As the European Central Bank's recent rate cuts fuel optimism for further monetary easing, France's CAC 40 Index has shown modest gains, reflecting a resilient market environment. In such conditions, dividend stocks on Euronext Paris can offer investors a blend of income and potential stability, making them an attractive option amidst evolving economic landscapes.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Vicat (ENXTPA:VCT) | 5.77% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 8.01% | ★★★★★★ |

| Électricite de Strasbourg Société Anonyme (ENXTPA:ELEC) | 8.08% | ★★★★★☆ |

| Arkema (ENXTPA:AKE) | 4.28% | ★★★★★☆ |

| VIEL & Cie société anonyme (ENXTPA:VIL) | 3.64% | ★★★★★☆ |

| Samse (ENXTPA:SAMS) | 6.47% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA) | 5.55% | ★★★★★☆ |

| Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.82% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 8.00% | ★★★★★☆ |

| Eiffage (ENXTPA:FGR) | 4.69% | ★★★★☆☆ |

Click here to see the full list of 32 stocks from our Top Euronext Paris Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

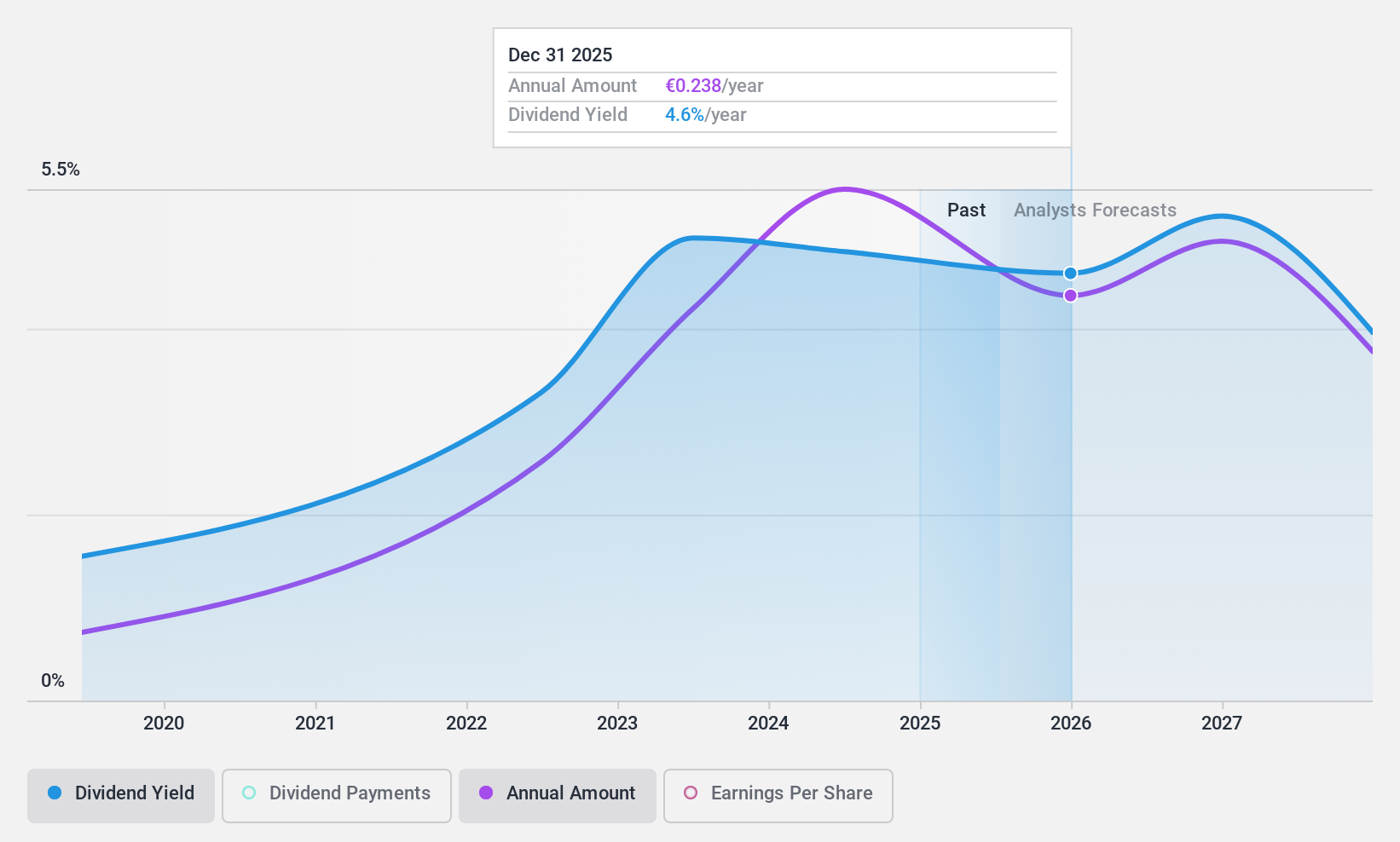

Fleury Michon (ENXTPA:ALFLE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fleury Michon SA is a company that produces and sells food products both in France and internationally, with a market cap of €100.54 million.

Operations: Fleury Michon's revenue is primarily derived from its Division GMS France segment, contributing €679.59 million, and its International Division, which adds €91.20 million.

Dividend Yield: 5.4%

Fleury Michon reported strong earnings growth for the first half of 2024, with net income rising to €46.7 million from €1.2 million a year ago, despite a decline in sales. The company's dividend is well-covered by both earnings and cash flow, with payout ratios of 34.1% and 12.6%, respectively. However, its dividend history has been volatile over the past decade, presenting some reliability concerns despite recent increases in payouts.

- Delve into the full analysis dividend report here for a deeper understanding of Fleury Michon.

- Our comprehensive valuation report raises the possibility that Fleury Michon is priced lower than what may be justified by its financials.

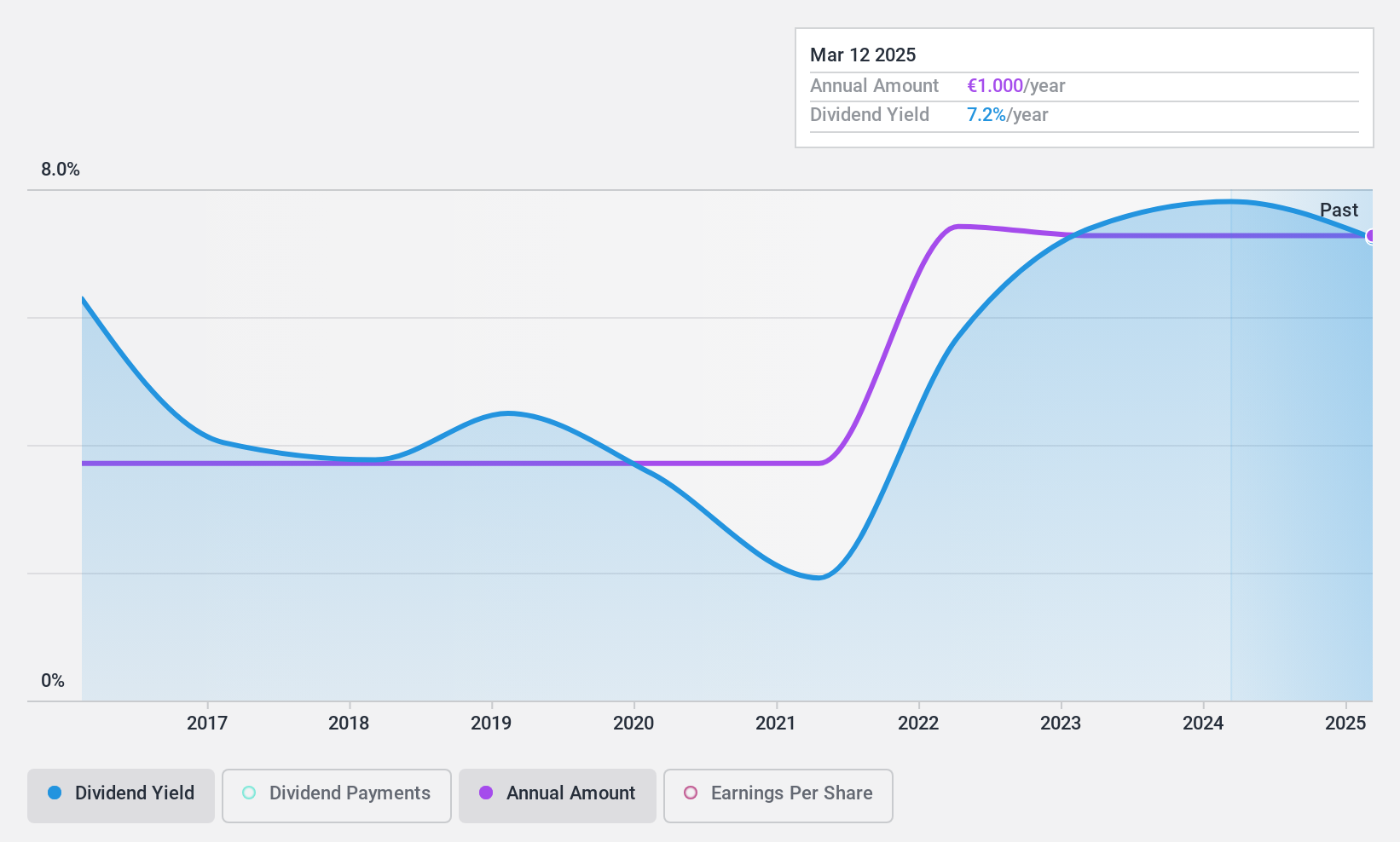

Piscines Desjoyaux (ENXTPA:ALPDX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Piscines Desjoyaux SA designs, manufactures, and markets swimming pools and related products in France and internationally, with a market cap of €112.18 million.

Operations: Piscines Desjoyaux SA generates its revenue through the design, manufacture, and sale of swimming pools and related products both domestically in France and on an international scale.

Dividend Yield: 8%

Piscines Desjoyaux's dividend payments have been stable and growing over the past decade, placing them among the top 25% of French dividend payers with an 8% yield. However, concerns arise as this dividend is not well covered by free cash flows and has a high cash payout ratio of 486.2%, indicating potential sustainability issues despite a reasonable earnings payout ratio of 72.5%. The stock trades at 18.7% below its estimated fair value.

- Click here to discover the nuances of Piscines Desjoyaux with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Piscines Desjoyaux's share price might be too pessimistic.

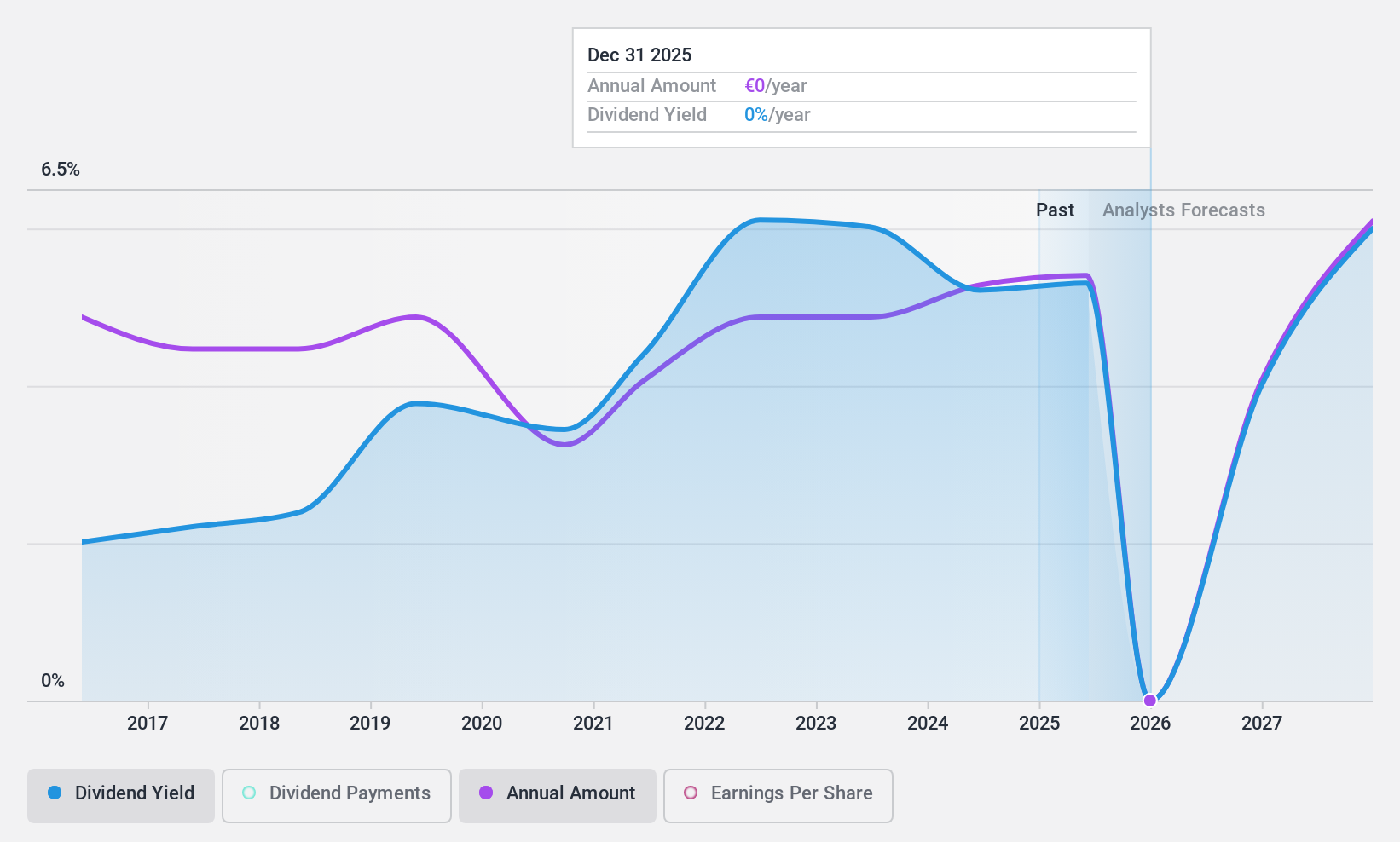

Etablissements Maurel & Prom (ENXTPA:MAU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Etablissements Maurel & Prom S.A. is involved in the exploration and production of oil, gas, and hydrocarbons across Gabon, Tanzania, Angola, Colombia, and France with a market cap of €989.87 million.

Operations: Etablissements Maurel & Prom S.A.'s revenue is primarily derived from its production segment, which accounts for $658.76 million, complemented by its drilling operations generating $30.57 million.

Dividend Yield: 6%

Etablissements Maurel & Prom's dividend yield of 6.02% ranks in the top 25% among French dividend payers, supported by a low payout ratio of 25.5%. The dividends are well covered by cash flows with a cash payout ratio of 36.9%, indicating sustainability. However, the company's five-year dividend history shows volatility and unreliability, with payments dropping over 20% annually at times. Despite this, it trades at a significant discount to its estimated fair value.

- Click to explore a detailed breakdown of our findings in Etablissements Maurel & Prom's dividend report.

- The valuation report we've compiled suggests that Etablissements Maurel & Prom's current price could be quite moderate.

Make It Happen

- Unlock our comprehensive list of 32 Top Euronext Paris Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALFLE

Fleury Michon

Produces and sells food products in France and internationally.

Excellent balance sheet, good value and pays a dividend.