- France

- /

- Oil and Gas

- /

- ENXTPA:MAU

Market Still Lacking Some Conviction On Etablissements Maurel & Prom S.A. (EPA:MAU)

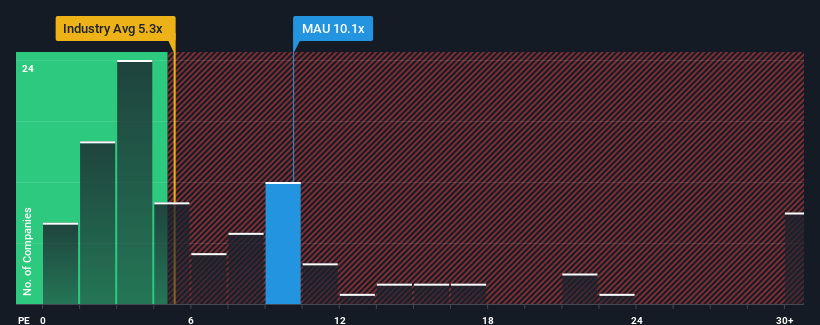

Etablissements Maurel & Prom S.A.'s (EPA:MAU) price-to-earnings (or "P/E") ratio of 10.1x might make it look like a buy right now compared to the market in France, where around half of the companies have P/E ratios above 15x and even P/E's above 27x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Etablissements Maurel & Prom hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for Etablissements Maurel & Prom

Does Growth Match The Low P/E?

Etablissements Maurel & Prom's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 47%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 23% each year over the next three years. That's shaping up to be materially higher than the 11% per year growth forecast for the broader market.

With this information, we find it odd that Etablissements Maurel & Prom is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Etablissements Maurel & Prom's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Etablissements Maurel & Prom's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Etablissements Maurel & Prom that you need to be mindful of.

Of course, you might also be able to find a better stock than Etablissements Maurel & Prom. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Etablissements Maurel & Prom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:MAU

Etablissements Maurel & Prom

Engages in exploration and production of oil and gas, and hydrocarbons in Gabon, Tanzania, Angola, and Venezuela.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives