- France

- /

- Basic Materials

- /

- ENXTPA:ALHGR

Why Investors Shouldn't Be Surprised By Hoffmann Green Cement Technologies Societe anonyme's (EPA:ALHGR) P/S

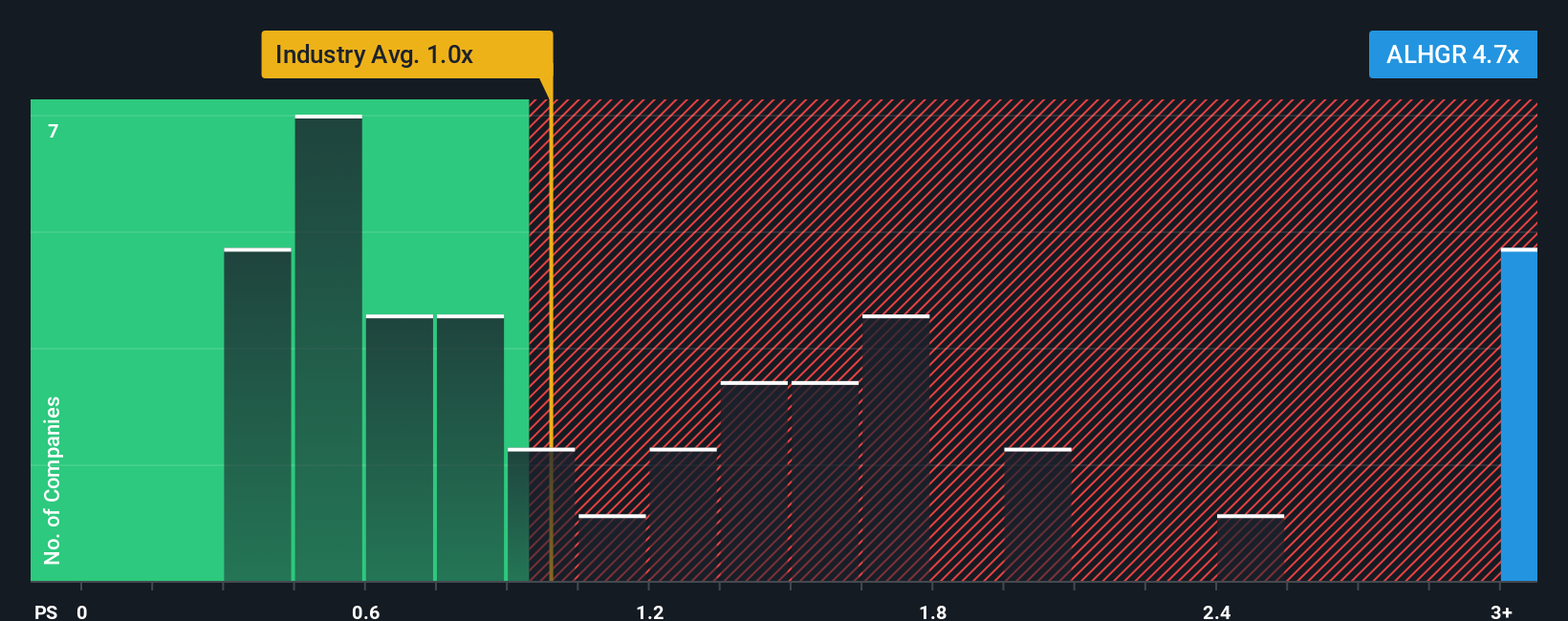

When you see that almost half of the companies in the Basic Materials industry in France have price-to-sales ratios (or "P/S") below 1x, Hoffmann Green Cement Technologies Societe anonyme (EPA:ALHGR) looks to be giving off strong sell signals with its 4.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Hoffmann Green Cement Technologies Societe anonyme

What Does Hoffmann Green Cement Technologies Societe anonyme's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Hoffmann Green Cement Technologies Societe anonyme has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Hoffmann Green Cement Technologies Societe anonyme's future stacks up against the industry? In that case, our free report is a great place to start.How Is Hoffmann Green Cement Technologies Societe anonyme's Revenue Growth Trending?

In order to justify its P/S ratio, Hoffmann Green Cement Technologies Societe anonyme would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 77% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue growth will be highly resilient over the next three years growing by 40% per annum. Meanwhile, the broader industry is forecast to contract by 0.7% each year, which would indicate the company is doing very well.

In light of this, it's understandable that Hoffmann Green Cement Technologies Societe anonyme's P/S sits above the majority of other companies. At this time, shareholders aren't keen to offload something that is potentially eyeing a much more prosperous future.

What Does Hoffmann Green Cement Technologies Societe anonyme's P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We can see that Hoffmann Green Cement Technologies Societe anonyme maintains its high P/S on the strength of its forecast growth potentially beating a struggling industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. We still remain cautious about the company's ability to keep swimming against the current of the broader industry turmoil. Although, if the company's prospects don't change they will continue to provide strong support to the share price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Hoffmann Green Cement Technologies Societe anonyme that you need to be mindful of.

If you're unsure about the strength of Hoffmann Green Cement Technologies Societe anonyme's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Hoffmann Green Cement Technologies Societe anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALHGR

Hoffmann Green Cement Technologies Societe anonyme

Designs, produces, distributes, and markets clinker-free decarbonized cement products in France.

Excellent balance sheet with limited growth.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026