- France

- /

- Oil and Gas

- /

- ENXTPA:TTE

TotalEnergies (ENXTPA:TTE): Assessing Valuation as Share Price Sees Recent Fluctuations

Reviewed by Simply Wall St

Every investor likes to keep an eye out for moves that might shake up the usual expectations, and that is certainly the case with TotalEnergies (ENXTPA:TTE) right now. There has not been any headline-making event or game-changing news to set the stock in motion, but the recent fluctuations could still make you wonder if there is something brewing beneath the surface. Even in the absence of a big announcement, unexpected twists in share price often prompt a deeper dive.

TotalEnergies has seen modest ups and downs over the year, with the stock trailing off by almost 10% for the past twelve months. Momentum has cooled compared to previous periods, despite the company reporting slight revenue and net income growth on an annual basis. This slower phase has unfolded alongside the broader energy sector’s volatility and a few minor updates from TotalEnergies, but nothing that has dramatically shifted the landscape for shareholders or analysts.

The question now is whether this period of soft performance hints at an undervalued entry point for investors, or if the market has already built future expectations into the price.

Most Popular Narrative: 18% Undervalued

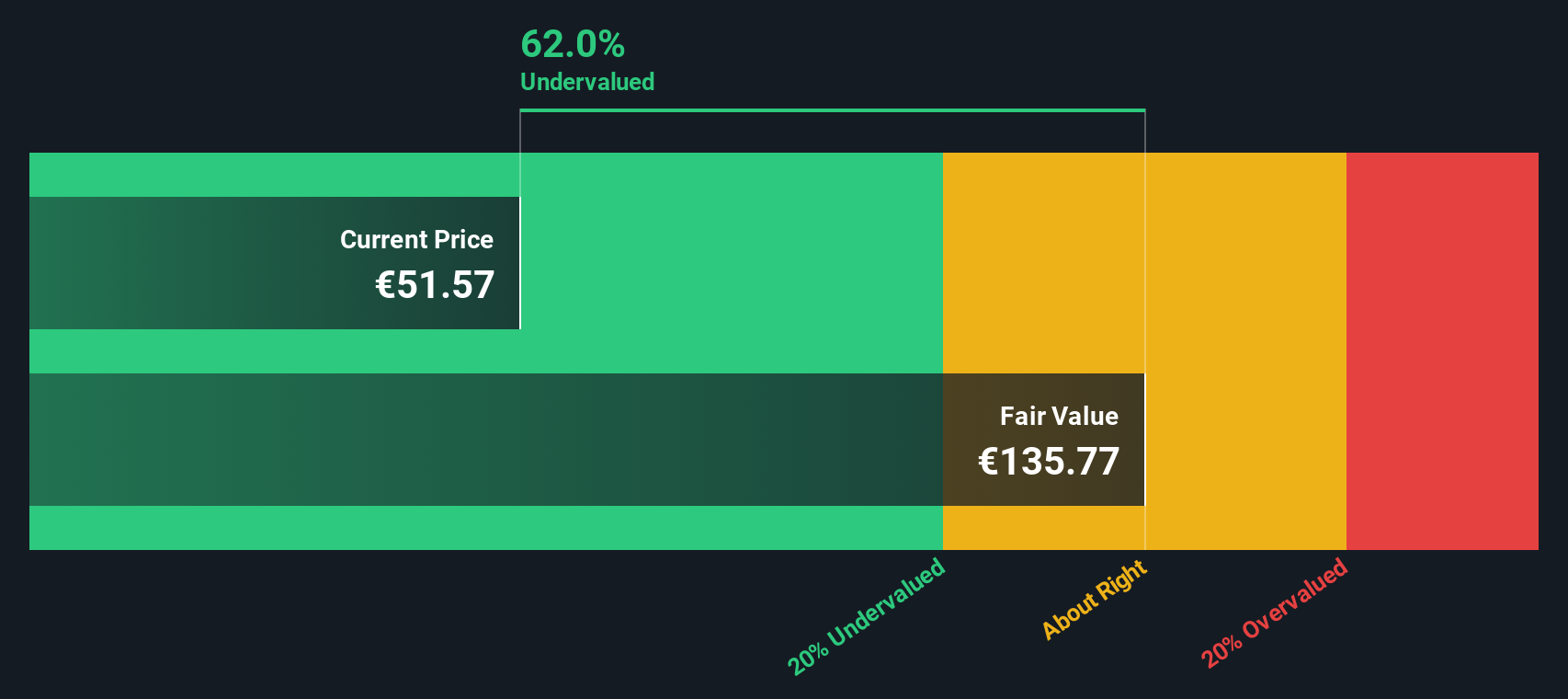

According to the most widely followed narrative, TotalEnergies is currently trading at a notable discount compared to analysts’ fair value estimate, with the stock seen as undervalued by nearly a fifth.

The company's ongoing expansion in gas and power, including LNG projects in the U.S., Canada, Qatar, and Malaysia as well as its strong position in signing flexible, long-term LNG contracts, positions TotalEnergies to benefit from the global shift toward cleaner energy and the sustained robust demand for natural gas, supporting future top-line revenue growth and margin stability.

Want to know what’s fueling these lofty valuation claims? The secret is a mix of aggressive growth bets and bold assumptions on future earnings. Wondering which key forecast is driving the price target far above today’s share price? Take a closer look to uncover the quantitative logic behind this bullish analyst view and see why their projections might surprise you.

Result: Fair Value of €63.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent low oil prices or setbacks in renewables growth could quickly undermine the optimistic outlook for TotalEnergies’ long-term earnings potential.

Find out about the key risks to this TotalEnergies narrative.Another View: Our DCF Model Tells a Different Story

While analysts see the stock as undervalued based on earnings forecasts, our SWS DCF model also indicates the shares are trading below fair value. However, does this approach capture all the real risks ahead?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own TotalEnergies Narrative

If you see things differently or want to dig into the numbers yourself, it is easy to build your own perspective on TotalEnergies in just a few minutes. Do it your way.

A great starting point for your TotalEnergies research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Want to get ahead of the trend? The Simply Wall Street Screener can help you target exciting stocks with real potential that fit your goals. Don’t let great opportunities slip by.

- Capitalize on tomorrow’s technology by tapping into companies driving artificial intelligence innovation with AI penny stocks.

- Secure steady payouts by uncovering top businesses known for reliable income streams through dividend stocks with yields > 3%.

- Spot hidden gems trading for less than they’re worth when you use undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TotalEnergies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:TTE

TotalEnergies

A multi-energy company, produces and markets oil and biofuels, natural gas, biogas and low-carbon hydrogen, renewables, and electricity in France, rest of Europe, and internationally.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives