As global markets react to recent Federal Reserve rate cuts, small-cap stocks have shown notable resilience, with France's CAC 40 Index adding 0.47% amid cautious investor sentiment in Europe. This backdrop presents a unique opportunity to explore lesser-known French companies that may benefit from the evolving economic landscape. In this context, identifying promising stocks involves looking for robust fundamentals and growth potential that align well with current market conditions. Here are three undiscovered gems in France poised for potential success.

Top 10 Undiscovered Gems With Strong Fundamentals In France

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| EssoF | 1.19% | 11.14% | 41.41% | ★★★★★★ |

| Gévelot | 0.25% | 10.64% | 20.33% | ★★★★★★ |

| VIEL & Cie société anonyme | 54.02% | 5.66% | 19.86% | ★★★★★☆ |

| ADLPartner | 86.83% | 9.59% | 11.00% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| CFM Indosuez Wealth Management | 239.60% | 10.01% | 13.52% | ★★★★★☆ |

| La Forestière Equatoriale | 0.00% | -50.76% | 49.41% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative | 391.01% | 4.67% | 17.31% | ★★★★☆☆ |

| Société Fermière du Casino Municipal de Cannes | 11.60% | 6.69% | 10.30% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Caisse Regionale de Credit Agricole Mutuel Toulouse 31 (ENXTPA:CAT31)

Simply Wall St Value Rating: ★★★★★☆

Overview: Caisse Regionale de Credit Agricole Mutuel Toulouse 31 operates as a cooperative bank in France with a market cap of €279.37 million.

Operations: The cooperative bank generates revenue through various financial services and products. Its net profit margin is 13.45%.

Caisse Regionale de Credit Agricole Mutuel Toulouse 31, with total assets of €16.3B and equity of €2.0B, reported earnings growth of 25.4% over the past year, surpassing the Banks industry average of 1.3%. Total deposits stand at €13.5B against loans of €12.0B, while bad loans are appropriately managed at 1.4%. Trading at a significant discount to its estimated fair value (67.5%), CAT31's primarily low-risk funding structure bolsters its stability and appeal as an investment option.

- Click to explore a detailed breakdown of our findings in Caisse Regionale de Credit Agricole Mutuel Toulouse 31's health report.

Learn about Caisse Regionale de Credit Agricole Mutuel Toulouse 31's historical performance.

Neurones (ENXTPA:NRO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Neurones S.A. is an IT services company that offers infrastructure, application, and consulting services in France and internationally with a market cap of €1.05 billion.

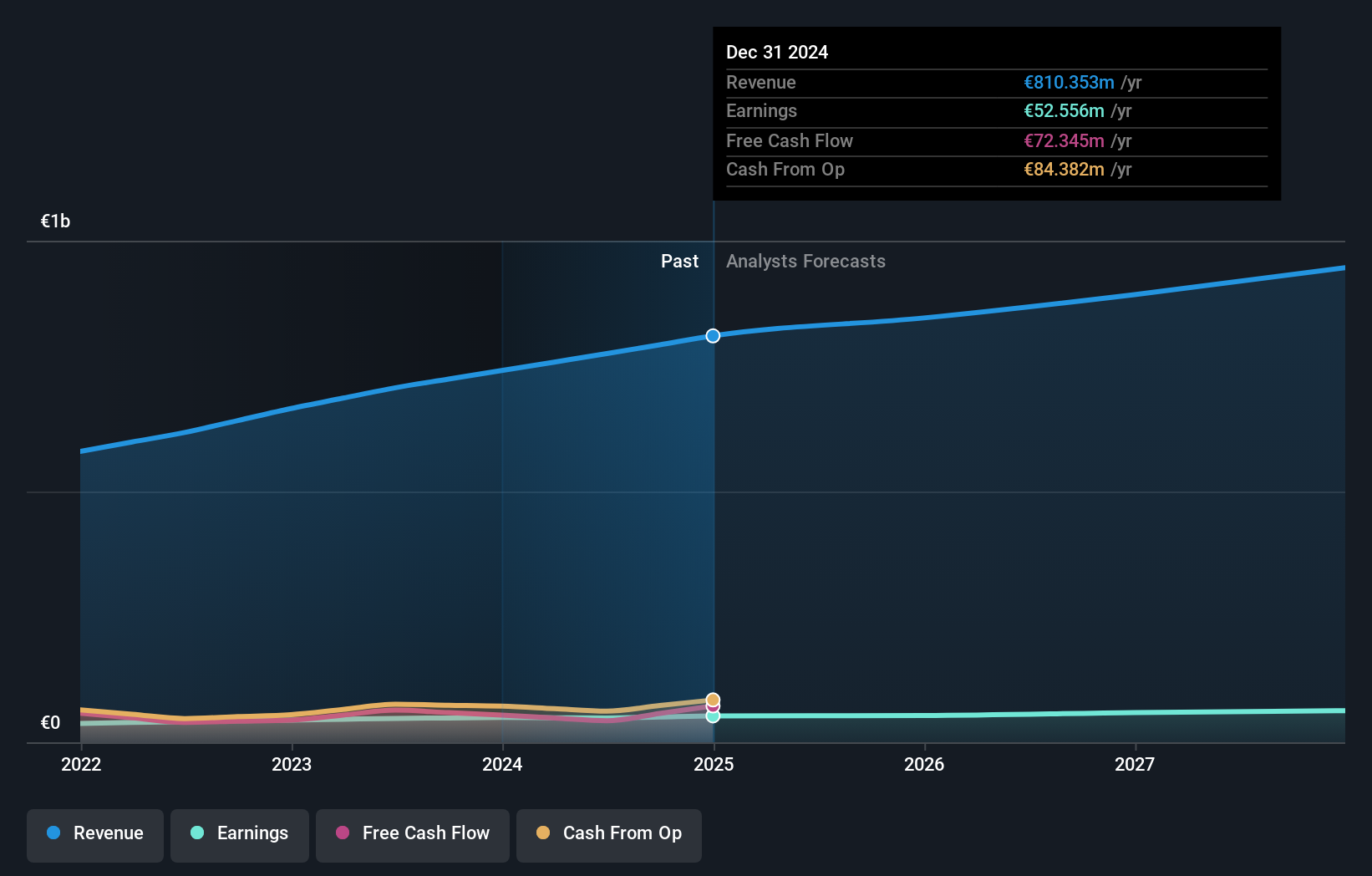

Operations: Neurones generates revenue primarily from infrastructure services (€483.86 million), application services (€236.52 million), and consulting (€54.53 million).

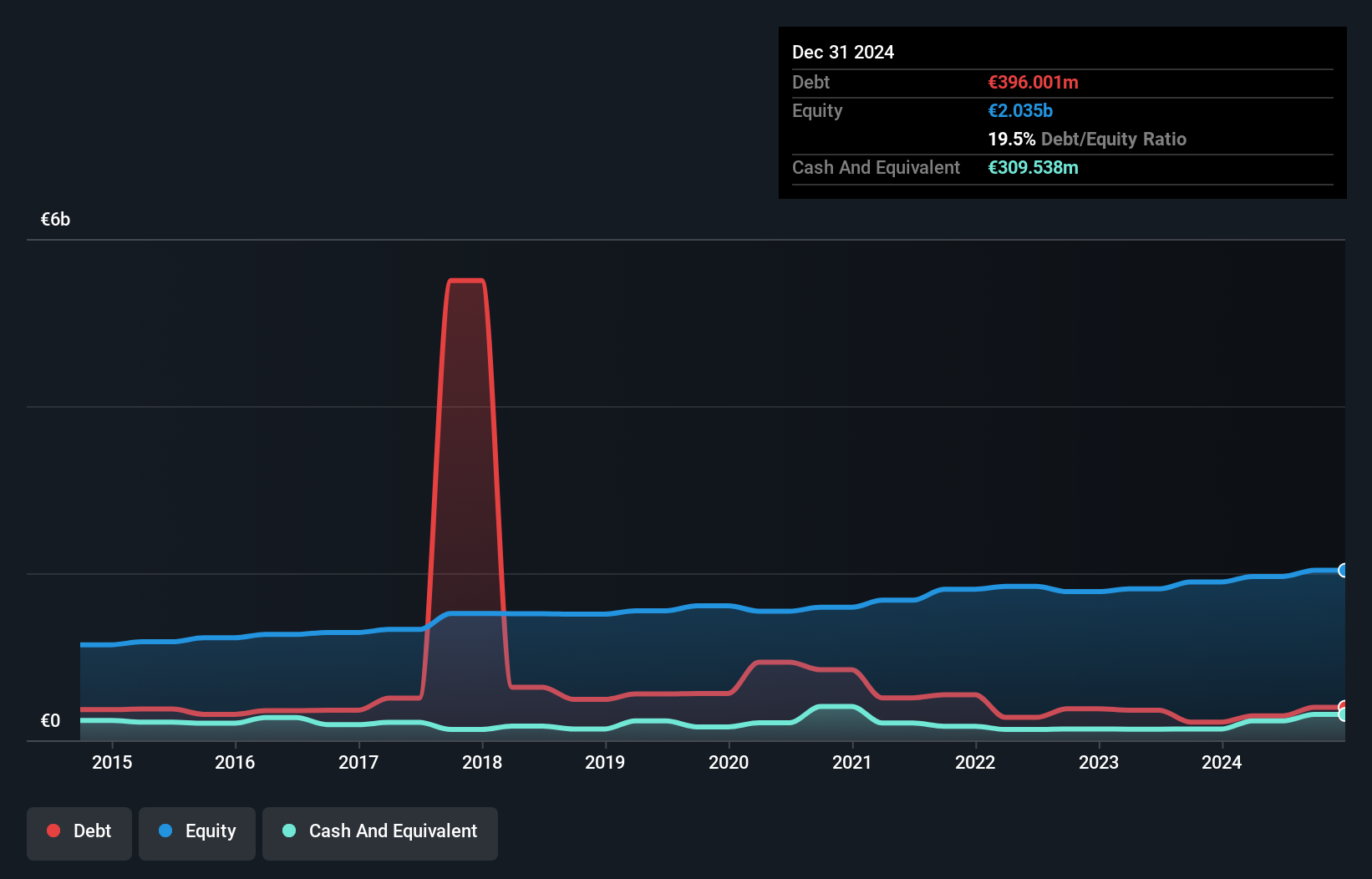

Neurones, a small IT services firm in France, has shown resilience with earnings growth of 1.8% over the past year, outpacing the industry’s -7.4%. The company reported half-year revenue of €402.43 million and net income of €24.5 million for June 2024, slightly down from €25.42 million last year. Neurones maintains high-quality earnings and is free cash flow positive with more cash than total debt, reflecting sound financial health despite a modest increase in debt-to-equity ratio to 2.8% over five years.

- Click here to discover the nuances of Neurones with our detailed analytical health report.

Assess Neurones' past performance with our detailed historical performance reports.

Savencia (ENXTPA:SAVE)

Simply Wall St Value Rating: ★★★★★★

Overview: Savencia SA produces, distributes, and markets dairy and cheese products in France, the rest of Europe, and internationally with a market cap of €706.14 million.

Operations: Savencia SA generates revenue primarily from producing, distributing, and marketing dairy and cheese products across various regions. The company operates with a market cap of €706.14 million.

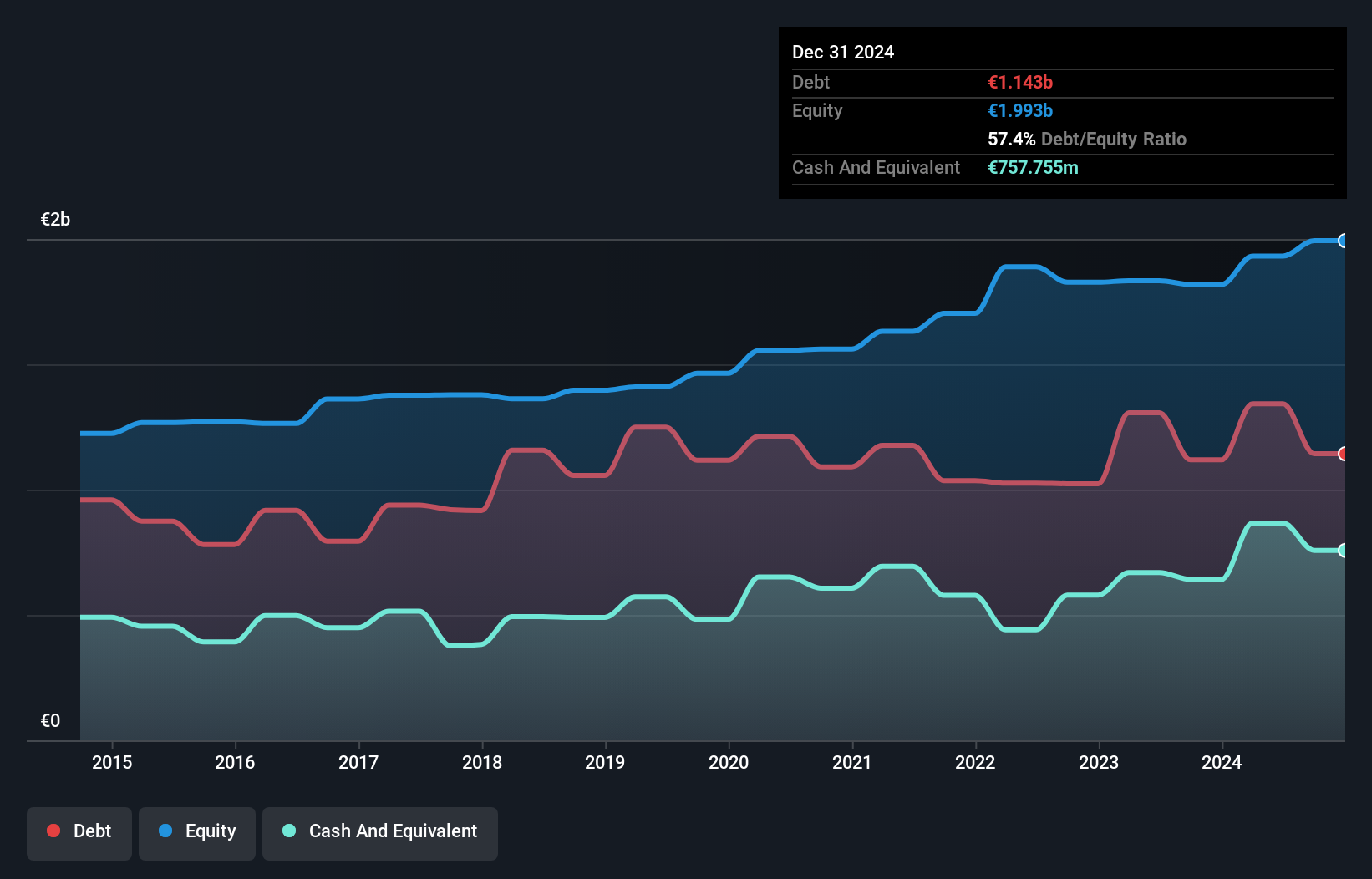

Savencia, a notable player in the food industry, has seen its earnings grow by 114.7% over the past year, outpacing the industry's 67.3%. The company's net debt to equity ratio stands at a satisfactory 24.9%, down from 69.5% five years ago. Despite a one-off loss of €43.6M impacting recent results, Savencia's interest payments are well covered by EBIT (32.3x). Trading at 78% below estimated fair value, it remains an attractive proposition for investors seeking growth and stability in France’s food sector.

- Navigate through the intricacies of Savencia with our comprehensive health report here.

Review our historical performance report to gain insights into Savencia's's past performance.

Key Takeaways

- Access the full spectrum of 34 Euronext Paris Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CAT31

Caisse Regionale de Credit Agricole Mutuel Toulouse 31

Operates as a cooperative bank in France.

Solid track record with excellent balance sheet.