Is Arkema’s Battery Separator Pact With Semcorp Altering The Investment Case For Arkema (ENXTPA:AKE)?

Reviewed by Sasha Jovanovic

- Earlier this month, Semcorp announced it had signed a Memorandum of Understanding with Arkema to accelerate innovation in battery separator technologies and support Semcorp’s international expansion across Electric Vehicles, Energy Storage Systems and Consumer Electronics.

- Because separators are central to battery safety, efficiency and lifespan, this collaboration highlights Arkema’s increasing exposure to high-performance materials used in electrification and energy storage applications.

- We’ll now examine how Arkema’s support for Semcorp’s next-generation battery separators could influence the company’s investment narrative around specialty materials.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Arkema Investment Narrative Recap

To invest in Arkema you need to believe in its shift toward higher value specialty materials that can offset exposure to cyclical end markets and margin pressure. The Semcorp MoU modestly reinforces the near term catalyst around higher value electrification materials, but does not fundamentally change the key risk that weak demand in construction and automotive, coupled with macro uncertainty in Europe and North America, may keep volumes and profitability under pressure.

Among recent announcements, the May 2024 partnership with solid state battery player ProLogium stands out as closely related to the Semcorp MoU. Taken together, these collaborations underline Arkema’s push into advanced battery materials, which could gradually diversify earnings away from more cyclical, lower margin activities if execution stays disciplined and demand for electrification materials holds up.

Yet despite these partnerships, investors still need to be aware of the risk that prolonged macro weakness could...

Read the full narrative on Arkema (it's free!)

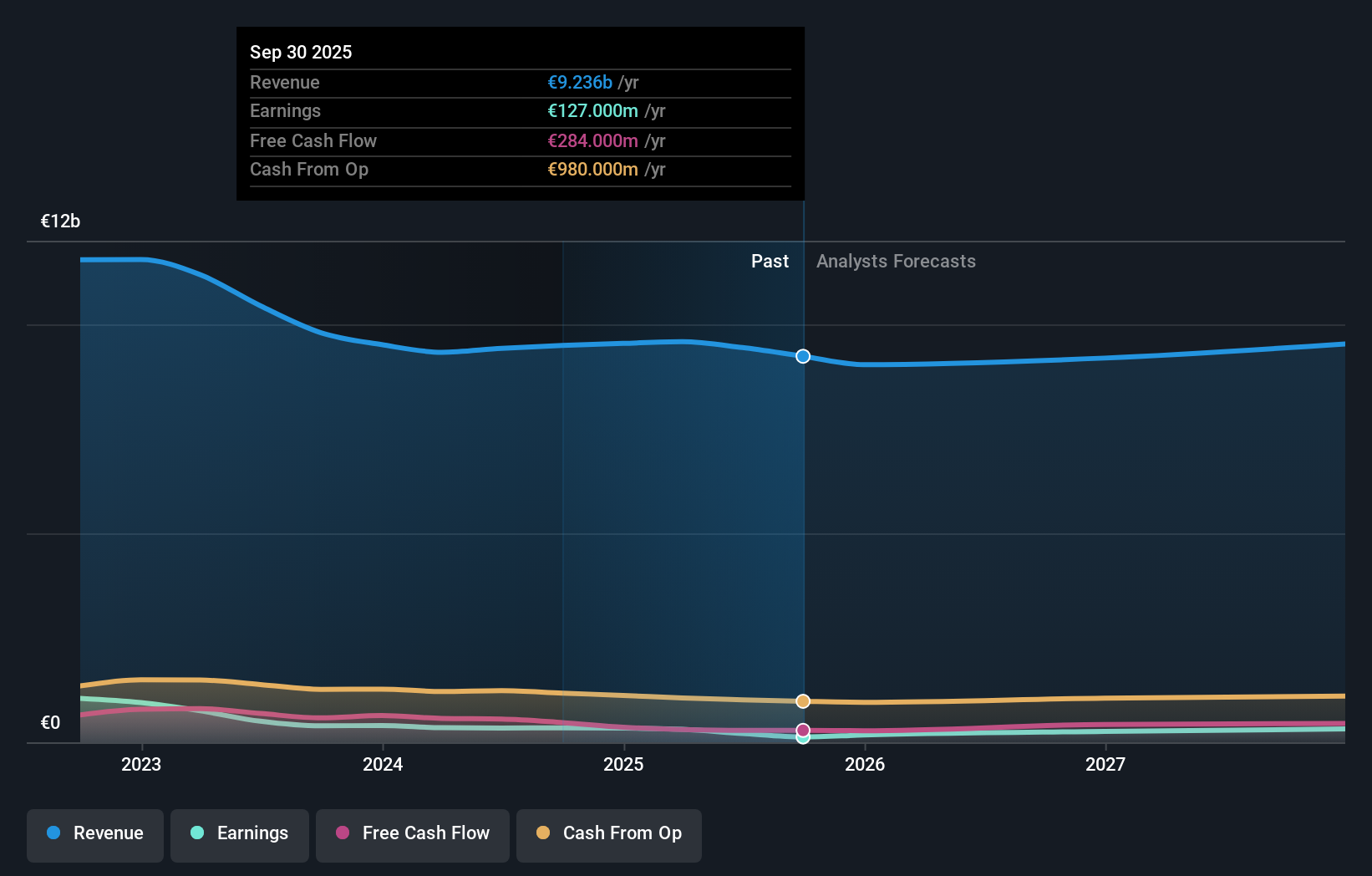

Arkema's narrative projects €10.3 billion revenue and €464.5 million earnings by 2028. This requires 2.9% yearly revenue growth and about a €273.5 million earnings increase from €191.0 million today.

Uncover how Arkema's forecasts yield a €65.06 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offer 9 fair value views for Arkema, ranging from €44.06 to €112.93, underscoring very different expectations. When you weigh those against the risk of structurally weak construction and automotive demand, it becomes even more important to compare several perspectives on Arkema’s earnings resilience.

Explore 9 other fair value estimates on Arkema - why the stock might be worth 13% less than the current price!

Build Your Own Arkema Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arkema research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Arkema research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arkema's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AKE

Arkema

Manufactures and sells specialty materials in Europe, the United States, Canada, Mexico, China, Hong Kong, Taiwan, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026