- France

- /

- Medical Equipment

- /

- ENXTPA:EL

The Bull Case for EssilorLuxottica (ENXTPA:EL) Could Change Following FDA Clearance of Stellest Myopia Lens

Reviewed by Sasha Jovanovic

- In late September 2025, EssilorLuxottica announced that its Essilor Stellest lens received U.S. FDA market authorization via the De Novo pathway, making it the first authorized spectacle lens clinically proven to slow myopia progression in children.

- This regulatory milestone signals EssilorLuxottica's growing influence in MedTech, pairing clinical innovation with global reach to address the rising myopia epidemic in pediatric populations.

- We'll examine how the FDA green light for the Essilor Stellest lens strengthens EssilorLuxottica’s MedTech leadership in the evolving investment narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

EssilorLuxottica Société anonyme Investment Narrative Recap

Owning shares in EssilorLuxottica often hinges on confidence in the company’s ability to innovate at the intersection of vision care and technology, particularly as global demand rises for advanced, clinically proven solutions like the recently FDA-authorized Essilor Stellest lens. While this regulatory win meaningfully strengthens its MedTech leadership, the most important near-term catalyst remains successful commercialization and adoption, whereas the biggest risk continues to be margin pressure from inflation and input costs; the current news does not materially reduce this concern.

The recent unveiling of the Oakley Meta Vanguard AI glasses, produced through EssilorLuxottica’s ongoing partnership with Meta Platforms, underscores the group’s commitment to smart eyewear as a key growth driver, reinforcing how innovations across both MedTech and wearable technology could act as complementary catalysts for the broader business in the months ahead.

However, against this backdrop, investors should also be aware that persistent inflationary pressures and global tariff headwinds may continue to affect gross margins and net income...

Read the full narrative on EssilorLuxottica Société anonyme (it's free!)

EssilorLuxottica Société anonyme is projected to reach €32.6 billion in revenue and €3.7 billion in earnings by 2028. This outlook is based on analysts forecasting a 6.1% annual revenue growth rate and a €1.3 billion increase in earnings from the current €2.4 billion.

Uncover how EssilorLuxottica Société anonyme's forecasts yield a €283.63 fair value, in line with its current price.

Exploring Other Perspectives

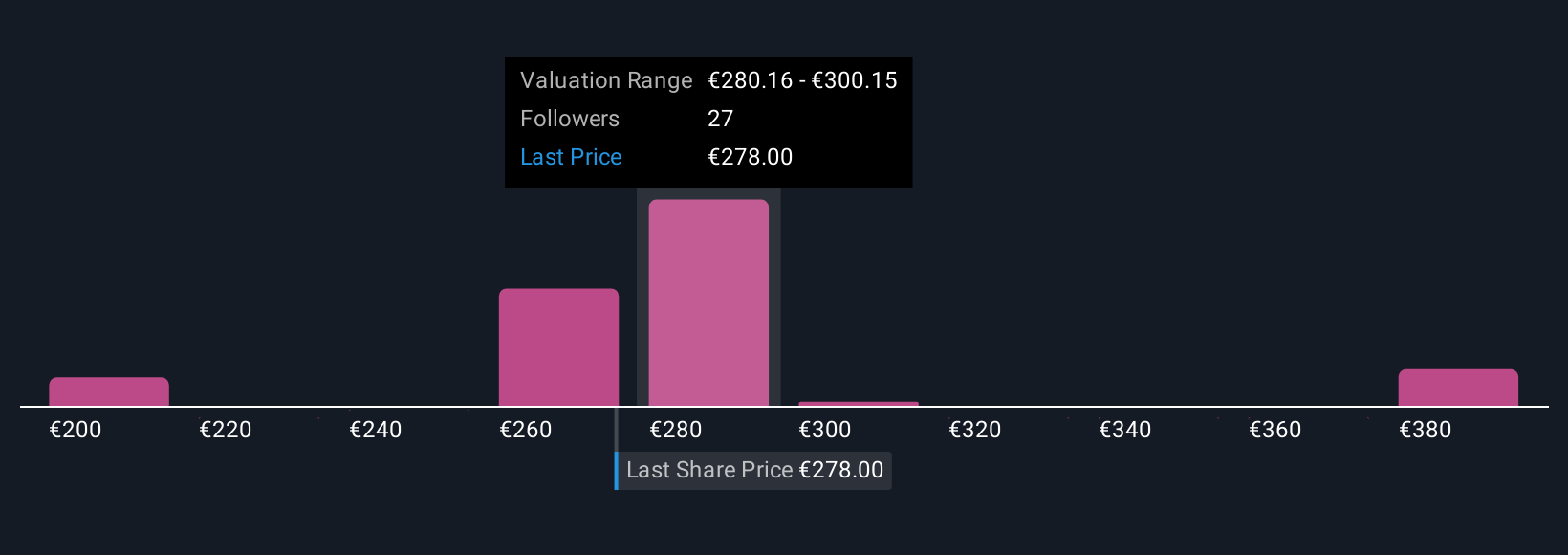

Private investors in the Simply Wall St Community have set fair value estimates for EssilorLuxottica between €200 and €400 across 8 analyses. This reflects a broad spectrum of expectations, while ongoing inflation and tariff risks remain critical for those weighing long-term profitability scenarios.

Explore 8 other fair value estimates on EssilorLuxottica Société anonyme - why the stock might be worth 28% less than the current price!

Build Your Own EssilorLuxottica Société anonyme Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EssilorLuxottica Société anonyme research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free EssilorLuxottica Société anonyme research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EssilorLuxottica Société anonyme's overall financial health at a glance.

No Opportunity In EssilorLuxottica Société anonyme?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EssilorLuxottica Société anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EL

EssilorLuxottica Société anonyme

Designs, manufactures, and distributes ophthalmic lenses, frames, and sunglasses in North America, the Middle East, Africa, Europe, Latin America, and the Asia-Pacific.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives