- France

- /

- Energy Services

- /

- ENXTPA:TE

Why We're Not Concerned About Technip Energies N.V.'s (EPA:TE) Share Price

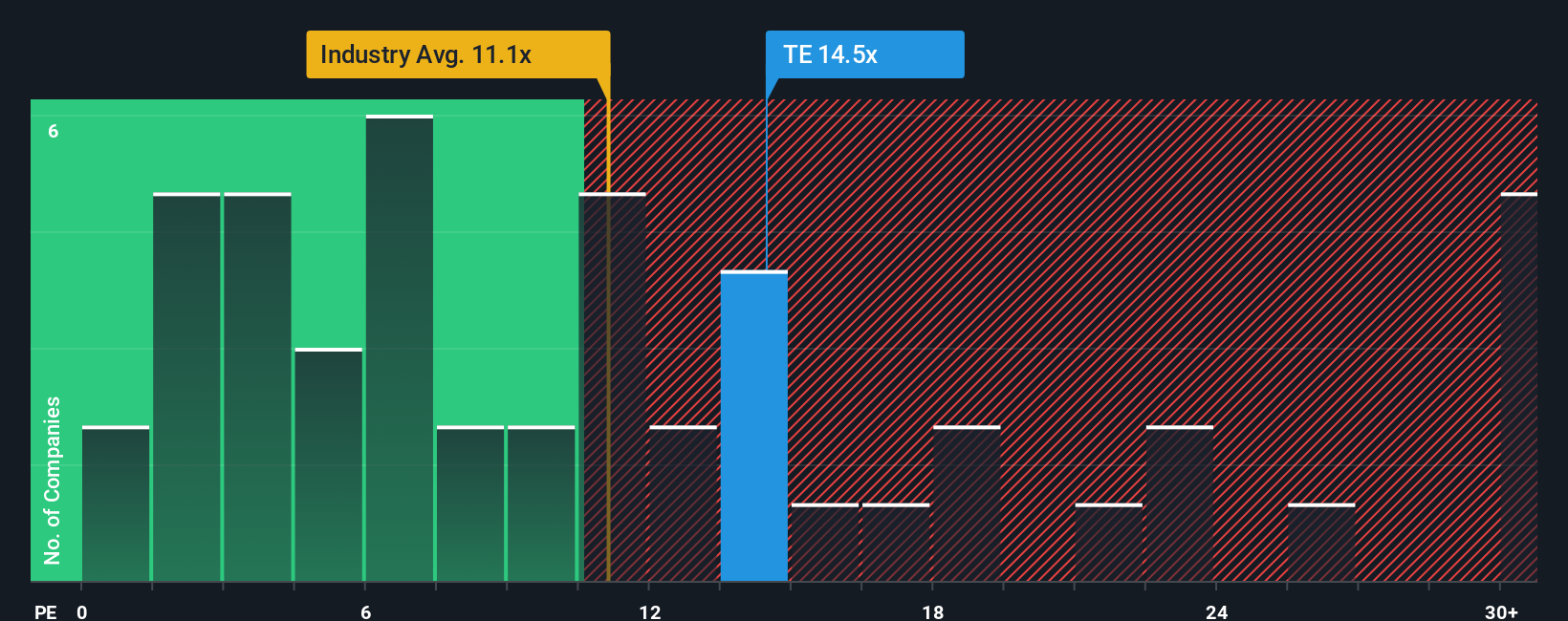

It's not a stretch to say that Technip Energies N.V.'s (EPA:TE) price-to-earnings (or "P/E") ratio of 14.5x right now seems quite "middle-of-the-road" compared to the market in France, where the median P/E ratio is around 16x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Technip Energies certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Technip Energies

How Is Technip Energies' Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Technip Energies' to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 9.3%. Pleasingly, EPS has also lifted 41% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the twelve analysts covering the company suggest earnings should grow by 12% each year over the next three years. That's shaping up to be similar to the 13% each year growth forecast for the broader market.

In light of this, it's understandable that Technip Energies' P/E sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On Technip Energies' P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Technip Energies' analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. Unless these conditions change, they will continue to support the share price at these levels.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Technip Energies with six simple checks on some of these key factors.

You might be able to find a better investment than Technip Energies. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Technip Energies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:TE

Technip Energies

Operates as an engineering and technology company for the energy transition in Europe, Central Asia, the Asia Pacific, Africa, the Middle East, and the Americas.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026