- France

- /

- Entertainment

- /

- ENXTPA:ALCHI

A Piece Of The Puzzle Missing From Alchimie S.A.S.'s (EPA:ALCHI) Share Price

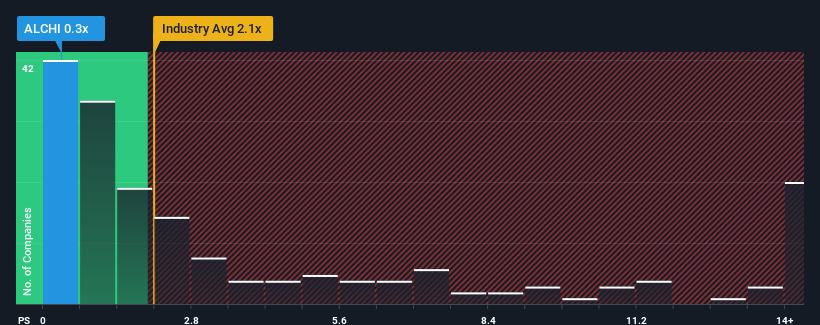

Alchimie S.A.S.'s (EPA:ALCHI) price-to-sales (or "P/S") ratio of 0.3x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Entertainment industry in France have P/S ratios greater than 2x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for AlchimieS

What Does AlchimieS' Recent Performance Look Like?

As an illustration, revenue has deteriorated at AlchimieS over the last year, which is not ideal at all. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on AlchimieS will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on AlchimieS' earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For AlchimieS?

AlchimieS' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 32%. This means it has also seen a slide in revenue over the longer-term as revenue is down 6.6% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for a contraction of 11% shows the industry is even less attractive on an annualised basis.

With this information, it's perhaps strange but not a major surprise that AlchimieS is trading at a lower P/S in comparison. Even if the company's recent growth rates continue outperforming the industry, shrinking revenues are unlikely to lead to a stable P/S long-term. There is still potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

What Does AlchimieS' P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we've mentioned, AlchimieS' lower than industry P/S comes as a bit of a surprise due to its recent three-year revenue not being as bad as the forecasts for a struggling industry. There could be some major unobserved threats to revenue preventing the P/S ratio from matching this comparatively more attractive revenue performance. Perhaps there is some hesitation about the company's ability to stay its recent course and resist the broader industry turmoil. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see a lot of volatility.

Plus, you should also learn about these 3 warning signs we've spotted with AlchimieS.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Alchimie, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALCHI

Alchimie

Operates as an OTT video streaming platform in France and internationally.

Slight and slightly overvalued.

Similar Companies

Market Insights

Community Narratives