- France

- /

- Metals and Mining

- /

- ENXTPA:ALAMG

Further Upside For Auplata Mining Group (EPA:ALAMG) Shares Could Introduce Price Risks After 200% Bounce

The Auplata Mining Group (EPA:ALAMG) share price has done very well over the last month, posting an excellent gain of 200%. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 49% over that time.

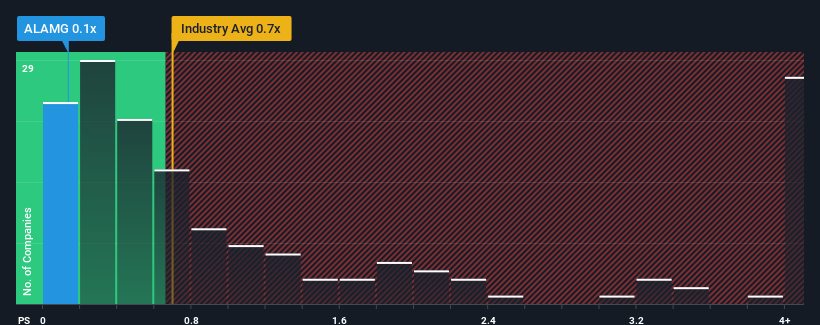

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Auplata Mining Group's P/S ratio of 0.1x, since the median price-to-sales (or "P/S") ratio for the Metals and Mining industry in France is also close to 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Auplata Mining Group

What Does Auplata Mining Group's P/S Mean For Shareholders?

Auplata Mining Group has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. Those who are bullish on Auplata Mining Group will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Auplata Mining Group's earnings, revenue and cash flow.How Is Auplata Mining Group's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Auplata Mining Group's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 18% last year. The strong recent performance means it was also able to grow revenue by 204% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to decline by 1.3% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

With this in mind, we find it intriguing that Auplata Mining Group's P/S matches its industry peers. It looks like most investors are not convinced the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

The Final Word

Its shares have lifted substantially and now Auplata Mining Group's P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Auplata Mining Group revealed its growing revenue over the medium-term hasn't helped elevate its P/S above that of the industry, which is surprising given the industry is set to shrink. There could be some unobserved threats to revenue preventing the P/S ratio from outpacing the industry much like its revenue performance. Without the guidance of analysts, perhaps shareholders are feeling uncertain over whether the revenue performance can continue amidst a declining industry outlook. The fact that the company's relative performance has not provided a kick to the share price suggests that some investors are anticipating revenue instability.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Auplata Mining Group (3 don't sit too well with us) you should be aware of.

If these risks are making you reconsider your opinion on Auplata Mining Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALAMG

Auplata Mining Group

Engages in the mining and exploration of polymetallic deposits.

Low risk with weak fundamentals.

Market Insights

Community Narratives