Interparfums SA (EPA:ITP), which is in the personal products business, and is based in France, led the ENXTPA gainers with a relatively large price hike in the past couple of weeks. With many analysts covering the mid-cap stock, we may expect any price-sensitive announcements have already been factored into the stock’s share price. However, could the stock still be trading at a relatively cheap price? Today I will analyse the most recent data on Interparfums’s outlook and valuation to see if the opportunity still exists.

See our latest analysis for Interparfums

What is Interparfums worth?

Interparfums is currently expensive based on my price multiple model, where I look at the company's price-to-earnings ratio in comparison to the industry average. In this instance, I’ve used the price-to-earnings (PE) ratio given that there is not enough information to reliably forecast the stock’s cash flows. I find that Interparfums’s ratio of 34.85x is above its peer average of 24.03x, which suggests the stock is trading at a higher price compared to the Personal Products industry. Furthermore, Interparfums’s share price also seems relatively stable compared to the rest of the market, as indicated by its low beta. If you believe the share price should eventually reach levels around its industry peers, a low beta could suggest it is unlikely to rapidly do so anytime soon, and once it’s there, it may be hard to fall back down into an attractive buying range.

What kind of growth will Interparfums generate?

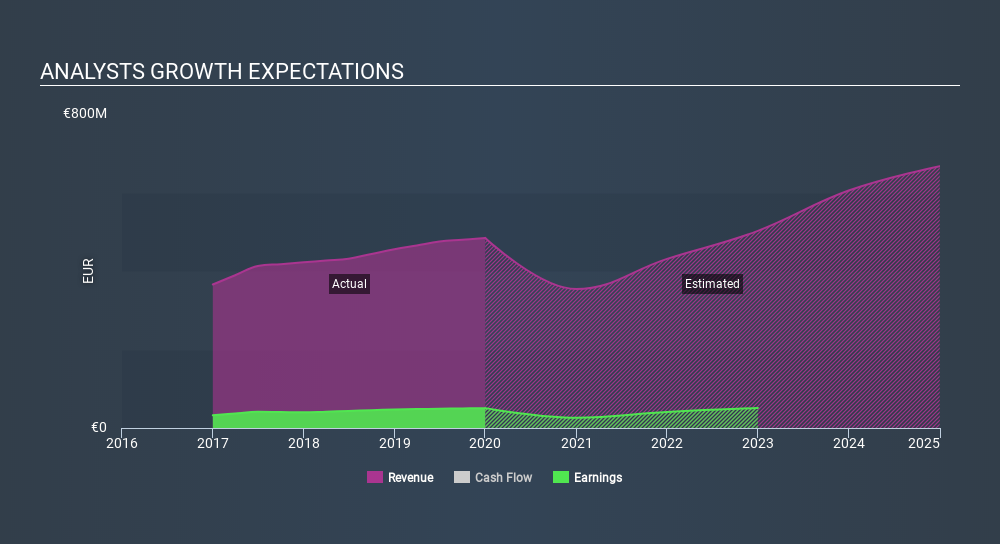

Investors looking for growth in their portfolio may want to consider the prospects of a company before buying its shares. Although value investors would argue that it’s the intrinsic value relative to the price that matter the most, a more compelling investment thesis would be high growth potential at a cheap price. However, with a negative profit growth of -0.7% expected over the next couple of years, near-term growth certainly doesn’t appear to be a driver for a buy decision for Interparfums. This certainty tips the risk-return scale towards higher risk.

What this means for you:

Are you a shareholder? If you believe ITP should trade below its current price, selling high and buying it back up again when its price falls towards the industry PE ratio can be profitable. Given the risk from a negative growth outlook, this could be the right time to reduce your total portfolio risk. But before you make this decision, take a look at whether its fundamentals have changed.

Are you a potential investor? If you’ve been keeping an eye on ITP for a while, now may not be the best time to enter into the stock. The price has climbed past its industry peers, in addition to a risky future outlook. However, there are also other important factors which we haven’t considered today, such as the track record of its management. Should the price fall in the future, will you be well-informed enough to buy?

Price is just the tip of the iceberg. Dig deeper into what truly matters – the fundamentals – before you make a decision on Interparfums. You can find everything you need to know about Interparfums in the latest infographic research report. If you are no longer interested in Interparfums, you can use our free platform to see my list of over 50 other stocks with a high growth potential.

If you decide to trade Interparfums, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account.Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTPA:ITP

Interparfums

Designs, manufactures, and distributes perfumes and cosmetics through license agreements with ready-to-wear, jewelry, or accessories houses in France, Africa, North America, South America, Eastern Europe, Western Europe, Asia, and the Middle East.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives