- France

- /

- Medical Equipment

- /

- ENXTPA:EL

EssilorLuxottica (ENXTPA:EL): Assessing Valuation After Launching Its New Scientific Advisory Committee

Reviewed by Simply Wall St

EssilorLuxottica Société anonyme (ENXTPA:EL) just set up a high profile Scientific Advisory Committee, and while that will not move earnings overnight, it quietly sharpens the long term innovation story behind the stock.

See our latest analysis for EssilorLuxottica Société anonyme.

That scientific committee announcement lands after a strong run, with the share price up sharply over the past year and especially the last quarter, while multi year total shareholder returns highlight enduring momentum rather than a short lived pop.

If innovation led names like EssilorLuxottica appeal to you, it could be worth scanning other healthcare stocks that are quietly building long term growth stories of their own.

Yet with the shares already near analyst targets after a powerful multi year run, the key question now is whether EssilorLuxottica still trades below its true potential or if the market has already priced in its next leg of growth.

Most Popular Narrative Narrative: 3.1% Undervalued

With EssilorLuxottica last closing at €308.80 versus a narrative fair value of €318.65, the market is almost aligned but still leaving a modest gap.

Ongoing innovation in vision solutions and smart eyewear, along with strategic acquisitions, enhances competitive advantage and supports future market share and profitability.

Want to see what kind of revenue, margin, and earnings runway justifies this premium vision story? The narrative pins its value on ambitious, tightly modeled upgrades in growth, profitability, and future valuation multiples, all tied to a very specific earnings target and share count path. Curious how finely balanced those assumptions really are?

Result: Fair Value of €318.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps in smart eyewear or tougher regulatory and margin pressures could quickly test the optimism baked into EssilorLuxottica's premium valuation.

Find out about the key risks to this EssilorLuxottica Société anonyme narrative.

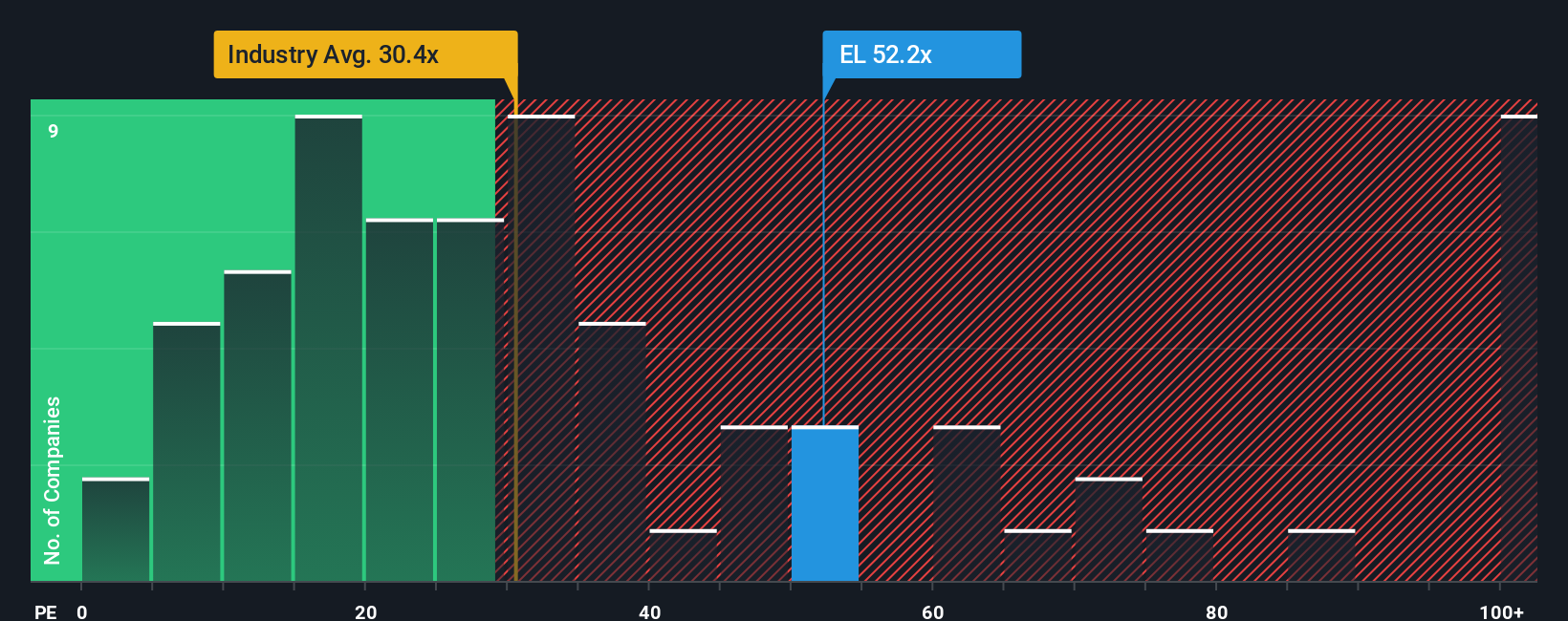

Another View, Stretched by Earnings Multiples

While the narrative fair value suggests modest upside, the current price implies a rich valuation at about 59.8 times earnings versus a fair ratio closer to 45.9 times, and far above peers and the European Medical Equipment industry near the high 20s to low 30s. That gap points to real derating risk if growth or margins disappoint.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EssilorLuxottica Société anonyme Narrative

If you see the numbers differently or prefer to stress test your own assumptions, you can shape a personalized story in minutes, Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding EssilorLuxottica Société anonyme.

Ready for more investment ideas?

Before the market moves on without you, use the Simply Wall St Screener to identify fresh opportunities that match your strategy.

- Explore early stage companies by reviewing these 3571 penny stocks with strong financials that combine smaller market caps with improving fundamentals and potential for valuation changes.

- Align your portfolio with the productivity trend by targeting these 25 AI penny stocks involved in the adoption of automation and intelligent software.

- Search for quality at a lower price by filtering for these 919 undervalued stocks based on cash flows where current prices are well below estimates of long term cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EssilorLuxottica Société anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EL

EssilorLuxottica Société anonyme

Designs, manufactures, and distributes ophthalmic lenses, frames, and sunglasses in North America, the Middle East, Africa, Europe, Latin America, and the Asia-Pacific.

Adequate balance sheet with moderate growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026