How Investors Are Reacting To COFACE (ENXTPA:COFA) Nine-Month Net Income Decline

Reviewed by Sasha Jovanovic

- COFACE SA announced its financial results for the nine months ended September 30, 2025, reporting net income of €176.26 million, down from €207.68 million a year earlier, and earnings per share of €1.18 versus €1.39 previously.

- This decrease in earnings highlights how operational or market challenges may be affecting profitability despite continued activity in core business segments.

- We’ll explore how the recent decline in net income could influence COFACE’s investment outlook and ongoing growth catalysts.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

COFACE Investment Narrative Recap

For shareholders in COFACE, confidence usually rests on the company’s resilience in credit insurance, its selective growth strategy, and sustained investments in technology and information services. While the latest nine-month results showed a noticeable dip in net income, there is limited immediate impact on the main catalysts, namely, scaling BI services and the Cedar Rose acquisition, yet cost pressures and softer insurance revenues remain the most important short-term risk to watch as margin trends evolve.

The most relevant recent announcement is the November 3, 2025 board meeting, which reviewed consolidated financials in the wake of falling earnings. Board oversight in this context speaks to ongoing evaluation of both performance and underlying business risks, directly aligning with concerns about margin preservation highlighted by the recent results. Investors following COFACE’s growth plans may want to stay alert for management’s responses to these financial pressures...

Read the full narrative on COFACE (it's free!)

COFACE's outlook points to €2.1 billion in revenue and €256.3 million in earnings by 2028. This implies annual revenue growth of 3.9% and an earnings increase of €13.3 million from the current €243.0 million.

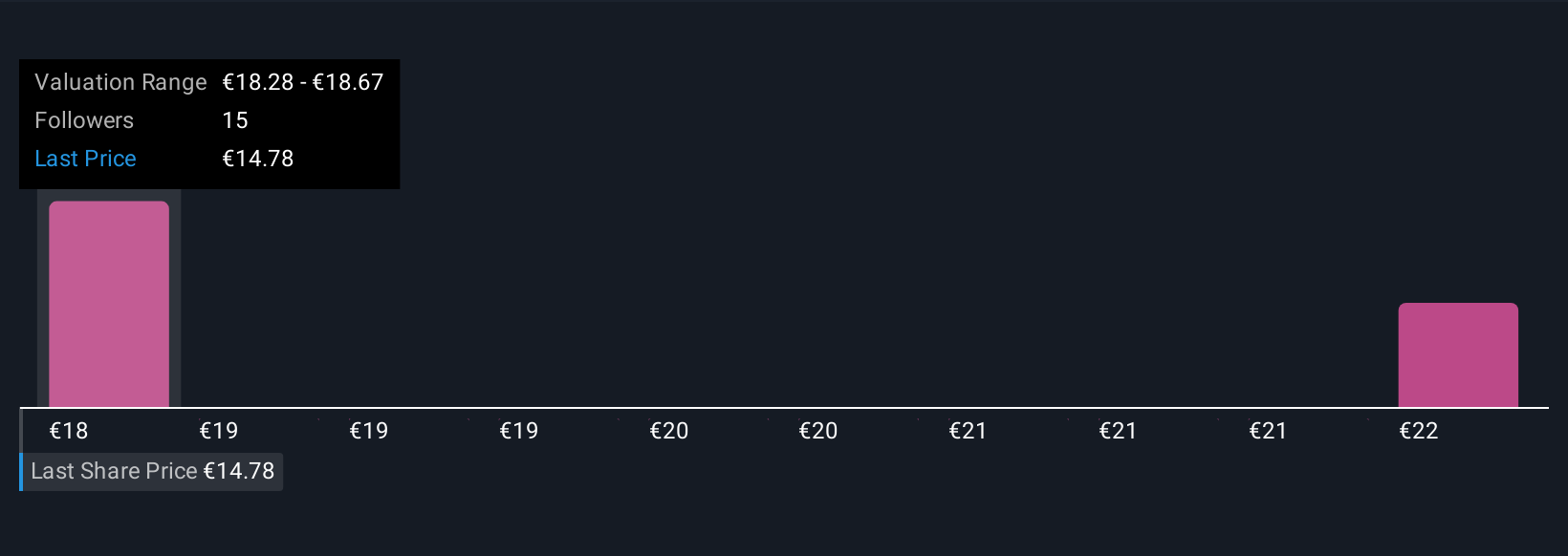

Uncover how COFACE's forecasts yield a €18.28 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered two independent estimates of COFACE’s fair value, landing between €18.28 and €22.24 per share. Given rising cost ratios and pressure on insurance revenues, many readers may want to compare how their outlooks stack up against these varying community viewpoints.

Explore 2 other fair value estimates on COFACE - why the stock might be worth just €18.28!

Build Your Own COFACE Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your COFACE research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free COFACE research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate COFACE's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:COFA

COFACE

Through its subsidiaries, provides credit insurance products and related services for microenterprises, small and medium enterprises, mid-market companies, international corporations, financial institutions, and clients of distribution partners.

Undervalued with mediocre balance sheet.

Market Insights

Community Narratives