Is Now the Right Moment for Air Liquide After Its 25% Rally in 2025?

Reviewed by Bailey Pemberton

Figuring out what to do with L'Air Liquide stock right now? You are not alone. This French industrial giant is a frequent feature in many long-term portfolios, and for good reason. After a steady, if unspectacular, 2.6% climb over the past year, plus an impressive 11.6% boost year-to-date, investors are wondering if more growth is still in the tank or if caution should take the driver's seat.

Short-term traders have noticed a slight rebound recently, with the last 7 days edging up 1.5%, while the broader 30-day move has been almost flat. Over the past three years, though, L'Air Liquide has delivered a robust 64.7% total return. Zooming out even further to five years, the gain is 77.0%. The long-term story shows resilience and steady compounding, which has caught the eye of those looking beyond short-term jitters. Much of this performance has been supported by global trends favoring clean energy, hydrogen, and reliable industrial gas supply.

However, when it comes to valuation, things get more complicated. If you are looking for a classic deep value opportunity, the simple score is telling. A value score of 0 out of 6 checks means the market is not offering this company at a bargain, at least by traditional valuation measures. So what can investors really make of L'Air Liquide stock at today's price? Let us break down the most popular ways to judge valuation, and stay tuned, because at the end, we will look at a smarter, bigger-picture approach to deciding what the stock is truly worth.

L'Air Liquide scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: L'Air Liquide Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future free cash flows and discounting them back to the present. This approach helps to determine what the company is fundamentally worth, based on how much cash it can generate for shareholders.

For L'Air Liquide, the most recent twelve-month free cash flow stands at approximately €3.05 billion. Analysts provide estimates for the next five years, showing steady growth, with projections reaching €4.02 billion by 2029. Beyond analyst forecasts, further projections to ten years are analytically extrapolated by Simply Wall St, reflecting ongoing but moderating increases.

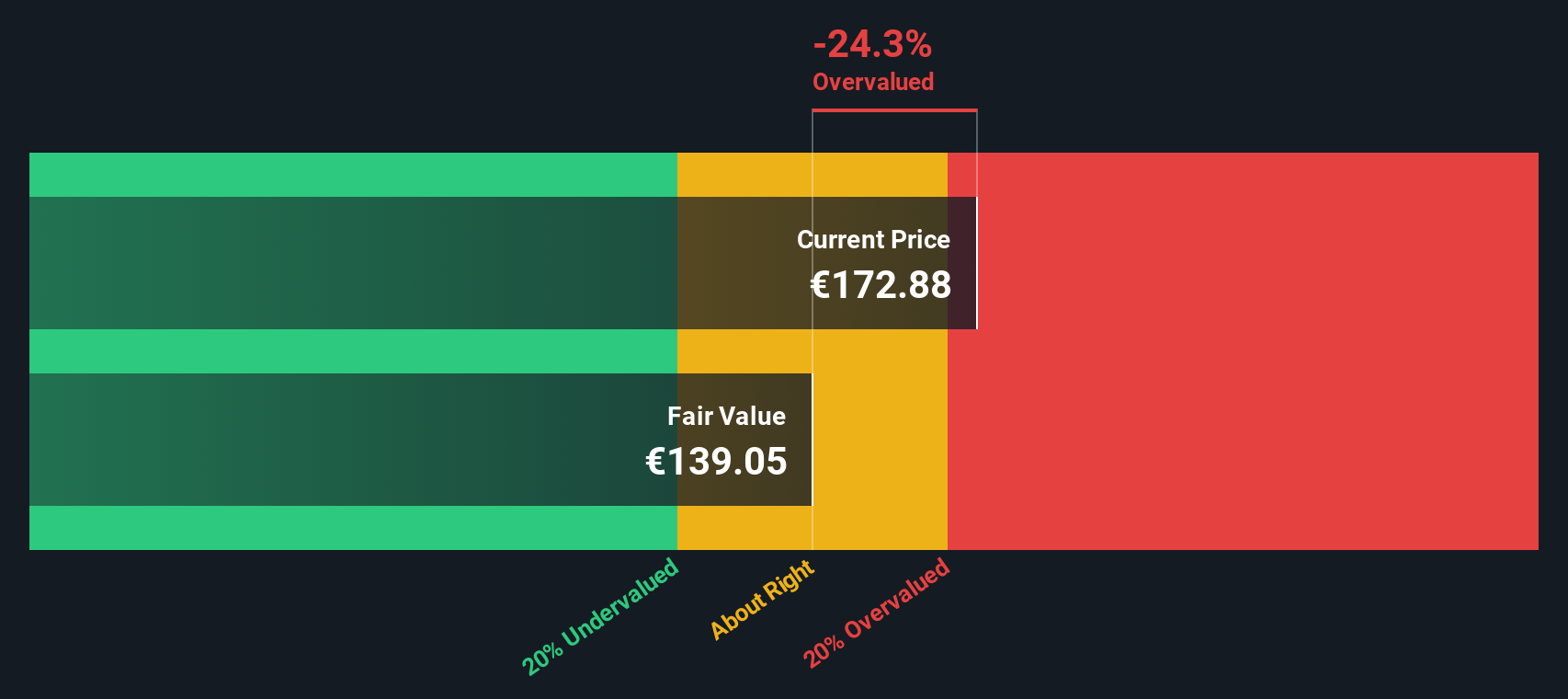

Based on these cash flow projections and after discounting them to today's value, the DCF model calculates a fair value of €138.87 per share. Comparing this intrinsic value to the current share price shows the stock trades at a premium, implying that L'Air Liquide is about 25.3% overvalued right now. This suggests optimism about the business's future has already been priced in, leaving less margin of safety for buyers at these levels.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests L'Air Liquide may be overvalued by 25.3%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: L'Air Liquide Price vs Earnings

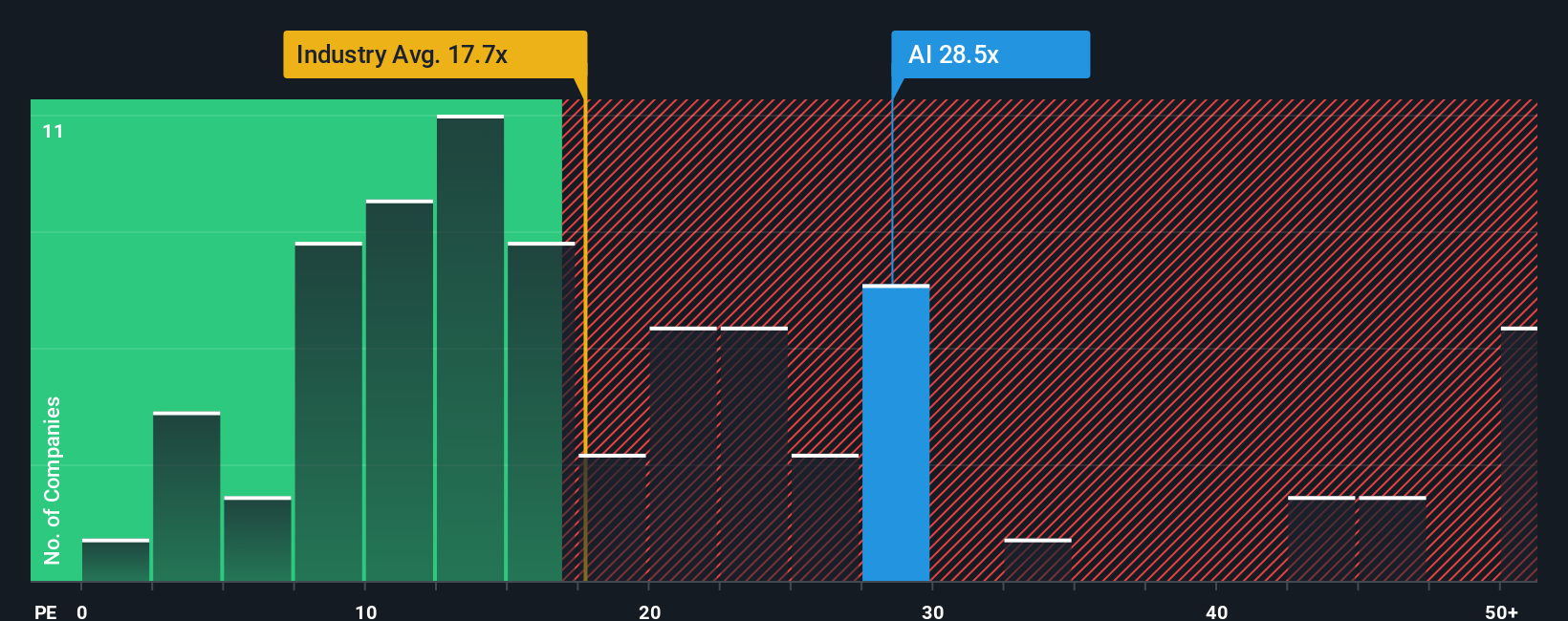

For consistently profitable companies like L'Air Liquide, the Price-to-Earnings (PE) ratio is a tried-and-true metric for valuation. The PE ratio allows investors to see how much the market is willing to pay today for each euro of current earnings, offering a quick snapshot of market sentiment and future expectations.

Growth prospects and perceived risk play a big role in what constitutes a "normal" or "fair" PE ratio. If a company is expected to grow faster or is seen as lower risk, investors are often willing to pay a higher multiple for those earnings. Slower-growing or riskier businesses typically warrant a lower PE.

Currently, L'Air Liquide trades at a PE ratio of 29.3x. That is notably higher than the Chemicals industry average of 22.6x and also above the peer average of 25.9x. While this suggests the market has high expectations, Simply Wall St's "Fair Ratio" for L'Air Liquide stands at 24.7x. The Fair Ratio provides a more tailored benchmark by factoring in the company’s earnings growth outlook, profit margins, industry trends, market cap, and unique risks, offering a more nuanced view than simple peer or industry comparisons.

Comparing L'Air Liquide’s actual PE of 29.3x to its Fair Ratio of 24.7x signals that the stock is currently overvalued on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your L'Air Liquide Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your perspective on a company, where you connect the story behind the business, including its unique strengths, risks, opportunities, and future potential, to financial assumptions like fair value, expected revenue growth, and future margins.

Narratives work by linking L'Air Liquide’s business story, such as expanding in hydrogen or digitalizing operations, directly to your forecasts and a fair value estimate. This helps you turn your outlook into a clear, actionable investment stance. They are easy to use and fully accessible on Simply Wall St’s Community page, which is trusted by millions of investors. Narratives update dynamically whenever key news or earnings results are released.

By comparing your Narrative’s fair value to the current market price, you can decide if now looks like a great buying opportunity, time to hold, or a moment for caution. Importantly, different investors can have different Narratives even for the same company. One may see huge potential and set a fair value near €216, while another takes a more cautious view with €154. Your decisions are therefore tailored to what you believe, not just to consensus numbers.

Do you think there's more to the story for L'Air Liquide? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AI

L'Air Liquide

Provides gases, technologies, and services for the industrial and health sectors in Europe, the Americas, the Asia Pacific, the Middle East, and Africa.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives