- France

- /

- Basic Materials

- /

- ENXTPA:ALHGR

Shareholders in Hoffmann Green Cement Technologies Societe anonyme (EPA:ALHGR) have lost 81%, as stock drops 10% this past week

As an investor, mistakes are inevitable. But you want to avoid the really big losses like the plague. So spare a thought for the long term shareholders of Hoffmann Green Cement Technologies Societe anonyme (EPA:ALHGR); the share price is down a whopping 81% in the last three years. That would be a disturbing experience. And over the last year the share price fell 43%, so we doubt many shareholders are delighted. Furthermore, it's down 52% in about a quarter. That's not much fun for holders. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Since Hoffmann Green Cement Technologies Societe anonyme has shed €7.5m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

View our latest analysis for Hoffmann Green Cement Technologies Societe anonyme

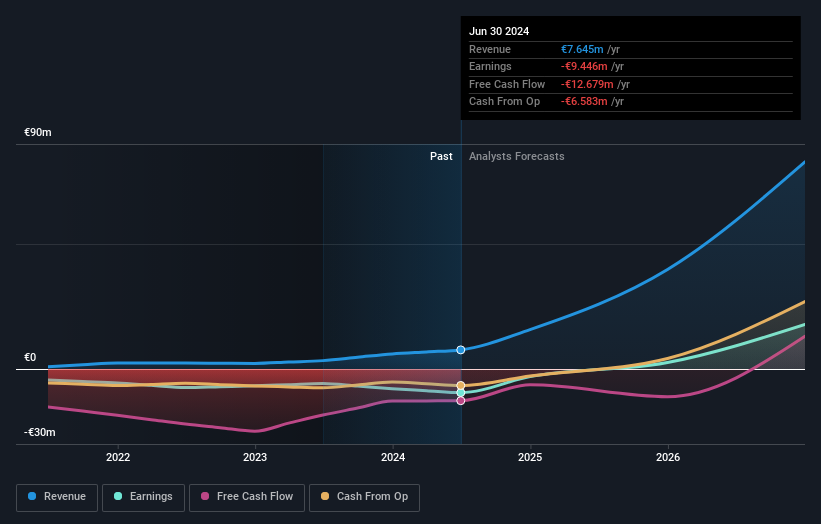

Given that Hoffmann Green Cement Technologies Societe anonyme didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over three years, Hoffmann Green Cement Technologies Societe anonyme grew revenue at 56% per year. That's well above most other pre-profit companies. So on the face of it we're really surprised to see the share price down 22% a year in the same time period. You'd want to take a close look at the balance sheet, as well as the losses. Ultimately, revenue growth doesn't amount to much if the business can't scale well. Unless the balance sheet is strong, the company might have to raise capital.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So it makes a lot of sense to check out what analysts think Hoffmann Green Cement Technologies Societe anonyme will earn in the future (free profit forecasts).

A Different Perspective

Investors in Hoffmann Green Cement Technologies Societe anonyme had a tough year, with a total loss of 43%, against a market gain of about 0.8%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 12% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Hoffmann Green Cement Technologies Societe anonyme you should know about.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hoffmann Green Cement Technologies Societe anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALHGR

Hoffmann Green Cement Technologies Societe anonyme

Designs, produces, distributes, and markets low carbon cements.

Slight with imperfect balance sheet.

Market Insights

Community Narratives