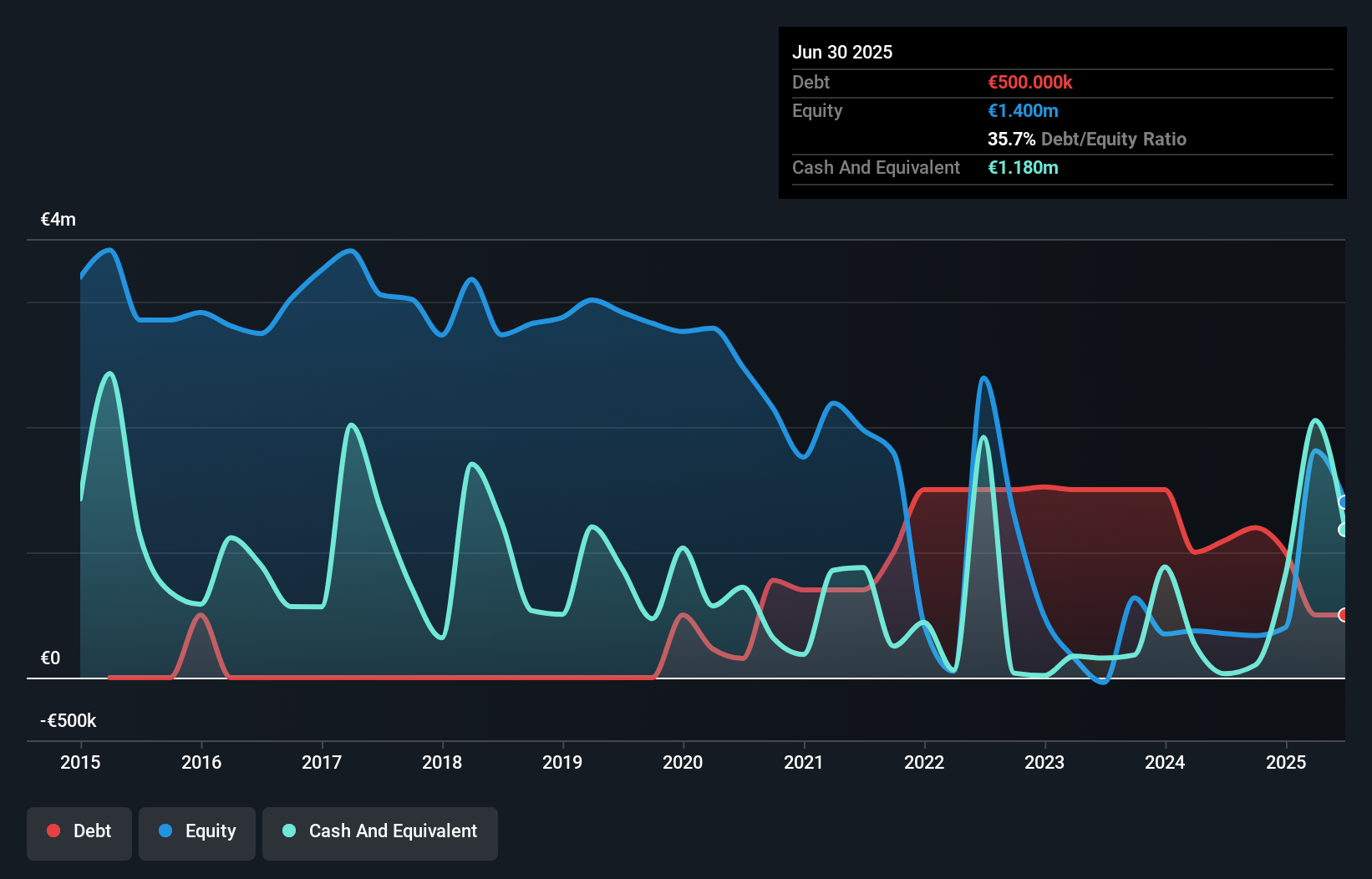

QPR Software Oyj, with a market cap of €12.15 million, faces challenges as it navigates restructuring and executive changes. Recent personnel reductions aim to enhance profitability and competitiveness. Despite being unprofitable, the company has reduced losses over five years and maintains a positive cash flow with a runway exceeding three years. However, short-term liabilities surpass current assets (€2.6M vs €3.3M), indicating liquidity concerns despite having more cash than total debt. The stock trades significantly below estimated fair value but exhibits high volatility compared to Finnish peers, reflecting investor uncertainty amid ongoing operational adjustments.

- Click here and access our complete financial health analysis report to understand the dynamics of QPR Software Oyj.

- Understand QPR Software Oyj's earnings outlook by examining our growth report.

Next Steps

- Take a closer look at our European Penny Stocks list of 326 companies by clicking here.

- Ready To Venture Into Other Investment Styles? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QPR Software Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:QPR1V

QPR Software Oyj

Provides services and software tools for developing business processes and enterprise architecture in Finland, rest of Europe, Russia, Turkey, and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives