- France

- /

- Medical Equipment

- /

- ENXTPA:EL

EssilorLuxottica (ENXTPA:EL): Evaluating Current Valuation After Recent Share Price Gains

Reviewed by Kshitija Bhandaru

EssilorLuxottica Société anonyme (ENXTPA:EL) continues to attract attention as investors examine its performance over the past month, with shares moving up around 6%. Recent financials highlight steady gains in both revenue and net income, which is fueling further interest.

See our latest analysis for EssilorLuxottica Société anonyme.

This steady climb in EssilorLuxottica’s share price lately suggests growing optimism among investors. The strong one-year total shareholder return of 32% also indicates renewed momentum supporting its longer-term growth story.

If you’re keen to see what other healthcare standouts are trending right now, it could be worth checking out See the full list for free.

With robust returns posted over the last year, the question now turns to EssilorLuxottica’s valuation. Are current prices leaving room for upside, or is the market already factoring in all of the company’s growth prospects?

Most Popular Narrative: 2.7% Undervalued

With EssilorLuxottica Société anonyme’s latest close at €276.10 and the most followed narrative’s fair value at €283.63, sentiment suggests there is modest upside still in play. The market and analysts are converging on a price that signals cautious optimism for further growth catalysts ahead.

Investments in smart eyewear, AI-enabled vision solutions, and MedTech (Ray-Ban Meta, Oakley Meta, Nuance Audio, acquisition of Optegra Eye Clinics) capitalize on long-term demand for technologically advanced and personalized eye health platforms. These initiatives are driving product mix upgrades and higher average selling prices, which will benefit gross margin and future earnings.

Curious what bold growth forecasts underpin this narrative’s fair value? There is a hidden story of rising earnings, margin expansion, and analyst disagreement that could change the game. Find out how these projections shape expectations for EssilorLuxottica’s financial future.

Result: Fair Value of €283.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent inflationary pressures and the rapid shift toward disruptive optical technologies remain uncertainties that could pose challenges for EssilorLuxottica's growth narrative.

Find out about the key risks to this EssilorLuxottica Société anonyme narrative.

Another View: Looking at Valuation Multiples

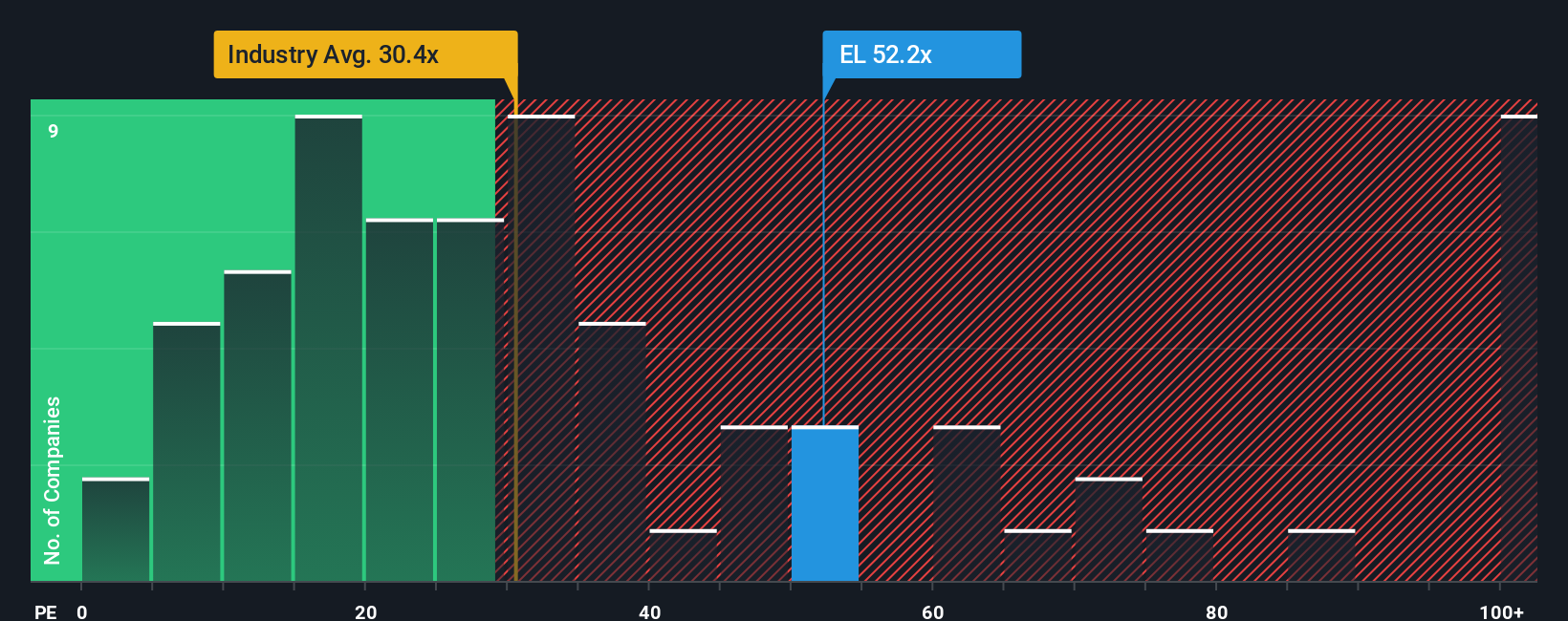

While the fair value narrative suggests EssilorLuxottica still has upside, the company’s price-to-earnings ratio stands at 53.5x. This figure is well above both the European industry average of 29.2x and the peer group’s 32.8x. Even when compared to a fair ratio of 33.1x, EssilorLuxottica appears expensive. This gap suggests there may be higher valuation risk if future growth expectations are not met. Are investors paying too much for its leadership and innovation?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EssilorLuxottica Société anonyme Narrative

If you see the numbers differently or would like to reach your own conclusions, you can craft a fresh narrative in under three minutes, your way with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding EssilorLuxottica Société anonyme.

Looking for more investment ideas?

Opportunities don’t last forever, and being ahead means staying curious about what’s next. Take advantage now and find smart prospects that match your ambitions.

- Catch high-yield potential by tapping into these 19 dividend stocks with yields > 3%. Here, reliable companies offer attractive returns above 3%.

- Accelerate your portfolio with these 25 AI penny stocks, which includes companies leading innovation in artificial intelligence and shaping the next wave of tech growth.

- Unlock new value by targeting these 893 undervalued stocks based on cash flows, focusing on companies with strong future cash flows and favorable market positioning.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EssilorLuxottica Société anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EL

EssilorLuxottica Société anonyme

Designs, manufactures, and distributes ophthalmic lenses, frames, and sunglasses in North America, the Middle East, Africa, Europe, Latin America, and the Asia-Pacific.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives