- France

- /

- Basic Materials

- /

- ENXTPA:NK

Imerys S.A. (EPA:NK) Stocks Shoot Up 30% But Its P/S Still Looks Reasonable

Imerys S.A. (EPA:NK) shares have had a really impressive month, gaining 30% after a shaky period beforehand. Taking a wider view, although not as strong as the last month, the full year gain of 11% is also fairly reasonable.

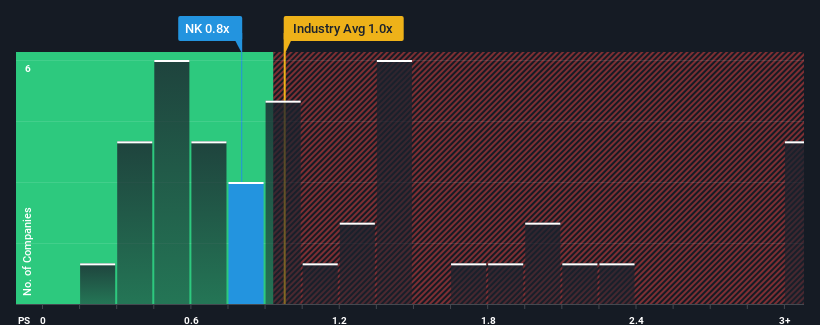

Although its price has surged higher, it's still not a stretch to say that Imerys' price-to-sales (or "P/S") ratio of 0.8x right now seems quite "middle-of-the-road" compared to the Basic Materials industry in France, where the median P/S ratio is around 1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Imerys

How Imerys Has Been Performing

Recent times haven't been great for Imerys as its revenue has been falling quicker than most other companies. One possibility is that the P/S is moderate because investors think the company's revenue trend will eventually fall in line with most others in the industry. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Imerys.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Imerys would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 5.0%. This means it has also seen a slide in revenue over the longer-term as revenue is down 1.6% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 4.3% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 4.9% each year, which is not materially different.

In light of this, it's understandable that Imerys' P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What Does Imerys' P/S Mean For Investors?

Imerys appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A Imerys' P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Basic Materials industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Imerys you should know about.

If these risks are making you reconsider your opinion on Imerys, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:NK

Imerys

Engages in the supply of specialty minerals for various industries across Europe, the Middle East, Africa, Asia Pacific, and America.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives