- Switzerland

- /

- Media

- /

- SWX:APGN

Undiscovered Gems Three Promising Stocks For December 2024

Reviewed by Simply Wall St

As global markets navigate a period of mixed performance, with major indices like the Russell 2000 underperforming their larger-cap counterparts and economic indicators suggesting a cooling labor market, investors are keenly observing potential shifts in monetary policy. In this environment, identifying promising small-cap stocks can be challenging yet rewarding; these "undiscovered gems" often offer unique growth opportunities that align well with current market dynamics, such as rate adjustments and sector-specific trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Chilanga Cement | NA | 12.53% | 25.20% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 4.38% | -14.46% | ★★★★★☆ |

| Transcorp Power | 46.33% | 114.79% | 152.92% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Malteries Franco-Belges Société Anonyme (ENXTPA:MALT)

Simply Wall St Value Rating: ★★★★★★

Overview: Malteries Franco-Belges Société Anonyme specializes in producing and selling malt mainly to brewers both within France and internationally, with a market capitalization of €376.95 million.

Operations: Malteries Franco-Belges generates revenue primarily from its malt factory, which reported €145.10 million in sales. The company has a market capitalization of €376.95 million.

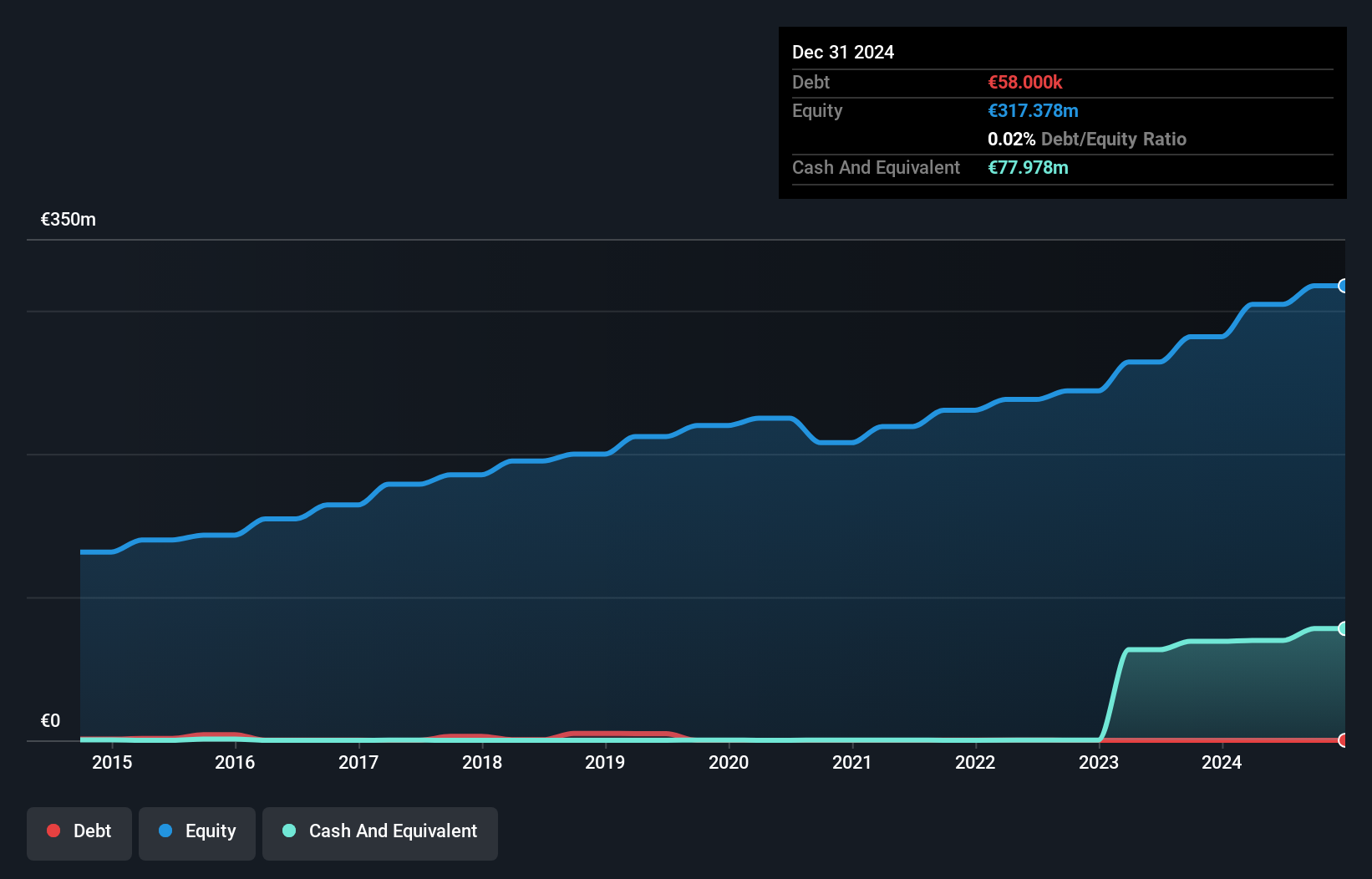

Malteries Franco-Belges, a relatively small player, has showcased notable financial strength with its net income soaring to €44.62 million from €27.21 million year-on-year. The company's debt-to-equity ratio impressively shrank from 2.2 to 0.02 over the past five years, reflecting prudent financial management. Trading at 54% below its estimated fair value suggests potential undervaluation in the market's eyes. Earnings per share have jumped significantly to €90 from €54.9, indicating robust profitability and high-quality earnings that outpace industry growth rates by a considerable margin of 64% versus the industry's 35%.

- Click here and access our complete health analysis report to understand the dynamics of Malteries Franco-Belges Société Anonyme.

Understand Malteries Franco-Belges Société Anonyme's track record by examining our Past report.

Bera Holding (IBSE:BERA)

Simply Wall St Value Rating: ★★★★★★

Overview: Bera Holding A.S. is a diversified company engaged in sectors such as paper and cardboard, machinery, oil, construction and building materials, marble, textiles, tourism, and food on a global scale with a market cap of TRY10.97 billion.

Operations: Bera Holding A.S. generates revenue primarily from the paper-carton-packaging segment at TRY3.67 billion and construction and building materials at TRY3.24 billion, with additional contributions from food, machinery, and other sectors. The company reported a net profit margin of 5% in its latest financial period, reflecting its operational efficiency across diverse industries.

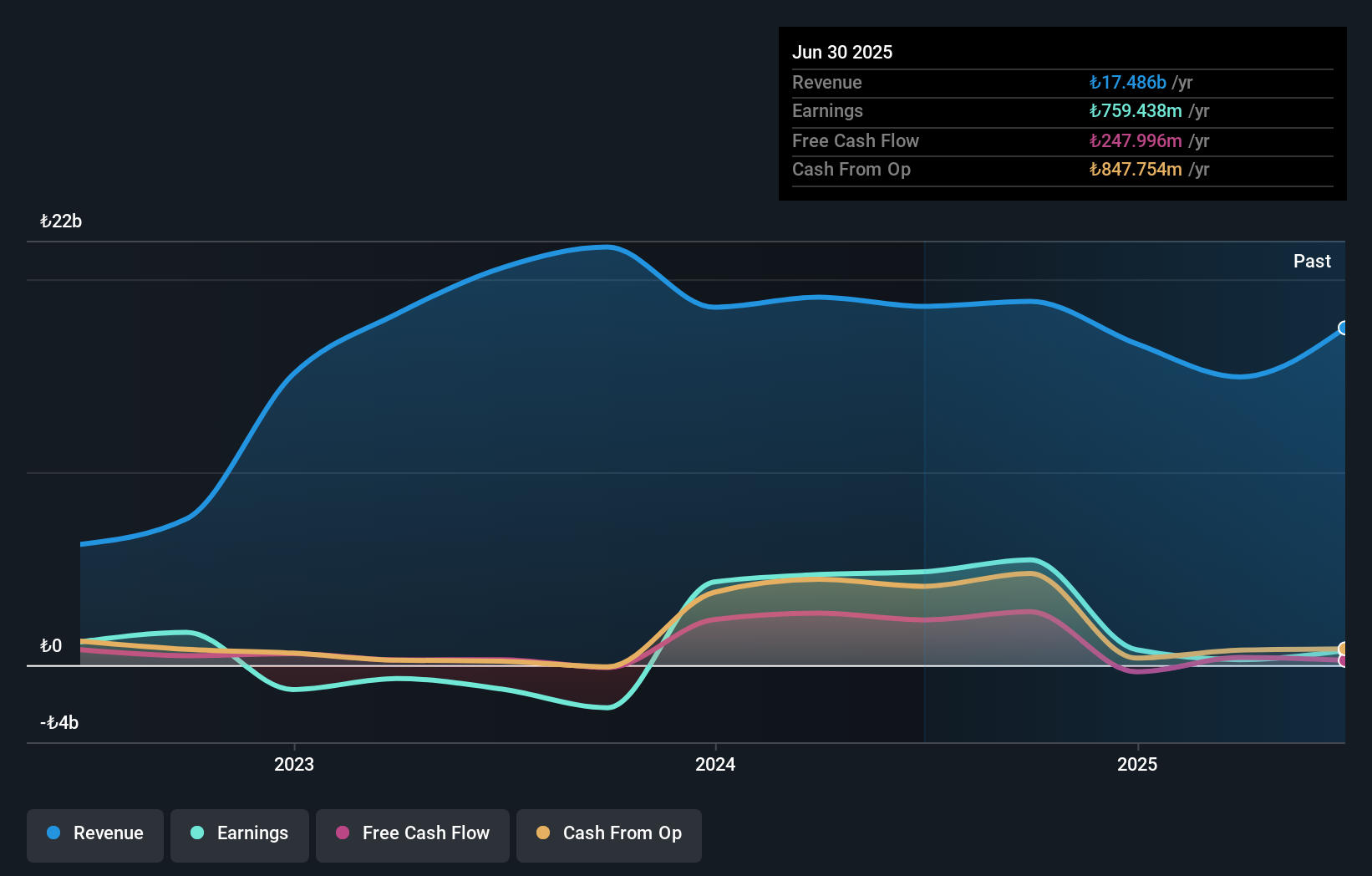

Bera Holding showcases a compelling transformation, having turned profitable this year. The company's debt to equity ratio has impressively decreased from 47.6% to 5.8% over the past five years, and it trades at 85.8% below its estimated fair value, suggesting potential undervaluation. With net income of TRY 1,146 million for the first nine months of 2024 compared to TRY 248 million last year, Bera's financial health is on an upswing. Earnings per share have also improved significantly from TRY 0.363 to TRY 1.678 in the same period, indicating robust recovery and growth prospects ahead for this small cap entity.

- Click here to discover the nuances of Bera Holding with our detailed analytical health report.

Review our historical performance report to gain insights into Bera Holding's's past performance.

APG|SGA (SWX:APGN)

Simply Wall St Value Rating: ★★★★★☆

Overview: APG|SGA SA operates in the advertising industry, offering services mainly in Switzerland and Serbia, with a market capitalization of CHF608.01 million.

Operations: APG|SGA generates revenue of CHF329.12 million from the acquisition, sale, and management of advertising spaces.

APG|SGA, a smaller player in the media sector, offers an intriguing mix of financial stability and value potential. Despite earnings growth of 18.6% last year, it lagged behind the industry's 23.4%. Over five years, earnings have decreased by 6.4% annually; however, trading at 36.5% below estimated fair value suggests room for appreciation. The company boasts high-quality earnings and operates debt-free for over five years, eliminating interest coverage concerns. With positive free cash flow reaching US$36 million recently and no debt burden to manage, APG|SGA seems well-positioned to navigate future opportunities in its market space confidently.

Taking Advantage

- Navigate through the entire inventory of 4508 Undiscovered Gems With Strong Fundamentals here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:APGN

APG|SGA

Provides advertising services primarily in Switzerland and Serbia.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives