- France

- /

- Medical Equipment

- /

- ENXTPA:ALCJ

The Crossject Société Anonyme (EPA:ALCJ) Share Price Has Gained 78% And Shareholders Are Hoping For More

It's been a soft week for Crossject Société Anonyme (EPA:ALCJ) shares, which are down 13%. While that might be a setback, it doesn't negate the nice returns received over the last twelve months. After all, the share price is up a market-beating 78% in that time.

Check out our latest analysis for Crossject Société Anonyme

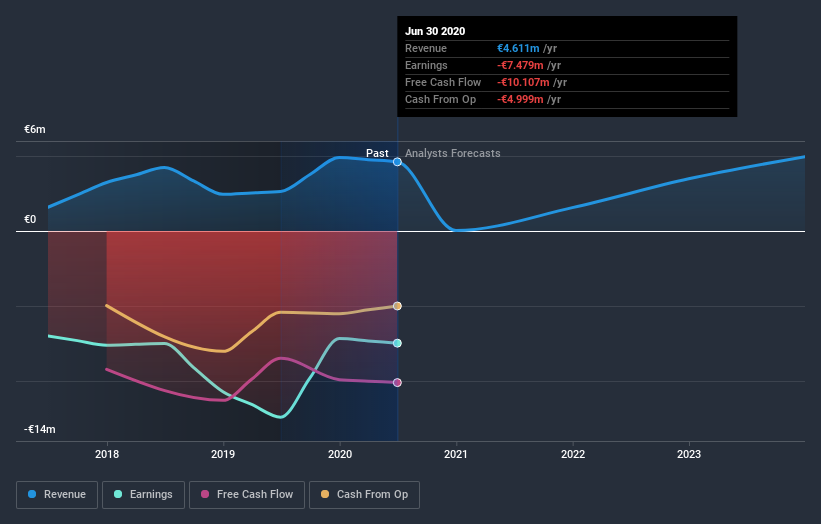

Crossject Société Anonyme isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Crossject Société Anonyme grew its revenue by 74% last year. That's stonking growth even when compared to other loss-making stocks. While the share price gain of 78% over twelve months is pretty tasty, you might argue it doesn't fully reflect the strong revenue growth. If that's the case, now might be the time to take a close look at Crossject Société Anonyme. Since we evolved from monkeys, we think in linear terms by nature. So if growth goes exponential, opportunity may exist for the enlightened.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's good to see that Crossject Société Anonyme has rewarded shareholders with a total shareholder return of 78% in the last twelve months. Notably the five-year annualised TSR loss of 10% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand Crossject Société Anonyme better, we need to consider many other factors. Take risks, for example - Crossject Société Anonyme has 2 warning signs (and 1 which is significant) we think you should know about.

But note: Crossject Société Anonyme may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you’re looking to trade Crossject Société Anonyme, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:ALCJ

Crossject Société Anonyme

Develops needle-free injection systems in France.

Exceptional growth potential medium-low.

Market Insights

Community Narratives