Sapmer SA (EPA:ALMER) Stock's 26% Dive Might Signal An Opportunity But It Requires Some Scrutiny

The Sapmer SA (EPA:ALMER) share price has fared very poorly over the last month, falling by a substantial 26%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 36% in that time.

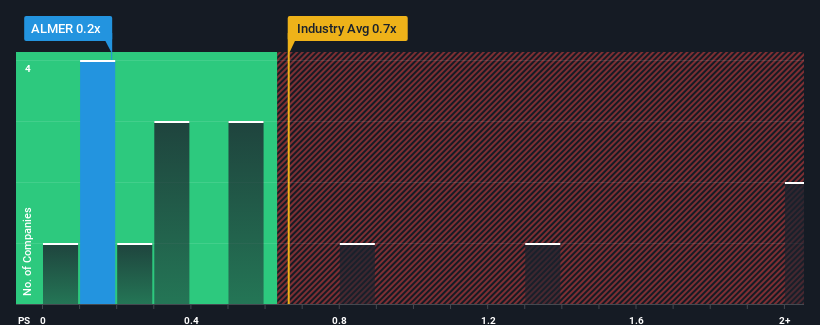

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Sapmer's P/S ratio of 0.2x, since the median price-to-sales (or "P/S") ratio for the Food industry in France is also close to 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Sapmer

What Does Sapmer's P/S Mean For Shareholders?

Sapmer has been doing a decent job lately as it's been growing revenue at a reasonable pace. Perhaps the expectation moving forward is that the revenue growth will track in line with the wider industry for the near term, which has kept the P/S subdued. Those who are bullish on Sapmer will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Sapmer's earnings, revenue and cash flow.How Is Sapmer's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Sapmer's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 2.7%. Revenue has also lifted 26% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 1.6% shows it's a great look while it lasts.

With this information, we find it odd that Sapmer is trading at a fairly similar P/S to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Key Takeaway

Following Sapmer's share price tumble, its P/S is just clinging on to the industry median P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As mentioned previously, Sapmer currently trades on a P/S on par with the wider industry, but this is lower than expected considering its recent three-year revenue growth is beating forecasts for a struggling industry. There could be some unobserved threats to revenue preventing the P/S ratio from outpacing the industry much like its revenue performance. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. It appears some are indeed anticipating revenue instability, because this relative performance should normally provide a boost to the share price.

Before you take the next step, you should know about the 4 warning signs for Sapmer (2 are potentially serious!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Sapmer, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALMER

Sapmer

Operates as a fishing company in South Africa, Northern America, Mauritius, Japan, Europe, China, and Réunion Island.

Slight with mediocre balance sheet.