The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like L.D.C (EPA:LOUP). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for L.D.C

L.D.C's Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. L.D.C managed to grow EPS by 15% per year, over three years. That's a good rate of growth, if it can be sustained.

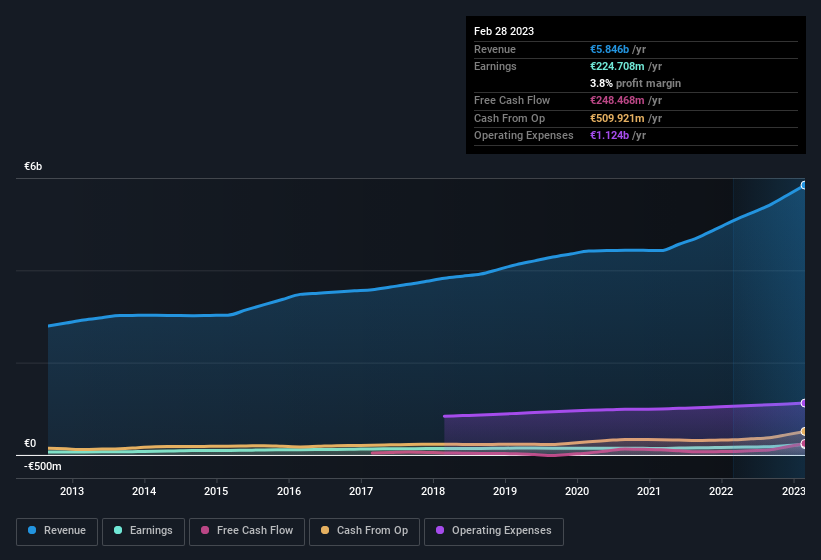

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note L.D.C achieved similar EBIT margins to last year, revenue grew by a solid 15% to €5.8b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for L.D.C?

Are L.D.C Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So those who are interested in L.D.C will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. In fact, they own 69% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. At the current share price, that insider holding is worth a staggering €1.6b. That level of investment from insiders is nothing to sneeze at.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Well, based on the CEO pay, you'd argue that they are indeed. Our analysis has discovered that the median total compensation for the CEOs of companies like L.D.C with market caps between €1.8b and €5.9b is about €1.7m.

The L.D.C CEO received total compensation of just €452k in the year to February 2023. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Should You Add L.D.C To Your Watchlist?

One important encouraging feature of L.D.C is that it is growing profits. Earnings growth might be the main attraction for L.D.C, but the fun does not stop there. With a meaningful level of insider ownership, and reasonable CEO pay, a reasonable mind might conclude that this is one stock worth watching. You still need to take note of risks, for example - L.D.C has 1 warning sign we think you should be aware of.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:LOUP

L.D.C

Produces and sells poultry and processed products in France and internationally.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026