Shareholders Will Probably Not Have Any Issues With Danone S.A.'s (EPA:BN) CEO Compensation

Key Insights

- Danone's Annual General Meeting to take place on 24th of April

- CEO Antoine de Saint-Affrique's total compensation includes salary of €1.40m

- The overall pay is comparable to the industry average

- Danone's total shareholder return over the past three years was 48% while its EPS grew by 2.2% over the past three years

CEO Antoine de Saint-Affrique has done a decent job of delivering relatively good performance at Danone S.A. (EPA:BN) recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 24th of April. We present our case of why we think CEO compensation looks fair.

See our latest analysis for Danone

Comparing Danone S.A.'s CEO Compensation With The Industry

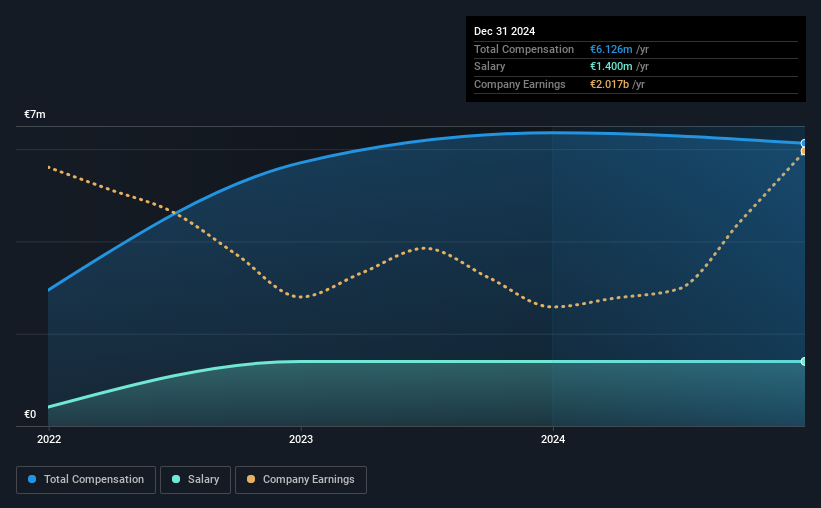

Our data indicates that Danone S.A. has a market capitalization of €48b, and total annual CEO compensation was reported as €6.1m for the year to December 2024. That's slightly lower by 3.6% over the previous year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at €1.4m.

For comparison, other companies in the French Food industry with market capitalizations above €7.0b, reported a median total CEO compensation of €5.1m. This suggests that Danone remunerates its CEO largely in line with the industry average. What's more, Antoine de Saint-Affrique holds €553k worth of shares in the company in their own name.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | €1.4m | €1.4m | 23% |

| Other | €4.7m | €5.0m | 77% |

| Total Compensation | €6.1m | €6.4m | 100% |

On an industry level, around 51% of total compensation represents salary and 49% is other remuneration. It's interesting to note that Danone allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Danone S.A.'s Growth Numbers

Over the past three years, Danone S.A. has seen its earnings per share (EPS) grow by 2.2% per year. The trailing twelve months of revenue was pretty much the same as the prior period.

We would argue that the lack of revenue growth in the last year is less than ideal, but the modest improvement in EPS is good. It's hard to reach a conclusion about business performance right now. This may be one to watch. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Danone S.A. Been A Good Investment?

Most shareholders would probably be pleased with Danone S.A. for providing a total return of 48% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. However, we still think that any proposed increase in CEO compensation will be examined closely to make sure the compensation is appropriate and linked to performance.

CEO compensation can have a massive impact on performance, but it's just one element. We've identified 1 warning sign for Danone that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:BN

Danone

Operates in the food and beverage industry in Europe, Ukraine, North America, China, North Asia, the Oceania, Latin America, rest of Asia, Africa, Turkey, the Middle East, and the Commonwealth of Independent States.

Established dividend payer with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion