As global markets navigate mixed performances, with the S&P 500 and Nasdaq Composite posting strong annual gains despite recent volatility, investors are closely watching economic indicators such as the Chicago PMI and GDP forecasts that signal potential challenges ahead. In this environment, identifying high growth tech stocks requires a focus on companies that demonstrate resilience through innovation and adaptability to shifting market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1258 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Exclusive Networks (ENXTPA:EXN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Exclusive Networks SA is a global cybersecurity specialist focused on digital infrastructure, with a market capitalization of approximately €1.71 billion.

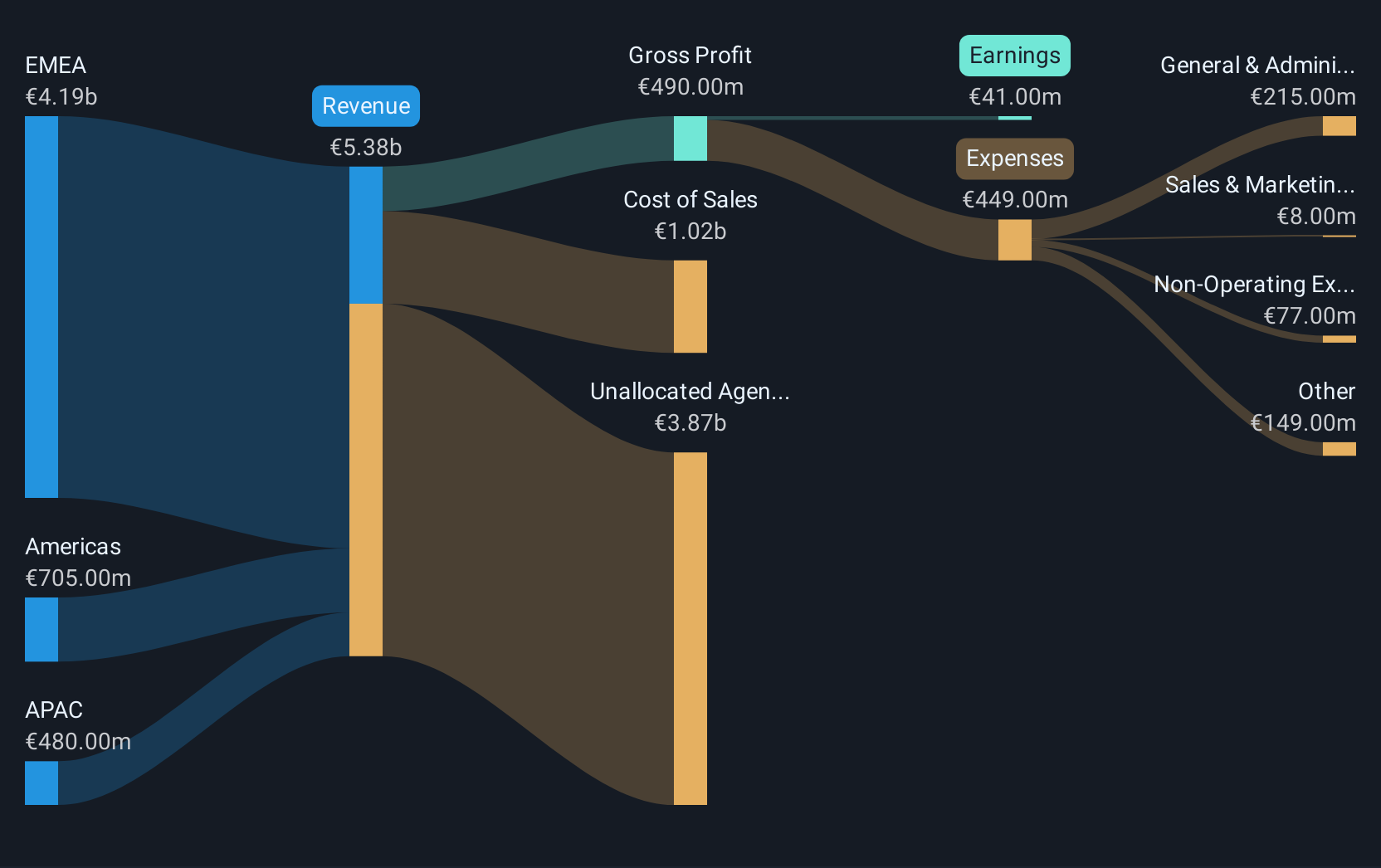

Operations: Exclusive Networks SA generates revenue primarily from its operations across three regions: EMEA (€4.19 billion), APAC (€480 million), and the Americas (€705 million). The company focuses on providing cybersecurity solutions for digital infrastructure globally.

Exclusive Networks, amidst a transformative acquisition by CD&R and Permira, is poised for robust growth with a forecasted earnings increase of 34.5% annually. This strategic change comes after a significant premium offer, reflecting confidence in its value and future prospects. Despite recent challenges indicated by a negative earnings growth last year, the company's revenue is expected to climb at 12.7% per year, outpacing the French market's 5.5%. The firm's commitment to innovation is evident from its R&D spending trends, ensuring it remains at the forefront of technological advancements in cybersecurity solutions. This focus on research not only fuels future growth but also enhances its competitive edge in an increasingly digital world.

- Dive into the specifics of Exclusive Networks here with our thorough health report.

Understand Exclusive Networks' track record by examining our Past report.

Atea (OB:ATEA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Atea ASA specializes in delivering IT infrastructure and related solutions to businesses and public sector organizations across the Nordic countries and Baltic regions, with a market cap of NOK 15.79 billion.

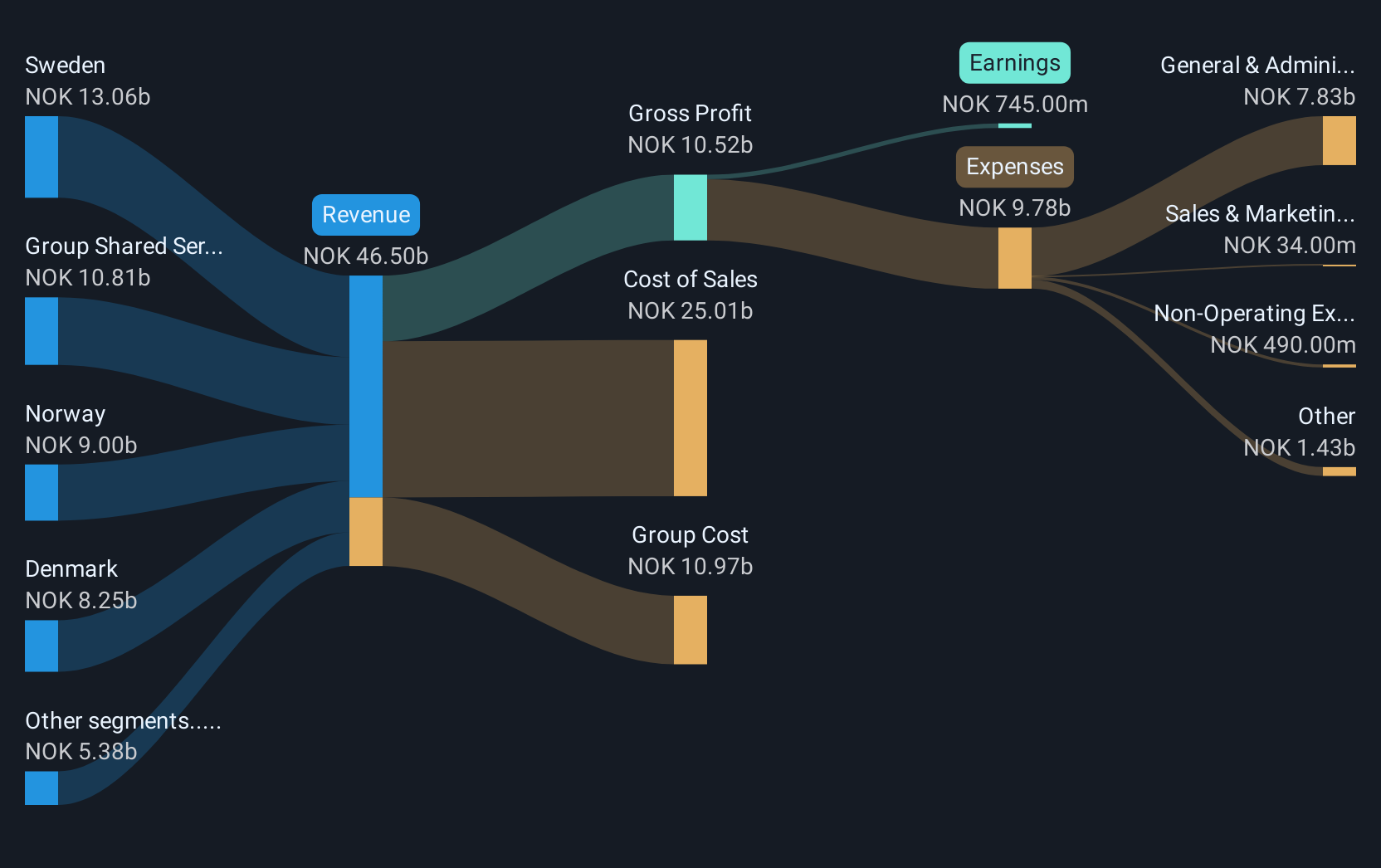

Operations: Atea ASA generates revenue from providing IT infrastructure and related solutions across Norway, Sweden, Denmark, Finland, and the Baltic regions. The company's largest revenue segment is Sweden, contributing NOK 12.44 billion. Group Shared Services is a notable cost component at NOK 9.20 billion.

Amidst a challenging backdrop, Atea has demonstrated resilience with an 8.3% forecast in annual revenue growth, surpassing the Norwegian market's average of 1.9%. This growth is complemented by a robust projected earnings increase of 18.9% annually, significantly outstripping the market's 8.9%. The company recently initiated a share repurchase program, underscoring its financial strength and commitment to shareholder value. Additionally, Atea's focus on R&D is evident from its strategic investments aimed at enhancing technological capabilities and maintaining competitive advantage in the IT sector.

SIIX (TSE:7613)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SIIX Corporation focuses on the sale and distribution of electronic components both in Japan and across international markets, with a market capitalization of ¥55.99 billion.

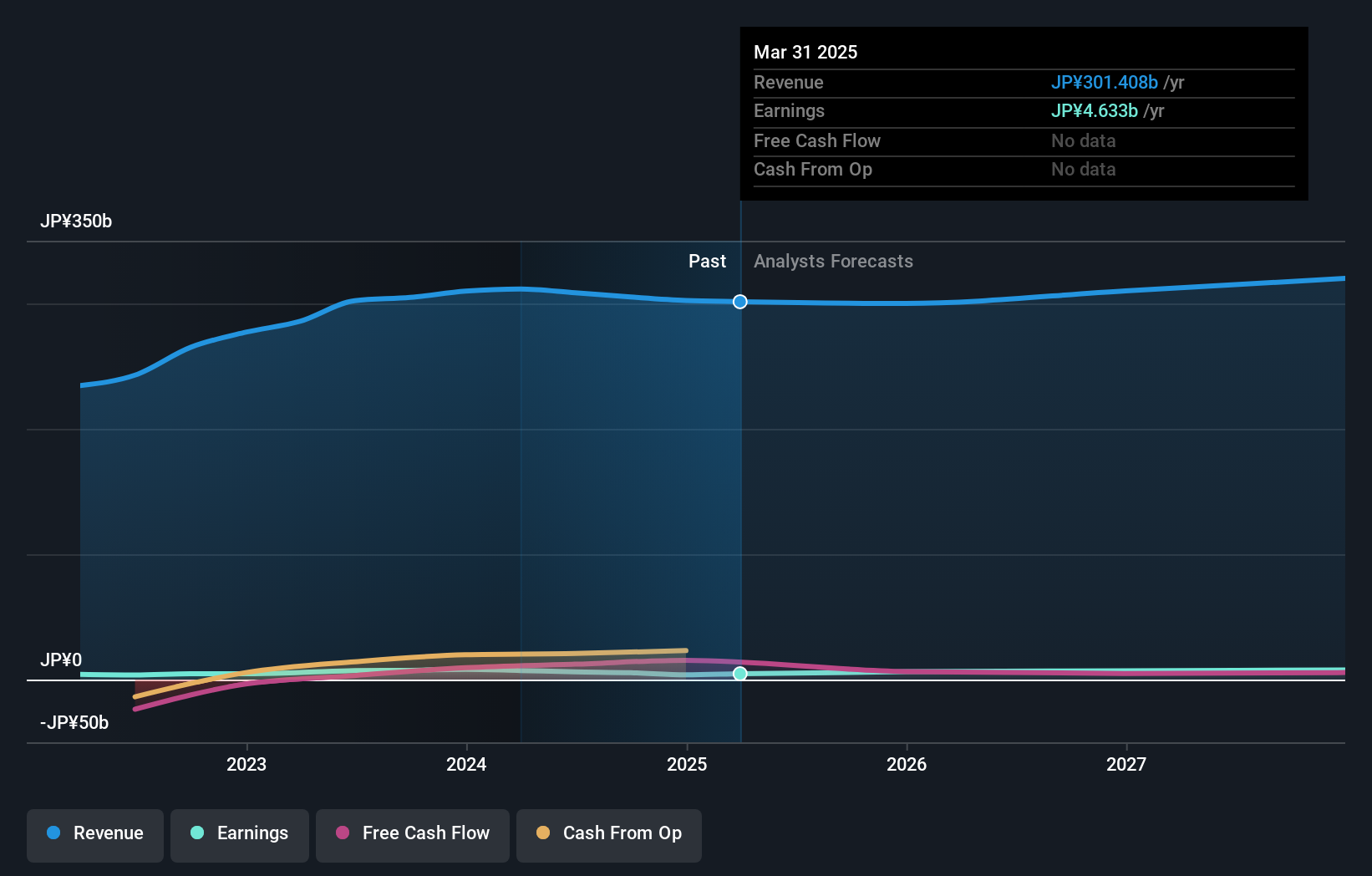

Operations: The company generates revenue through the sale and distribution of electronic components, with significant contributions from Southeast Asia at ¥115.45 billion and Japan at ¥103.89 billion. The Americas and Greater China also play vital roles in its revenue model, contributing ¥76.21 billion and ¥85.60 billion respectively, while Europe adds ¥27.16 billion to the overall sales figures.

SIIX showcases a dynamic growth trajectory with an anticipated annual revenue increase of 4.4%, slightly outpacing the Japanese market average of 4.2%. This is complemented by a robust forecast in earnings growth at 22.6% annually, significantly surpassing the market's expectation of 7.9%. The firm's commitment to innovation is underscored by its strategic R&D investments, positioning it well within the competitive landscape of high-tech industries despite broader market challenges. These financial and operational strategies suggest SIIX's potential to adapt and thrive in evolving technological sectors.

- Get an in-depth perspective on SIIX's performance by reading our health report here.

Examine SIIX's past performance report to understand how it has performed in the past.

Make It Happen

- Navigate through the entire inventory of 1258 High Growth Tech and AI Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exclusive Networks might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EXN

Exclusive Networks

Operates as a global cybersecurity specialist for digital infrastructure in Europe, the Middle East, Africa, the United States, and the Asia Pacific.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives