- France

- /

- Energy Services

- /

- ENXTPA:VIRI

Take Care Before Jumping Onto Viridien Société anonyme (EPA:VIRI) Even Though It's 25% Cheaper

The Viridien Société anonyme (EPA:VIRI) share price has fared very poorly over the last month, falling by a substantial 25%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 50% in that time.

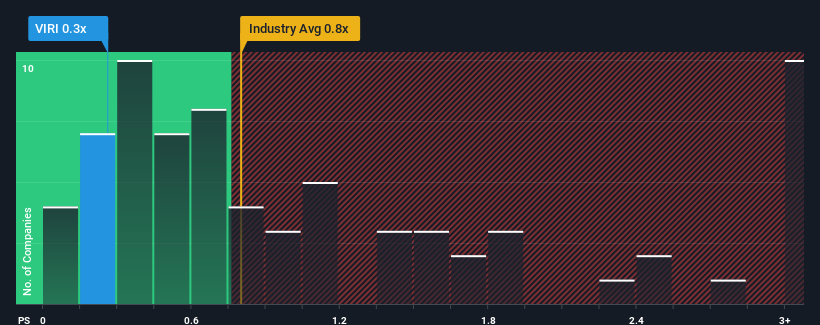

After such a large drop in price, considering around half the companies operating in France's Energy Services industry have price-to-sales ratios (or "P/S") above 0.8x, you may consider Viridien Société anonyme as an solid investment opportunity with its 0.3x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Viridien Société anonyme

How Viridien Société anonyme Has Been Performing

Viridien Société anonyme could be doing better as it's been growing revenue less than most other companies lately. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Viridien Société anonyme will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Viridien Société anonyme?

Viridien Société anonyme's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 8.0% last year. The latest three year period has also seen an excellent 45% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next three years should generate growth of 6.7% each year as estimated by the four analysts watching the company. With the industry only predicted to deliver 1.8% each year, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Viridien Société anonyme's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does Viridien Société anonyme's P/S Mean For Investors?

Viridien Société anonyme's recently weak share price has pulled its P/S back below other Energy Services companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A look at Viridien Société anonyme's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Viridien Société anonyme that you should be aware of.

If you're unsure about the strength of Viridien Société anonyme's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:VIRI

Viridien Société anonyme

Engages in the provision of data, products, services, and solutions in Earth science, data science, sensing, and monitoring in North America, Latin America, the Central and South Americas, Europe, Africa, the Middle East, and the Asia Pacific.

Proven track record and fair value.