MT Højgaard Holding And 2 Other European Small Caps With Promising Potential

Reviewed by Simply Wall St

As Europe's markets navigate mixed performances, with the pan-European STOXX Europe 600 Index ending slightly lower and major indices showing varied results, investors are keeping a close eye on economic indicators that could signal future opportunities. In this environment of cautious optimism, small-cap stocks often attract attention for their potential to outperform larger counterparts due to their agility and growth prospects. Identifying promising small caps involves looking for companies with strong fundamentals, innovative strategies, and resilience in the face of economic shifts—qualities that can be particularly valuable amid current market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| FRoSTA | 5.37% | 4.80% | 13.56% | ★★★★★★ |

| Evergent Investments | 3.63% | 11.51% | 22.05% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Dn Agrar Group | NA | 29.02% | 36.03% | ★★★★★☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

MT Højgaard Holding (CPSE:MTHH)

Simply Wall St Value Rating: ★★★★★★

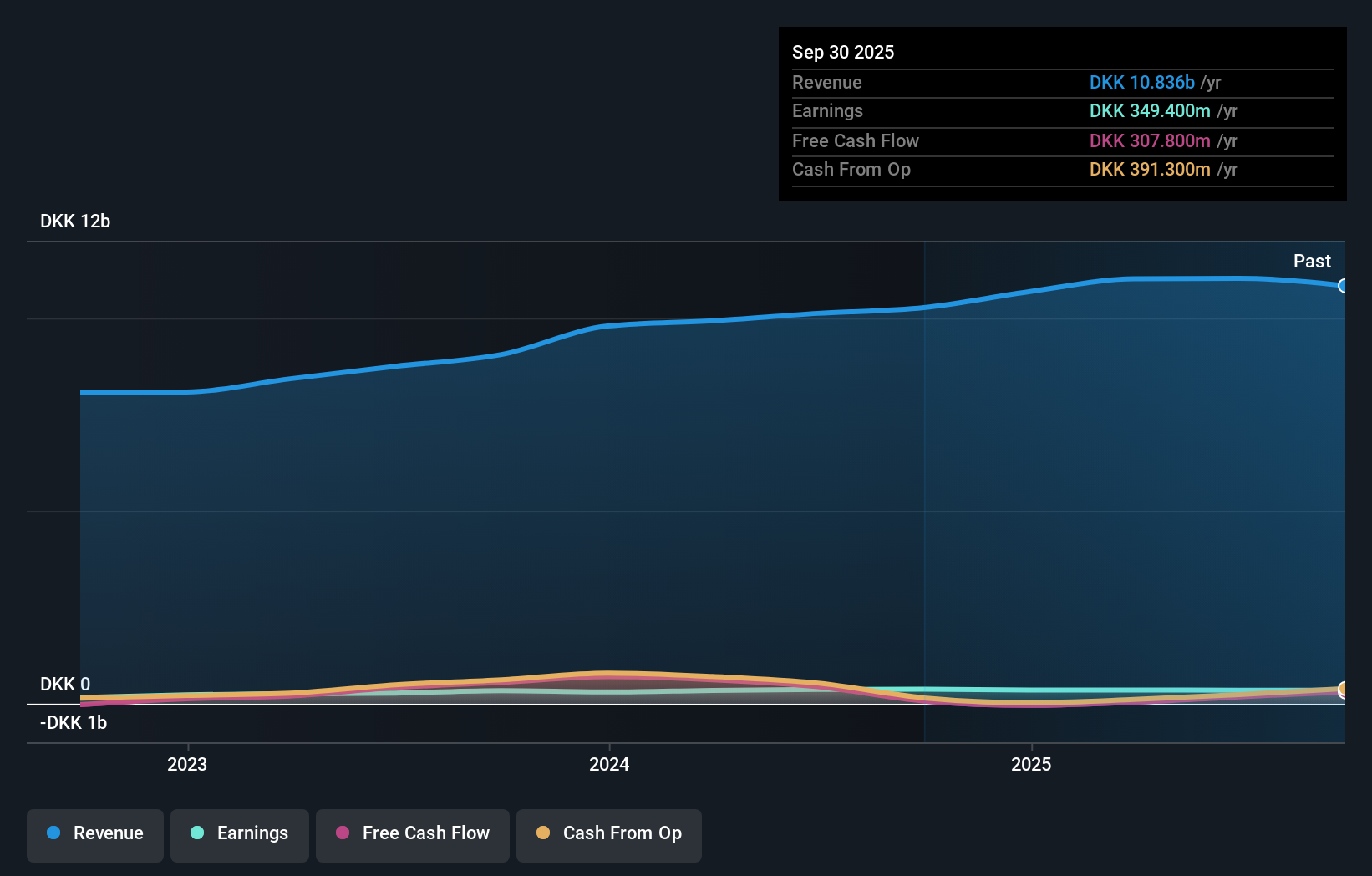

Overview: MT Højgaard Holding A/S provides construction, civil engineering, and infrastructure services to both private and public sectors in Denmark and internationally, with a market cap of DKK3.62 billion.

Operations: MT Højgaard Holding generates revenue primarily through its segments Enemærke & Petersen and MT Højgaard Danmark, with reported revenues of DKK4.38 billion and DKK6.04 billion, respectively.

MT Højgaard Holding, a notable player in the construction sector, has demonstrated financial resilience despite recent challenges. Its debt-to-equity ratio impressively decreased to 2.6% from 80.1% over five years, indicating improved financial stability. The company's net income for Q3 2025 rose to DKK 70.5 million from DKK 59.2 million a year prior, showcasing profitability amidst sales of DKK 2,397 million compared to last year's DKK 2,585 million for the same period. Trading at a price-to-earnings ratio of 10.4x below the Danish market average suggests potential value for investors seeking opportunities in this space.

- Get an in-depth perspective on MT Højgaard Holding's performance by reading our health report here.

Assess MT Højgaard Holding's past performance with our detailed historical performance reports.

Firstcaution (ENXTPA:MLFIR)

Simply Wall St Value Rating: ★★★★☆☆

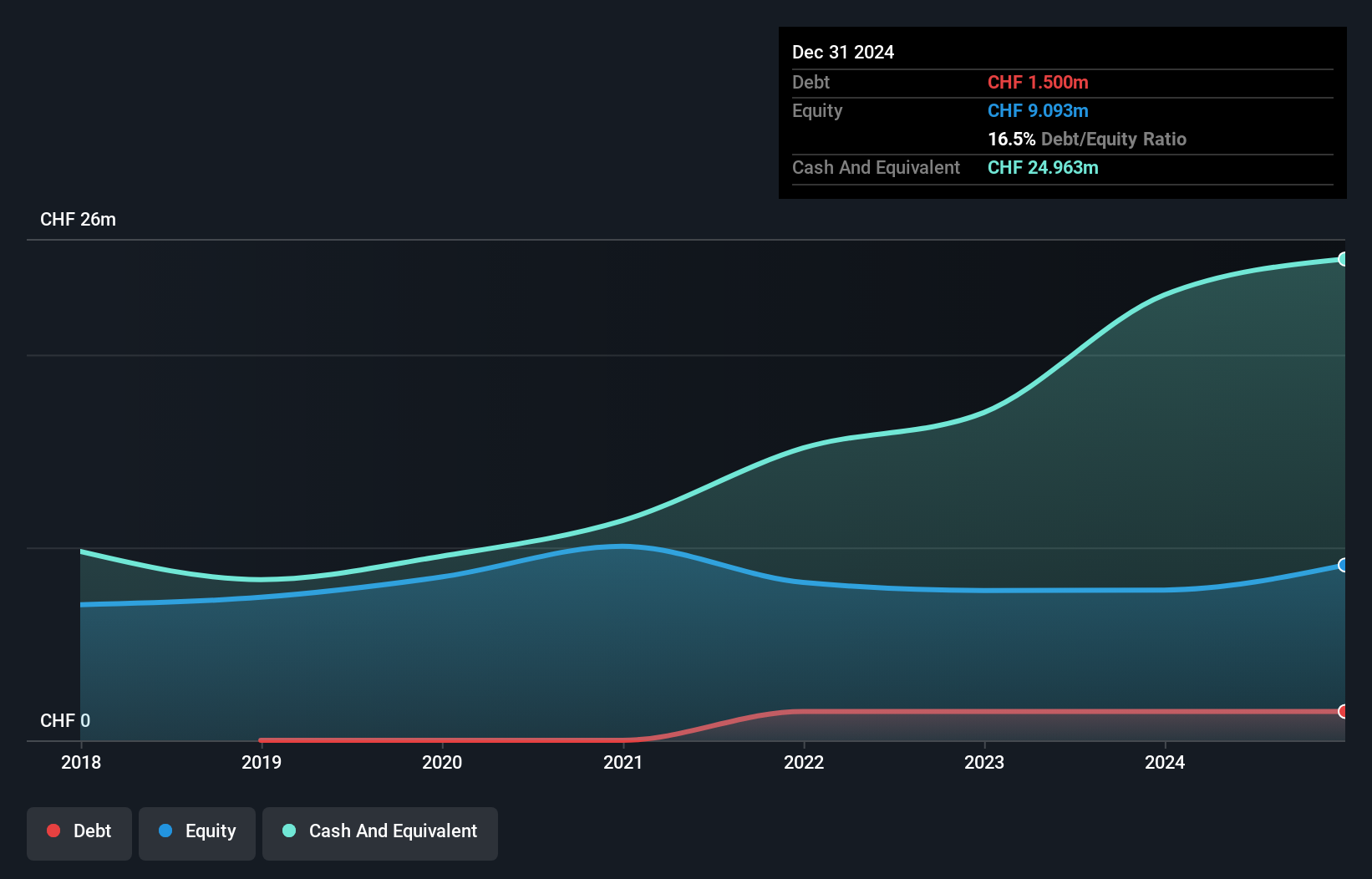

Overview: Firstcaution SA offers rental guarantee services in Switzerland and has a market cap of €213.55 million.

Operations: Firstcaution SA generates revenue primarily from its Insurance - Surety & Title segment, amounting to CHF 26.92 million.

Firstcaution, a small player in the insurance sector, has shown remarkable earnings growth of 5257% over the past year, outpacing the industry's average. Despite this impressive leap, its earnings have decreased by 12.7% annually over five years. The company's debt-to-equity ratio has increased to 16.5%, indicating a rise in leverage compared to five years ago when it was at zero. On a positive note, Firstcaution's interest obligations are well covered with an EBIT coverage ratio of 4.8x, suggesting solid operational performance relative to its financial commitments.

- Unlock comprehensive insights into our analysis of Firstcaution stock in this health report.

Review our historical performance report to gain insights into Firstcaution's's past performance.

SpareBank 1 Ringerike Hadeland (OB:RING)

Simply Wall St Value Rating: ★★★★☆☆

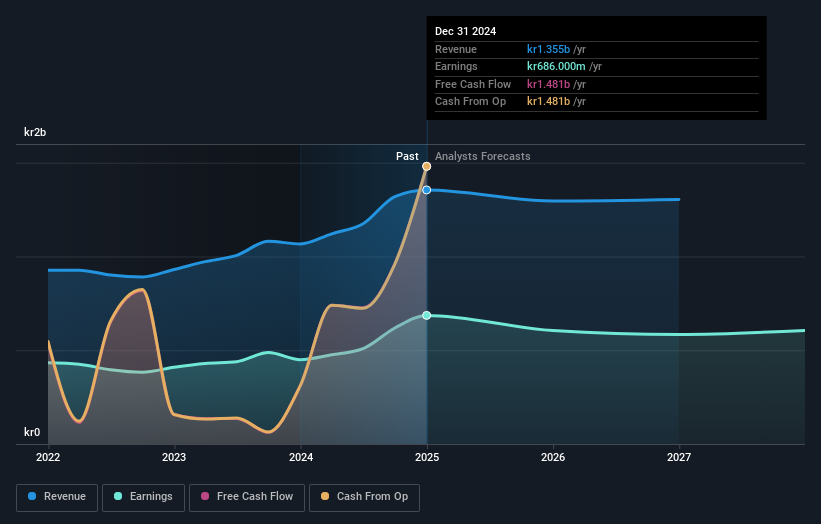

Overview: SpareBank 1 Ringerike Hadeland is a financial institution offering a range of banking products and services to private and corporate clients in Norway, with a market capitalization of NOK6.20 billion.

Operations: SpareBank 1 Ringerike Hadeland generates revenue from its primary segments: Private Market (NOK 469 million), Corporate Market (NOK 378 million), Real Estate Brokerage (NOK 68 million), and IT and Accounting Services (NOK 93 million).

SpareBank 1 Ringerike Hadeland, with total assets of NOK32.4 billion and equity of NOK5.4 billion, stands out for its robust financial health. The bank's deposits amount to NOK21.8 billion, while loans total NOK27 billion, indicating a solid lending base backed by primarily low-risk funding sources like customer deposits (81% of liabilities). Although earnings grew by 11.8% in the past year—outpacing the industry average of 8.4%—the bank trades at a notable discount to its estimated fair value (31%). However, future earnings are projected to decrease by an average of 2.2% annually over the next three years.

Summing It All Up

- Navigate through the entire inventory of 309 European Undiscovered Gems With Strong Fundamentals here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:RING

SpareBank 1 Ringerike Hadeland

A financial institution, provides various banking products and services to private and corporate customers in Norway.

Established dividend payer and good value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)