- Taiwan

- /

- Consumer Durables

- /

- TWSE:9911

Undiscovered Gems And 2 Other Promising Stocks To Consider

Reviewed by Simply Wall St

In a market environment where U.S. indexes are approaching record highs and smaller-cap indexes are outperforming their larger counterparts, investors are keenly observing the dynamics that could shape future opportunities. With strong labor market data and stabilizing mortgage rates fueling positive sentiment, there's a renewed interest in identifying potential growth areas within small-cap stocks. In such conditions, a good stock is often characterized by its ability to capitalize on emerging trends and demonstrate resilience amid broader economic shifts—qualities that make undiscovered gems particularly intriguing for those looking to diversify their portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Segar Kumala Indonesia | NA | 21.81% | 18.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Watt's | 73.27% | 7.85% | -1.33% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Bhakti Multi Artha | 45.21% | 32.37% | -16.43% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.04% | 35.44% | ★★★★☆☆ |

We'll examine a selection from our screener results.

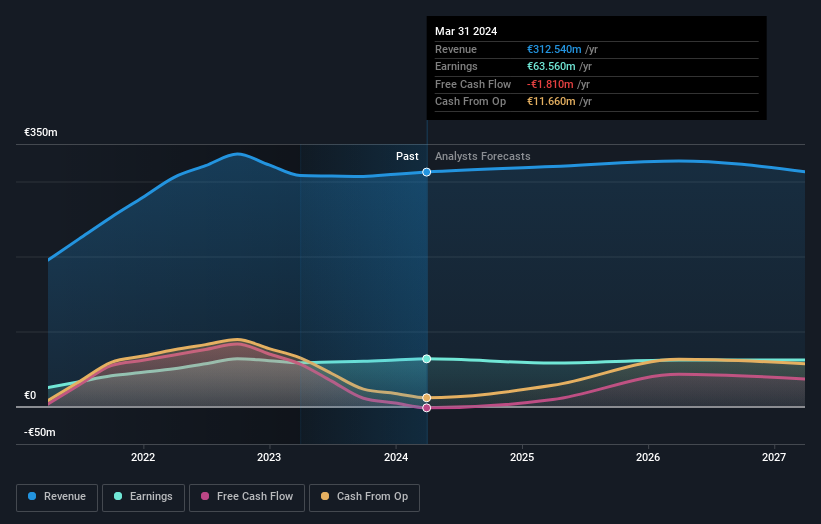

Laurent-Perrier (ENXTPA:LPE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Laurent-Perrier S.A. is a company engaged in the production and sale of champagne, with a market capitalization of €591.80 million.

Operations: Laurent-Perrier generates revenue primarily through the production and distribution of champagne wines, amounting to €312.54 million.

Laurent-Perrier, a niche player in the beverage sector, has shown robust performance with earnings growth of 8.7% over the past year, outpacing the industry average of -31.5%. The company's debt management is commendable; its debt to equity ratio has decreased from 84.3% to 39% over five years, and interest payments are well-covered by EBIT at 11.8 times coverage. Despite trading at a good value—11.3% below estimated fair value—future earnings might face headwinds with an expected decline of 0.4% annually over three years, which investors should consider when evaluating potential opportunities.

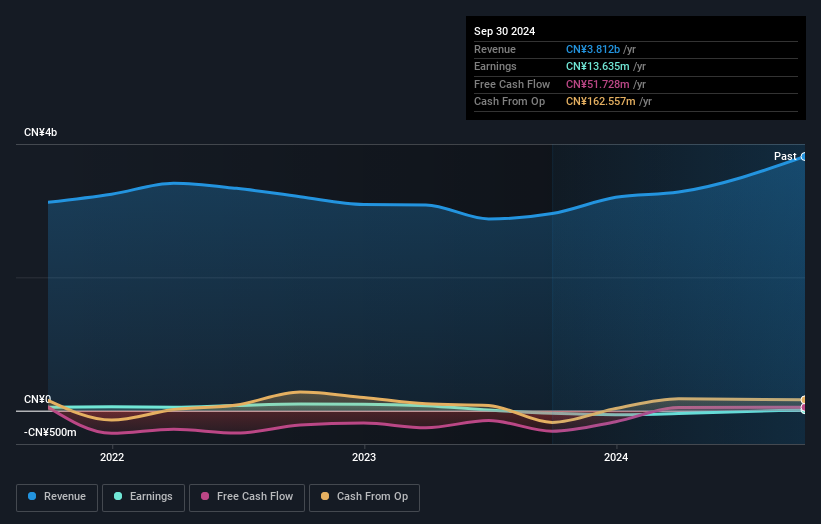

Anhui Xinke New MaterialsLtd (SHSE:600255)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Anhui Xinke New Materials Co., Ltd focuses on the research, development, production, and sales of copper alloy strip products in China with a market capitalization of CN¥4.19 billion.

Operations: Anhui Xinke generates revenue primarily from its processing and manufacturing segment, which accounts for CN¥3.81 billion.

Anhui Xinke, a nimble player in the materials sector, has shown notable progress recently. The company's sales for the first nine months of 2024 reached CNY 2.87 billion, up from CNY 2.26 billion in the previous year, highlighting a robust revenue increase. It managed to swing from a net loss of CNY 35 million last year to a net income of CNY 40 million this year. Despite these gains, interest payments remain only twice covered by EBIT, indicating potential financial strain if not addressed further. Its debt-to-equity ratio has risen over five years from 17% to nearly double at 38%.

- Take a closer look at Anhui Xinke New MaterialsLtd's potential here in our health report.

Gain insights into Anhui Xinke New MaterialsLtd's past trends and performance with our Past report.

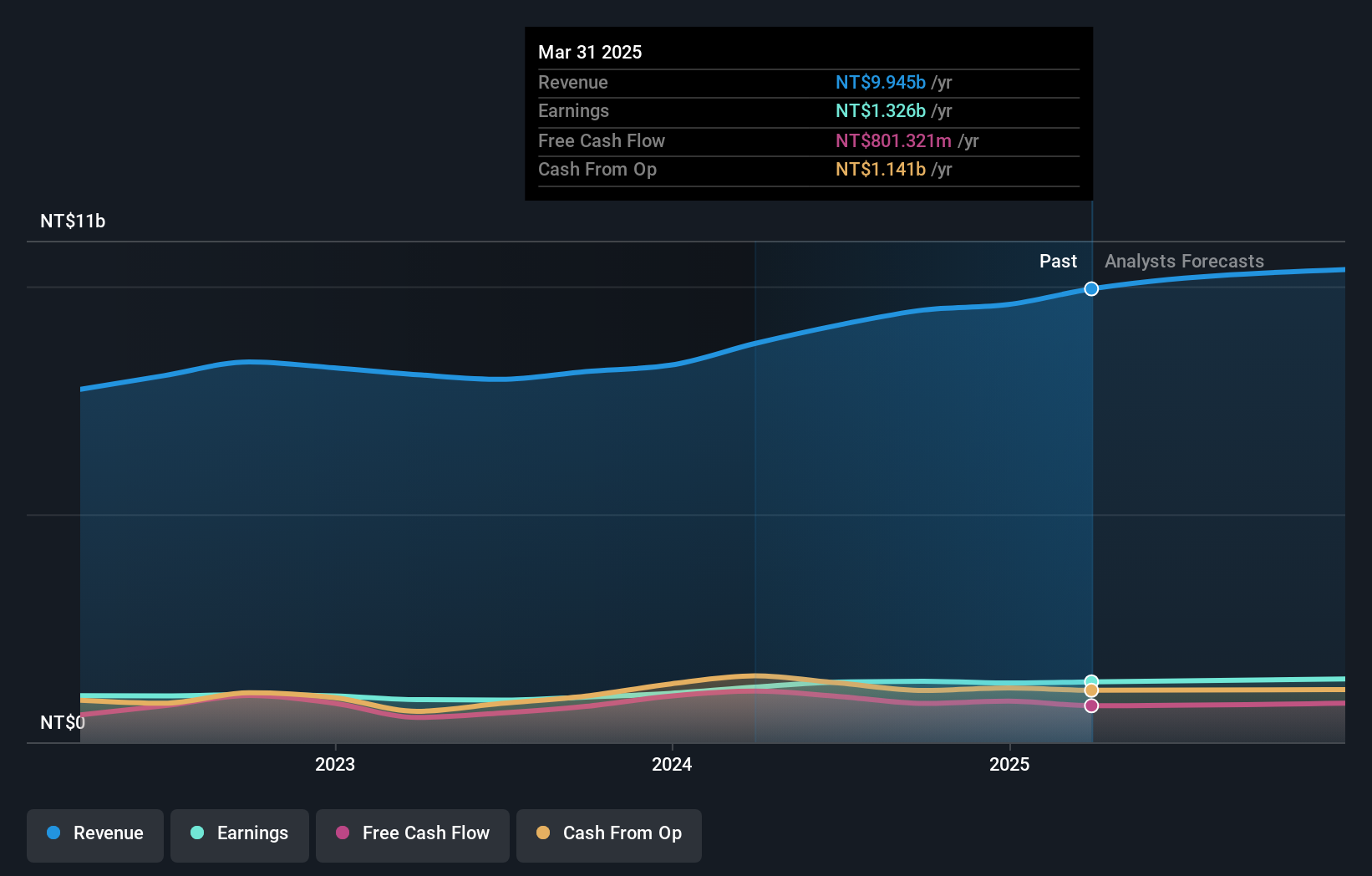

Taiwan Sakura (TWSE:9911)

Simply Wall St Value Rating: ★★★★★☆

Overview: Taiwan Sakura Corporation specializes in the manufacture and sale of kitchen appliances in Taiwan, with a market capitalization of NT$18.42 billion.

Operations: The company's primary revenue streams are from its Gas Appliance Division and Kitchenware Division, generating NT$5.76 billion and NT$2.83 billion, respectively.

Taiwan Sakura, a nimble player in the consumer durables sector, has demonstrated impressive growth with earnings rising by 35.1% over the past year, outpacing industry norms. The company's price-to-earnings ratio stands at 13.8x, offering a notable value compared to the Taiwan market average of 21.3x. Recent financials reveal third-quarter sales of TWD 2.46 billion and net income climbing to TWD 335 million from TWD 318 million last year, reflecting robust performance and efficient cost management. With innovative products like the R7261 range hood enhancing its portfolio, Taiwan Sakura continues to capture consumer interest effectively.

- Dive into the specifics of Taiwan Sakura here with our thorough health report.

Evaluate Taiwan Sakura's historical performance by accessing our past performance report.

Summing It All Up

- Gain an insight into the universe of 4634 Undiscovered Gems With Strong Fundamentals by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Sakura might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:9911

Taiwan Sakura

Engages in the manufacture and sale of kitchen appliances in Taiwan.

Outstanding track record with excellent balance sheet and pays a dividend.