- France

- /

- Aerospace & Defense

- /

- ENXTPA:SAF

3 Stocks On Euronext Paris Estimated Up To 40.8% Below Intrinsic Value

Reviewed by Simply Wall St

As the European Central Bank's recent rate cuts have spurred optimism across European markets, France's CAC 40 Index has seen a modest gain of 0.46%, reflecting cautious investor sentiment amid broader economic adjustments. In this environment, identifying undervalued stocks can be advantageous for investors seeking opportunities that may offer potential value relative to their intrinsic worth.

Top 10 Undervalued Stocks Based On Cash Flows In France

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Antin Infrastructure Partners SAS (ENXTPA:ANTIN) | €10.44 | €15.95 | 34.6% |

| SPIE (ENXTPA:SPIE) | €35.14 | €53.99 | 34.9% |

| Tikehau Capital (ENXTPA:TKO) | €22.10 | €30.50 | 27.6% |

| NSE (ENXTPA:ALNSE) | €29.30 | €57.64 | 49.2% |

| Vivendi (ENXTPA:VIV) | €10.235 | €17.92 | 42.9% |

| EKINOPS (ENXTPA:EKI) | €4.115 | €7.00 | 41.2% |

| Groupe Berkem Société anonyme (ENXTPA:ALKEM) | €3.07 | €5.11 | 39.9% |

| Vogo (ENXTPA:ALVGO) | €3.17 | €6.25 | 49.2% |

| Exail Technologies (ENXTPA:EXA) | €18.10 | €30.57 | 40.8% |

| OVH Groupe (ENXTPA:OVH) | €7.85 | €12.53 | 37.3% |

Let's uncover some gems from our specialized screener.

Exail Technologies (ENXTPA:EXA)

Overview: Exail Technologies offers solutions in robotics, maritime, navigation, aerospace, and photonics technologies both in France and internationally, with a market cap of €307.59 million.

Operations: The company generates revenue from two main segments: Advanced Technologies (€87.52 million) and Navigation & Maritime Robotics (€252.35 million).

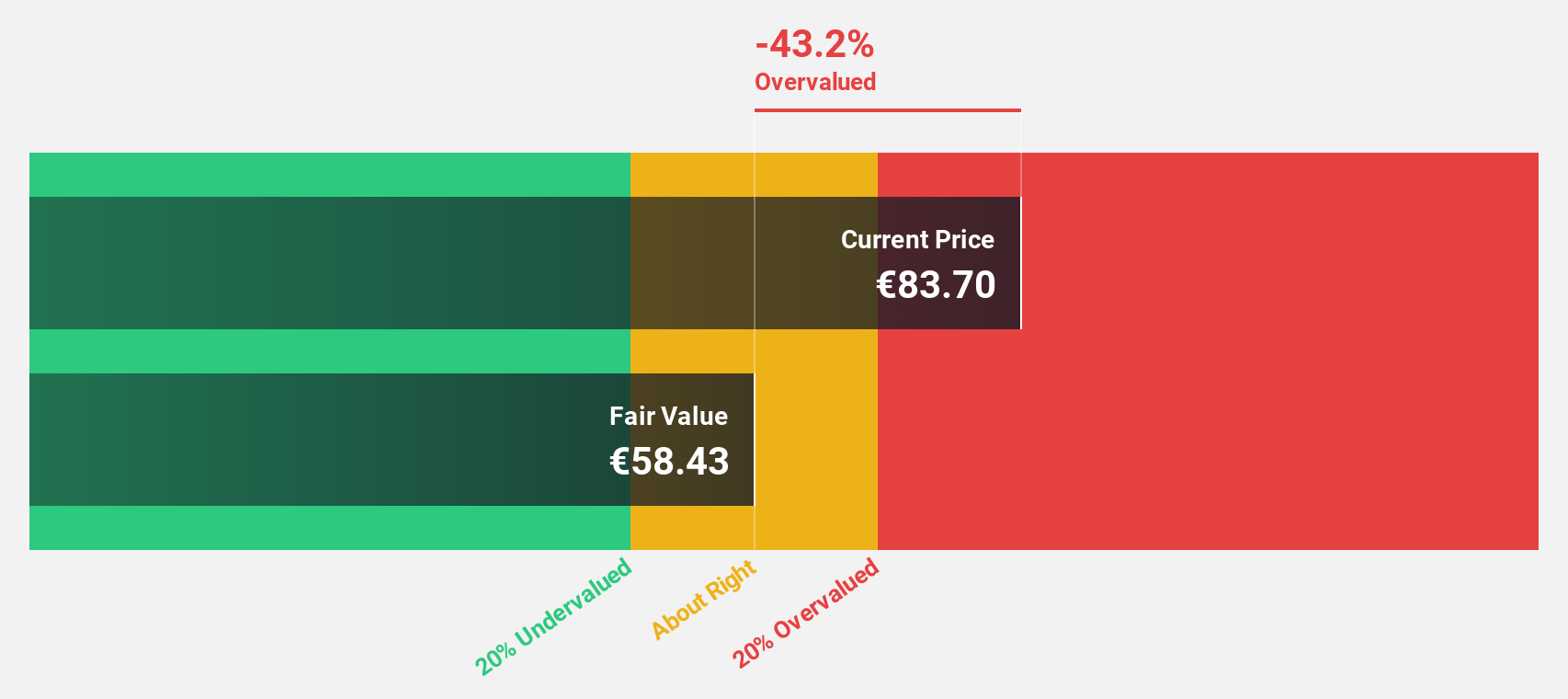

Estimated Discount To Fair Value: 40.8%

Exail Technologies is trading at €18.1, significantly below its estimated fair value of €30.57, indicating it may be undervalued based on cash flows. Despite a net loss of €3.71 million for the first half of 2024, revenue is forecast to grow at 14.3% annually, outpacing the French market's growth rate and supporting future profitability within three years. Analysts agree on a potential price rise by 28.7%, highlighting its good relative value compared to peers and industry standards.

- Our comprehensive growth report raises the possibility that Exail Technologies is poised for substantial financial growth.

- Navigate through the intricacies of Exail Technologies with our comprehensive financial health report here.

OVH Groupe (ENXTPA:OVH)

Overview: OVH Groupe S.A. is a global provider of public and private cloud services, shared hosting, and dedicated server solutions, with a market cap of approximately €1.49 billion.

Operations: The company's revenue is primarily derived from its Private Cloud segment (€589.61 million), followed by Web Cloud & Other (€185.43 million) and Public Cloud (€169.01 million).

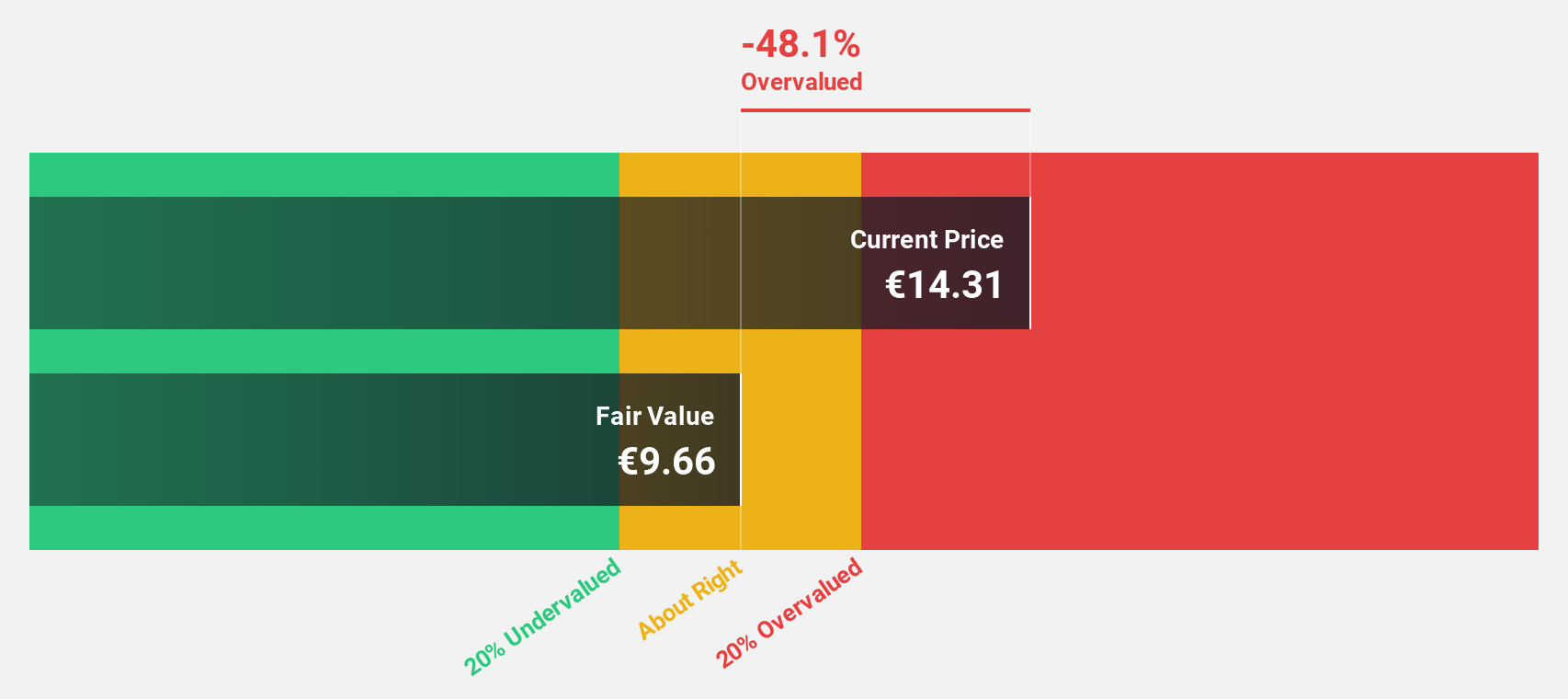

Estimated Discount To Fair Value: 37.3%

OVH Groupe, trading at €7.85, is undervalued with an estimated fair value of €12.53. Despite recent share price volatility, its earnings are projected to grow significantly at 101.37% annually, surpassing the French market's revenue growth rate of 5.6% with a forecasted 9.7%. Although OVH's return on equity remains low and profitability is expected within three years, it offers compelling value based on discounted cash flow analysis.

- According our earnings growth report, there's an indication that OVH Groupe might be ready to expand.

- Unlock comprehensive insights into our analysis of OVH Groupe stock in this financial health report.

Safran (ENXTPA:SAF)

Overview: Safran SA, along with its subsidiaries, operates in the aerospace and defense sectors globally and has a market capitalization of approximately €88.49 billion.

Operations: The company's revenue is primarily derived from Aerospace Propulsion (€12.66 billion), Aeronautical Equipment, Defense and Aerosystems (€9.91 billion), and Aircraft Interiors (€2.73 billion).

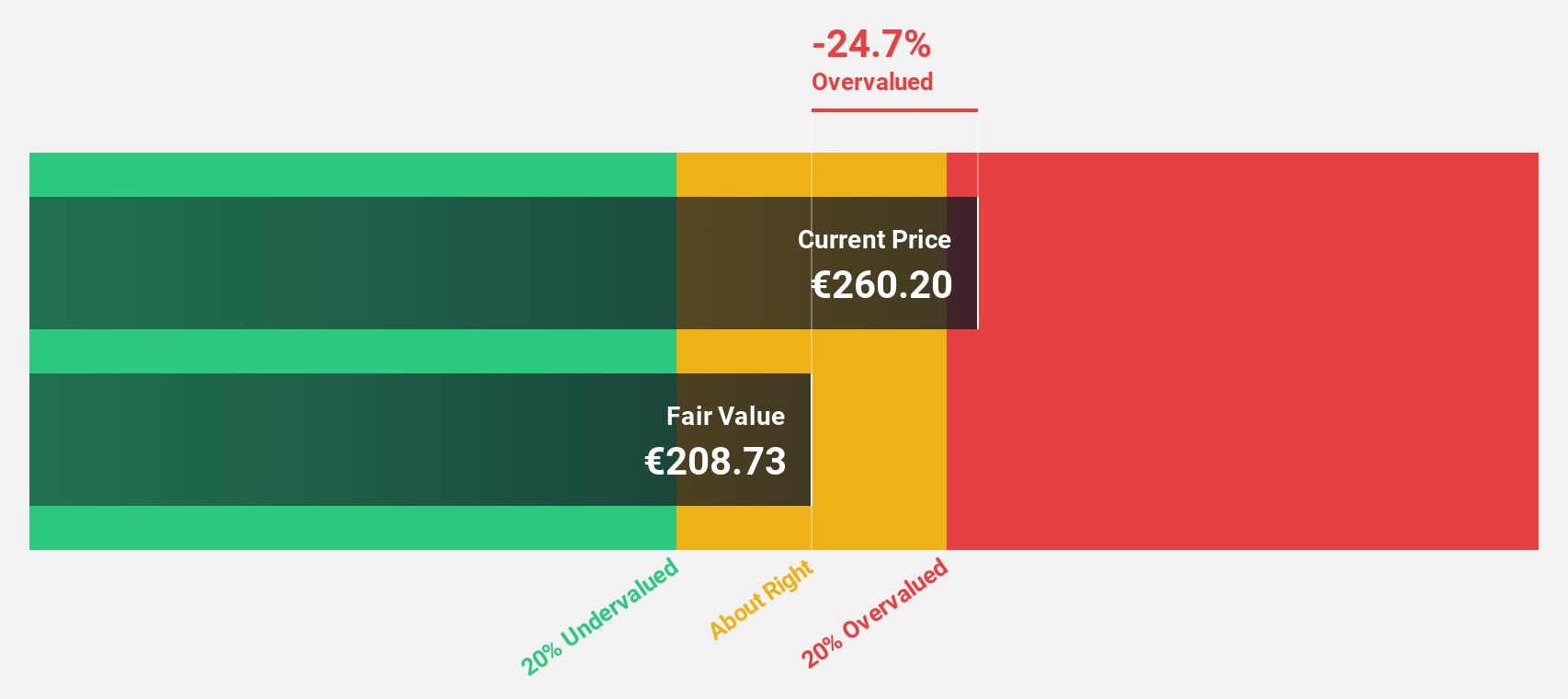

Estimated Discount To Fair Value: 26.1%

Safran SA, trading at €210.5, is undervalued with a fair value estimate of €284.69. Despite a recent drop in net income to €57 million for the first half of 2024, its earnings are forecasted to grow annually by 19.5%, outpacing the French market's growth rate of 12.1%. While profit margins have decreased from last year, Safran's revenue is expected to grow at 10.3% per year, faster than the market average.

- The analysis detailed in our Safran growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Safran's balance sheet health report.

Where To Now?

- Unlock our comprehensive list of 19 Undervalued Euronext Paris Stocks Based On Cash Flows by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SAF

Excellent balance sheet with reasonable growth potential.