- France

- /

- Basic Materials

- /

- ENXTPA:VCT

Vicat And 2 Other Dividend Stocks To Consider

Reviewed by Simply Wall St

In the current global market landscape, investors are navigating a complex environment marked by cautious Federal Reserve commentary and political uncertainties, such as looming government shutdowns. Despite these challenges, dividend stocks like Vicat offer potential stability through regular income streams, making them an attractive option for those seeking to balance risk in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.96% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.81% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.53% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.87% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.28% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.87% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.04% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.73% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.23% | ★★★★★★ |

Click here to see the full list of 1968 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

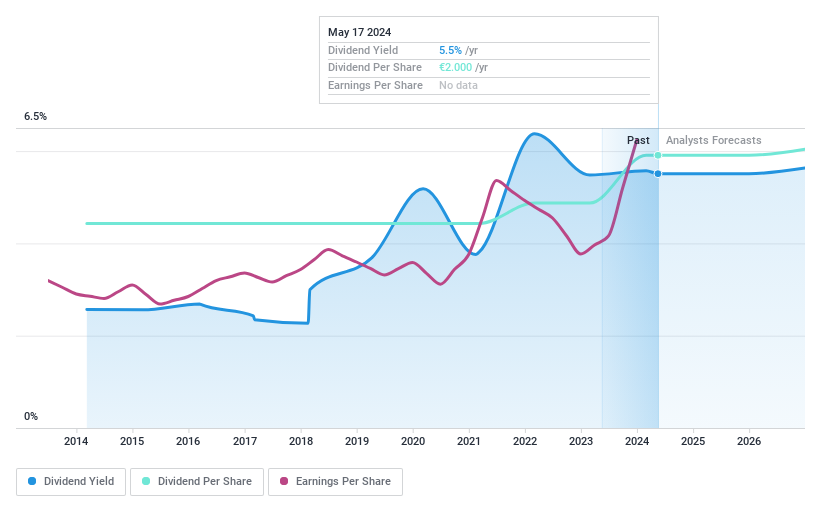

Vicat (ENXTPA:VCT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Vicat S.A., along with its subsidiaries, operates in the construction industry by producing and selling cement, ready-mixed concrete, and aggregates, with a market cap of €1.60 billion.

Operations: Vicat S.A.'s revenue is primarily derived from its Cement segment, which generated €2.52 billion, and its Concrete & Aggregates segment, contributing €1.55 billion.

Dividend Yield: 5.6%

Vicat offers a stable dividend profile with payments growing over the past decade and exhibiting reliability. Despite a high debt level, its dividends are well-covered by earnings and cash flows, with payout ratios of 33.4% and 45.7%, respectively. Trading below estimated fair value, Vicat provides good relative value compared to peers. However, its dividend yield of 5.57% is lower than the top quartile in France's market at 5.88%.

- Unlock comprehensive insights into our analysis of Vicat stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Vicat shares in the market.

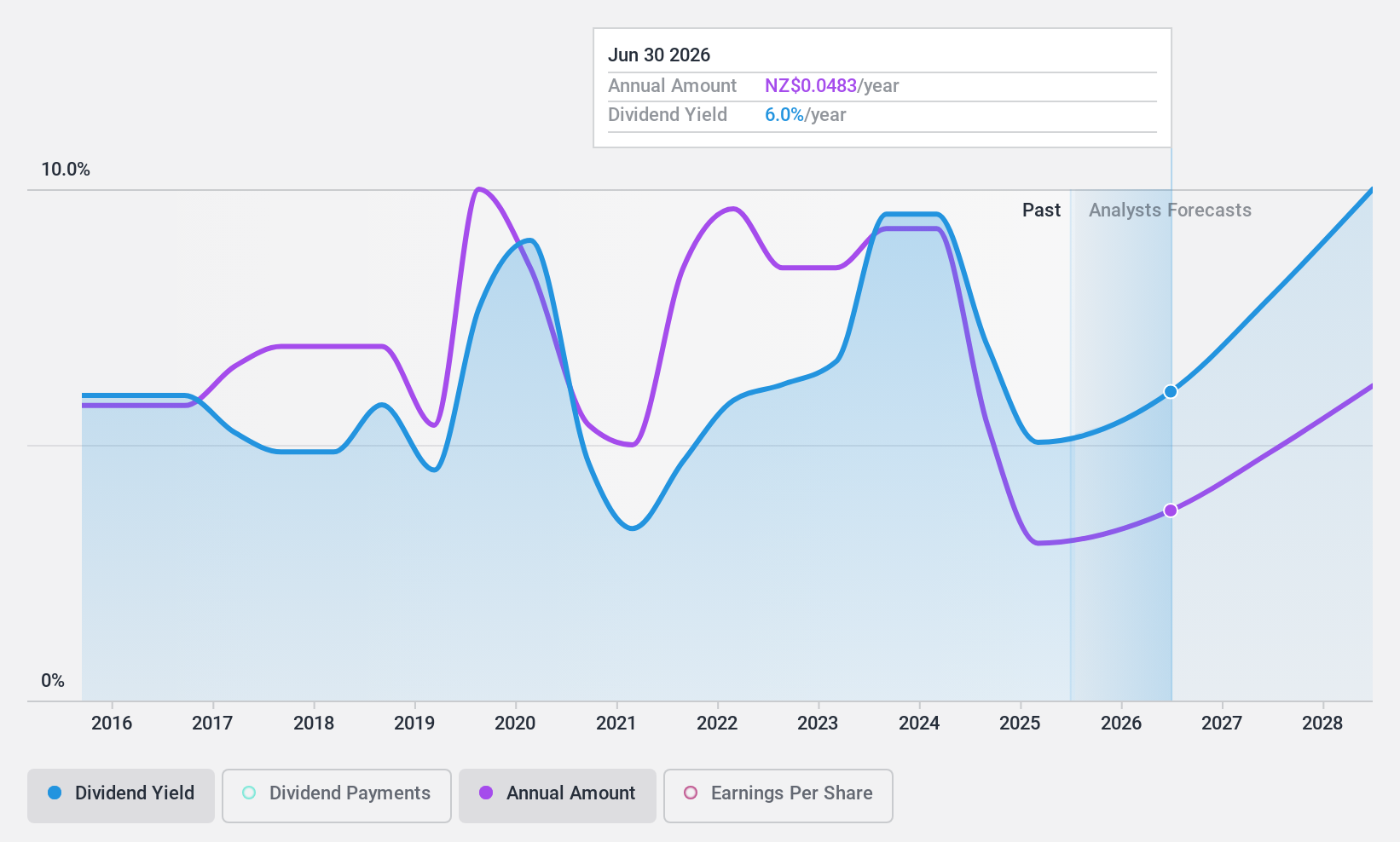

Heartland Group Holdings (NZSE:HGH)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Heartland Group Holdings Limited, with a market cap of NZ$909.30 million, operates in New Zealand and Australia offering a range of financial services through its subsidiaries.

Operations: Heartland Group Holdings Limited generates revenue through several segments, including Motor (NZ$39.68 million), Rural (NZ$32.16 million), Business (NZ$49.64 million), Personal Lending (NZ$4.42 million), Reverse Mortgages (NZ$49.24 million), and the Australian Banking Group (NZ$70.33 million).

Dividend Yield: 7.1%

Heartland Group Holdings offers a high dividend yield in New Zealand's top quartile, but its dividend history is volatile. Despite this, dividends are covered by earnings with a 71.1% payout ratio and forecasted to improve. The company faces challenges with a high level of bad loans and recent shareholder dilution. Leadership changes may impact strategy, as Andrew Dixson steps in as CEO, bringing experience from key strategic acquisitions and corporate finance oversight.

- Navigate through the intricacies of Heartland Group Holdings with our comprehensive dividend report here.

- According our valuation report, there's an indication that Heartland Group Holdings' share price might be on the expensive side.

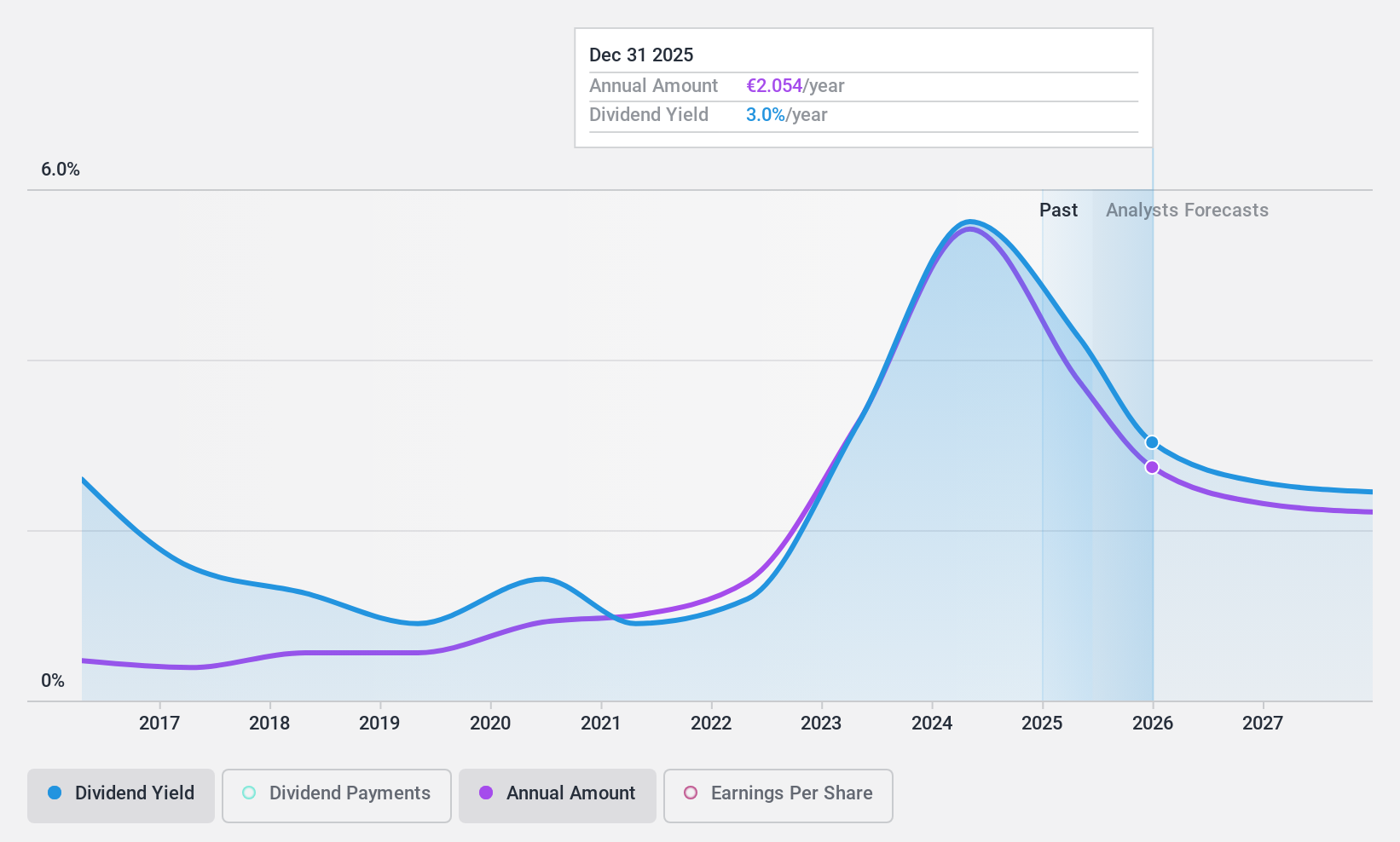

VERBUND (WBAG:VER)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: VERBUND AG, with a market cap of €24.16 billion, operates through its subsidiaries to generate, trade, and sell electricity to energy exchange markets, traders, electric utilities, industrial companies, households and commercial customers.

Operations: VERBUND AG's revenue is primarily derived from its Sales segment (€4.94 billion), followed by Hydro (€3.58 billion), Grid (€1.74 billion), and New Renewables (€328 million).

Dividend Yield: 6%

VERBUND's dividend history is volatile and unreliable, with significant fluctuations over the past decade. Despite this instability, dividends are currently covered by earnings and cash flows, with a payout ratio of 70.6% and a cash payout ratio of 65.6%. Recent earnings reports show declining sales and net income compared to the previous year, which may impact future dividend sustainability. The current dividend yield of 5.97% falls short of Austria's top quartile benchmark of 6.21%.

- Take a closer look at VERBUND's potential here in our dividend report.

- Insights from our recent valuation report point to the potential overvaluation of VERBUND shares in the market.

Taking Advantage

- Investigate our full lineup of 1968 Top Dividend Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VCT

Vicat

Engages in the production and sale of cement, ready-mixed concrete, and aggregates for construction industry.

Undervalued with solid track record and pays a dividend.