These 4 Measures Indicate That ADThink Media Société Anonyme (EPA:ALADM) Is Using Debt Reasonably Well

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that ADThink Media Société Anonyme (EPA:ALADM) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for ADThink Media Société Anonyme

What Is ADThink Media Société Anonyme's Net Debt?

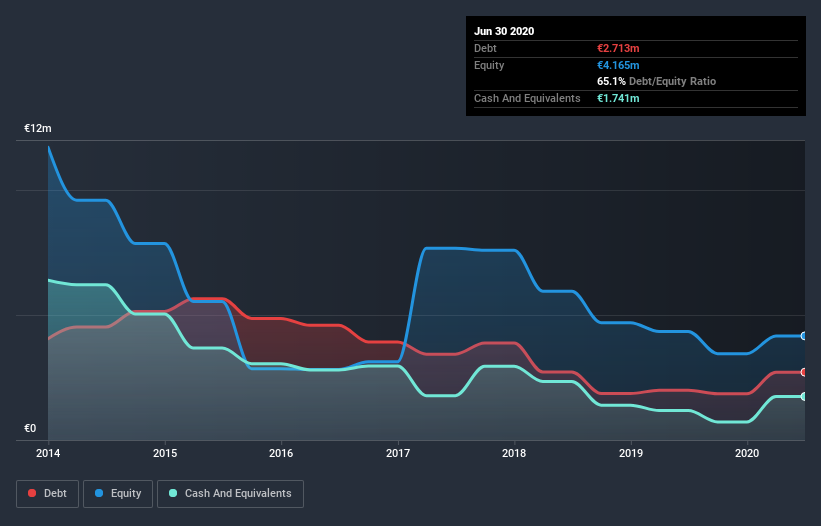

As you can see below, at the end of June 2020, ADThink Media Société Anonyme had €2.71m of debt, up from €1.99m a year ago. Click the image for more detail. However, it does have €1.74m in cash offsetting this, leading to net debt of about €972.0k.

A Look At ADThink Media Société Anonyme's Liabilities

Zooming in on the latest balance sheet data, we can see that ADThink Media Société Anonyme had liabilities of €4.53m due within 12 months and liabilities of €2.23m due beyond that. On the other hand, it had cash of €1.74m and €6.61m worth of receivables due within a year. So it can boast €1.59m more liquid assets than total liabilities.

It's good to see that ADThink Media Société Anonyme has plenty of liquidity on its balance sheet, suggesting conservative management of liabilities. Given it has easily adequate short term liquidity, we don't think it will have any issues with its lenders.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

ADThink Media Société Anonyme has a low net debt to EBITDA ratio of only 1.2. And its EBIT covers its interest expense a whopping 16.0 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. It was also good to see that despite losing money on the EBIT line last year, ADThink Media Société Anonyme turned things around in the last 12 months, delivering and EBIT of €735k. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if ADThink Media Société Anonyme can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. Over the last year, ADThink Media Société Anonyme saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

Based on what we've seen ADThink Media Société Anonyme is not finding it easy, given its conversion of EBIT to free cash flow, but the other factors we considered give us cause to be optimistic. There's no doubt that its ability to to cover its interest expense with its EBIT is pretty flash. When we consider all the elements mentioned above, it seems to us that ADThink Media Société Anonyme is managing its debt quite well. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with ADThink Media Société Anonyme (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you decide to trade ADThink Media Société Anonyme, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if NFTY might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTPA:ALNFT

NFTY

NFTY SA provides digital advertising services to advertisers and publishers in France.

Slightly overvalued with weak fundamentals.