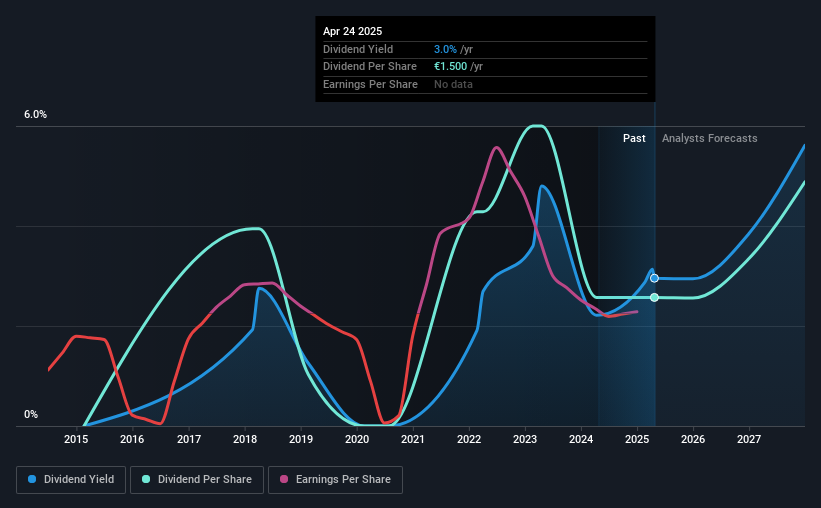

ERAMET S.A.'s (EPA:ERA) investors are due to receive a payment of €1.50 per share on 4th of June. This means the annual payment will be 3.0% of the current stock price, which is lower than the industry average.

Our free stock report includes 4 warning signs investors should be aware of before investing in ERAMET. Read for free now.ERAMET's Projected Earnings Seem Likely To Cover Future Distributions

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. Before this announcement, ERAMET was paying out 307% of what it was earning, and not generating any free cash flows either. Paying out such a large dividend compared to earnings while also not generating any free cash flow would definitely be difficult to keep up.

Looking forward, earnings per share is forecast to rise exponentially over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 21%, which would make us comfortable with the dividend's sustainability, despite the levels currently being elevated.

Check out our latest analysis for ERAMET

ERAMET's Dividend Has Lacked Consistency

Looking back, ERAMET's dividend hasn't been particularly consistent. This makes us cautious about the consistency of the dividend over a full economic cycle. Since 2018, the annual payment back then was €2.30, compared to the most recent full-year payment of €1.50. This works out to be a decline of approximately 5.9% per year over that time. A company that decreases its dividend over time generally isn't what we are looking for.

Dividend Growth Could Be Constrained

Given that the track record hasn't been stellar, we really want to see earnings per share growing over time. ERAMET has seen EPS rising for the last five years, at 23% per annum. Although earnings per share is up nicely ERAMET is paying out 307% of its earnings as dividends, which we feel is borderline unsustainable without extenuating circumstances.

The Dividend Could Prove To Be Unreliable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. Strong earnings growth means ERAMET has the potential to be a good dividend stock in the future, despite the current payments being at elevated levels. Overall, we don't think this company has the makings of a good income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 4 warning signs for ERAMET (of which 3 are significant!) you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if ERAMET might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ERA

ERAMET

Produces and sells manganese and nickel metals in Asia, Europe, North America, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Growing between 25-50% for the next 3-5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026