- France

- /

- Oil and Gas

- /

- ENXTPA:WAGA

Strong week for Waga Energy Société anonyme (EPA:WAGA) shareholders doesn't alleviate pain of one-year loss

Waga Energy Société anonyme (EPA:WAGA) shareholders will doubtless be very grateful to see the share price up 30% in the last month. But that doesn't change the fact that the returns over the last year have been less than pleasing. The cold reality is that the stock has dropped 25% in one year, under-performing the market.

On a more encouraging note the company has added €70m to its market cap in just the last 7 days, so let's see if we can determine what's driven the one-year loss for shareholders.

Check out our latest analysis for Waga Energy Société anonyme

Given that Waga Energy Société anonyme didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last twelve months, Waga Energy Société anonyme increased its revenue by 56%. That's a strong result which is better than most other loss making companies. The share price drop of 25% over twelve months would be considered disappointing by many, so you might argue the company is getting little credit for its impressive revenue growth. Prima facie, revenue growth like that should be a good thing, so it's worth checking whether losses have stabilized. Our brains have evolved to think in linear fashion, so there's value in learning to recognize exponential growth. We are, in some ways, simply the wisest of the monkeys.

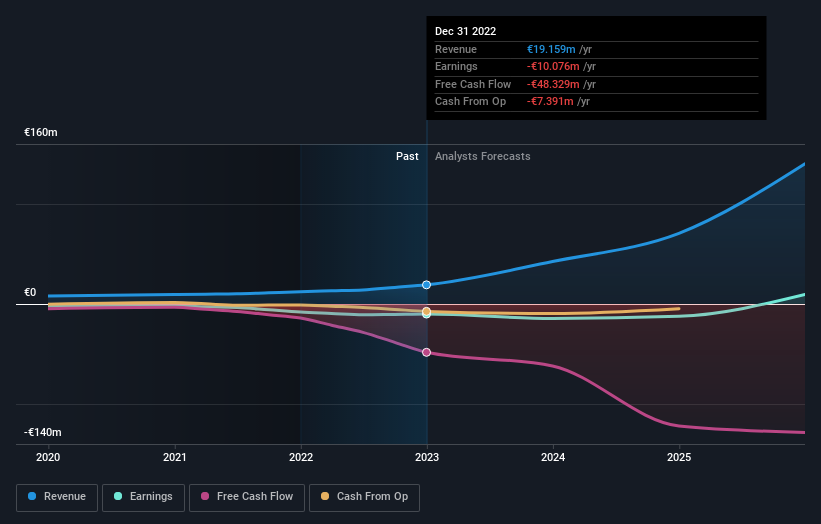

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. If you are thinking of buying or selling Waga Energy Société anonyme stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Given that the market gained 17% in the last year, Waga Energy Société anonyme shareholders might be miffed that they lost 25%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The share price decline has continued throughout the most recent three months, down 3.9%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Waga Energy Société anonyme (1 is concerning!) that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

If you're looking to trade Waga Energy, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Waga Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:WAGA

Waga Energy

Develops and produces biomethane for the renewable natural gas industry worldwide.

Mediocre balance sheet low.

Similar Companies

Market Insights

Community Narratives