As European markets navigate the turbulence caused by escalating trade tensions, with the STOXX Europe 600 Index recently ending lower amid these challenges, investors are increasingly on the lookout for resilient opportunities that can weather such volatility. In this environment, identifying stocks with strong fundamentals and potential for growth becomes crucial; Italmobiliare and two other lesser-known companies in Europe may offer such promise as undiscovered gems worth exploring.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Linc | NA | 19.35% | 23.17% | ★★★★★★ |

| Martifer SGPS | 123.58% | -2.38% | 5.61% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| Dekpol | 73.04% | 15.36% | 16.35% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.64% | 21.96% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Italmobiliare (BIT:ITM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Italmobiliare S.p.A. is an investment holding company that manages a diverse portfolio of equity and other investments across the financial and industrial sectors both in Italy and internationally, with a market capitalization of approximately €983.08 million.

Operations: The primary revenue contributors for Italmobiliare include Caffè Borbone (€334.53 million), Italmobiliare itself (€140.15 million), and Italgen (€66.80 million). The company also generates income from Capitelli, SIDI Sport, and Officina Profumo-Farmaceutica Di Santa Maria Novella among others, with each contributing between €11.57 million and €69.97 million to the total revenue stream.

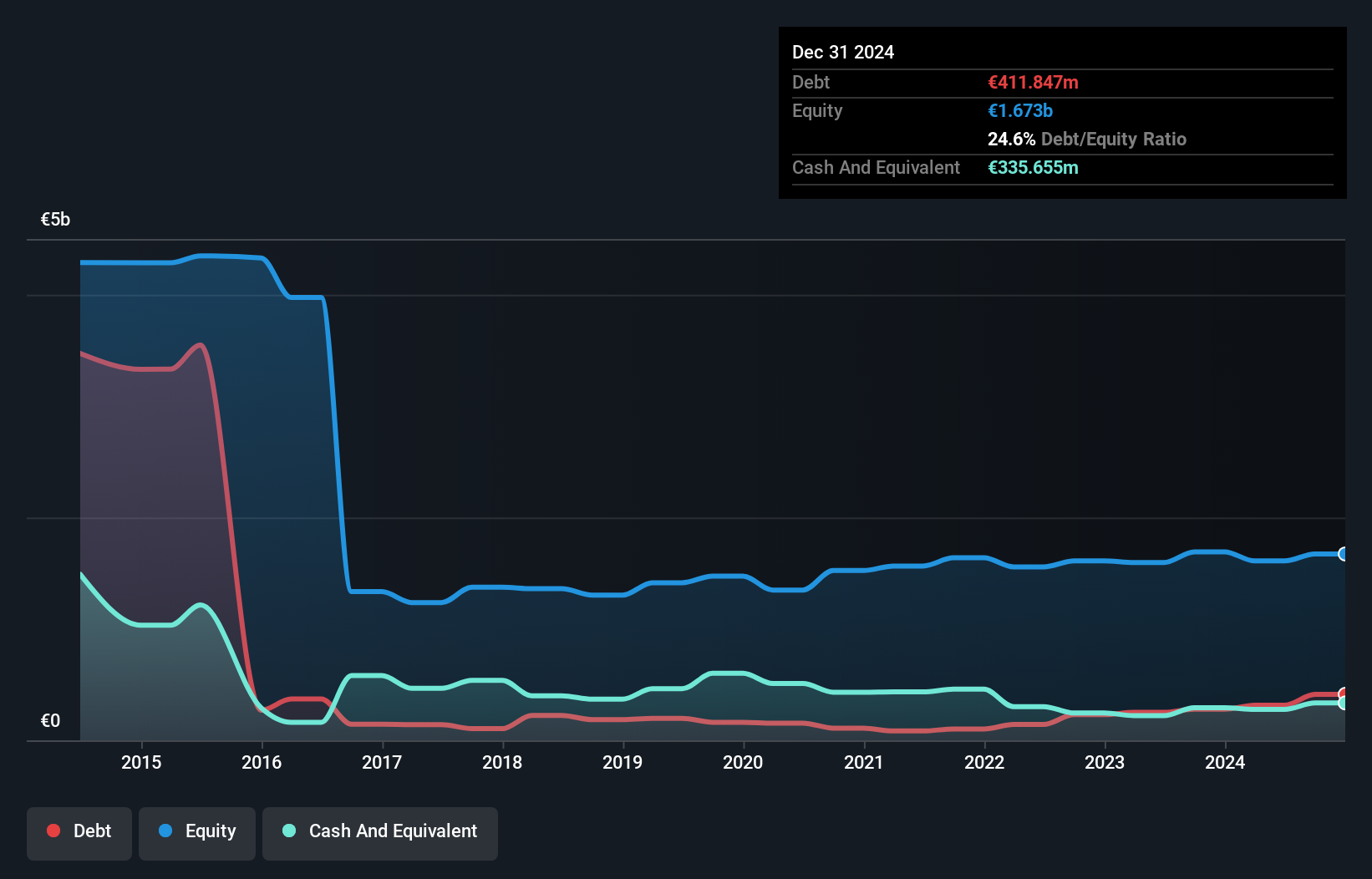

Italmobiliare, a noteworthy player in the European investment landscape, shows promise with its earnings growing by 41% over the past year. The company's interest payments are comfortably covered by EBIT at 5.6 times, indicating financial stability. With a net debt to equity ratio of 4.6%, it maintains a satisfactory debt level compared to industry standards. Trading at a price-to-earnings ratio of 10.5x, it's positioned attractively against the Italian market average of 14.2x. Despite not being free cash flow positive recently, Italmobiliare's high-quality earnings and growth outpacing industry averages highlight its potential value.

- Unlock comprehensive insights into our analysis of Italmobiliare stock in this health report.

Review our historical performance report to gain insights into Italmobiliare's's past performance.

Faes Farma (BME:FAE)

Simply Wall St Value Rating: ★★★★★★

Overview: Faes Farma, S.A. is engaged in the research, development, production, and marketing of pharmaceutical and healthcare products as well as raw materials on a global scale, with a market capitalization of approximately €1.20 billion.

Operations: Faes Farma generates revenue primarily from its Pharmaceutical Specialties and Healthcare segment, which accounts for €455.21 million, followed by the Nutrition and Animal Health segment at €52.20 million.

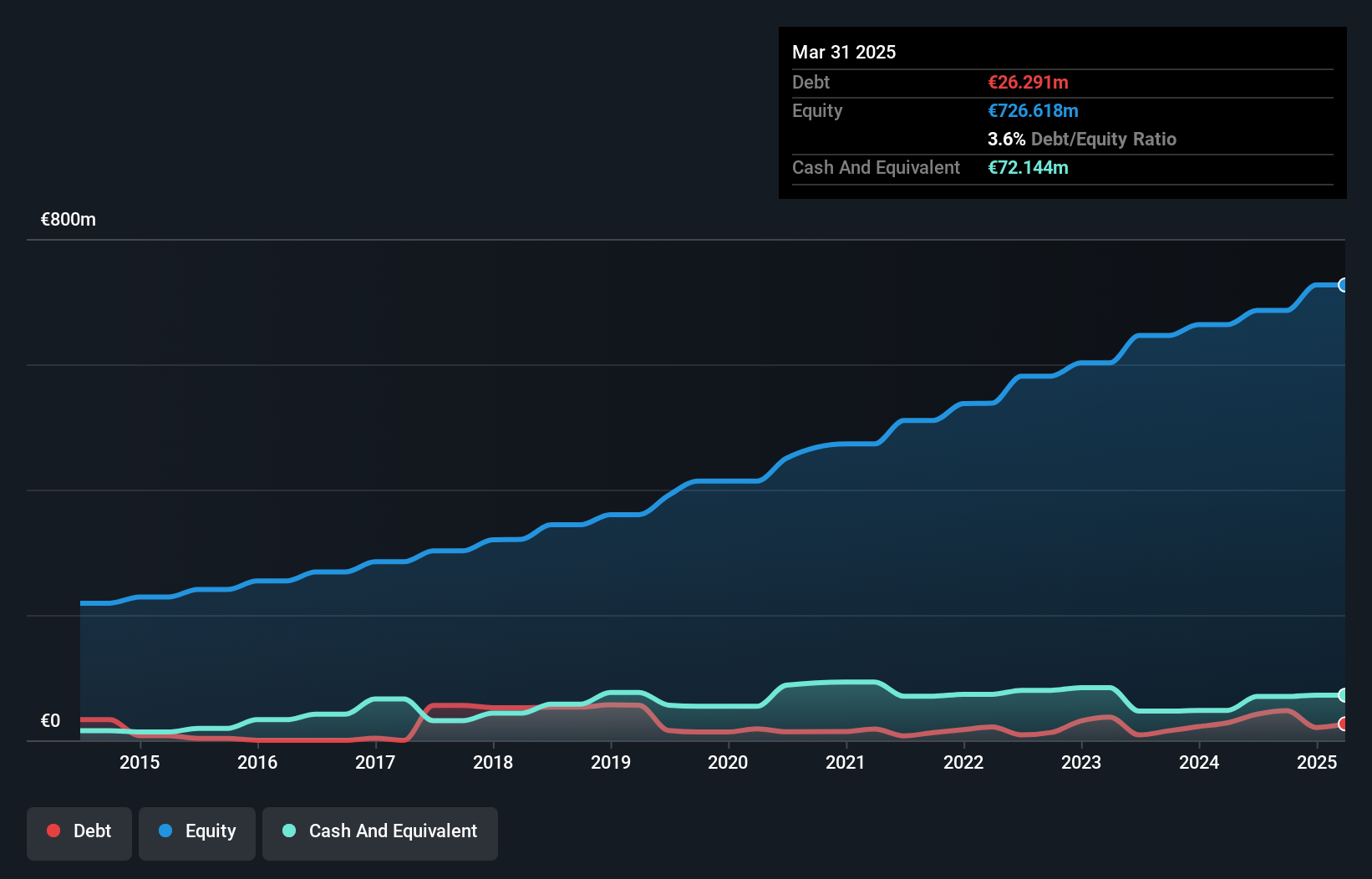

Faes Farma, a promising player in the pharmaceuticals sector, has demonstrated impressive earnings growth of 21.2% over the past year, outpacing the industry average of 19.8%. Trading at 29% below its estimated fair value, it offers an attractive entry point for investors. The company has effectively managed its debt levels, reducing its debt-to-equity ratio from 3.2 to 2.8 over five years and maintaining more cash than total debt. With free cash flow remaining positive and interest payments well covered by EBIT at a staggering 250 times coverage, Faes Farma appears financially robust despite forecasts suggesting potential earnings decline ahead.

- Navigate through the intricacies of Faes Farma with our comprehensive health report here.

Examine Faes Farma's past performance report to understand how it has performed in the past.

Etablissements Maurel & Prom (ENXTPA:MAU)

Simply Wall St Value Rating: ★★★★★★

Overview: Etablissements Maurel & Prom S.A. is involved in the exploration and production of oil, gas, and hydrocarbons across Gabon, Tanzania, Angola, Colombia, and France with a market cap of €896.52 million.

Operations: The company generates revenue primarily from the exploration and production of oil and gas. It operates across multiple regions, including Gabon, Tanzania, Angola, Colombia, and France.

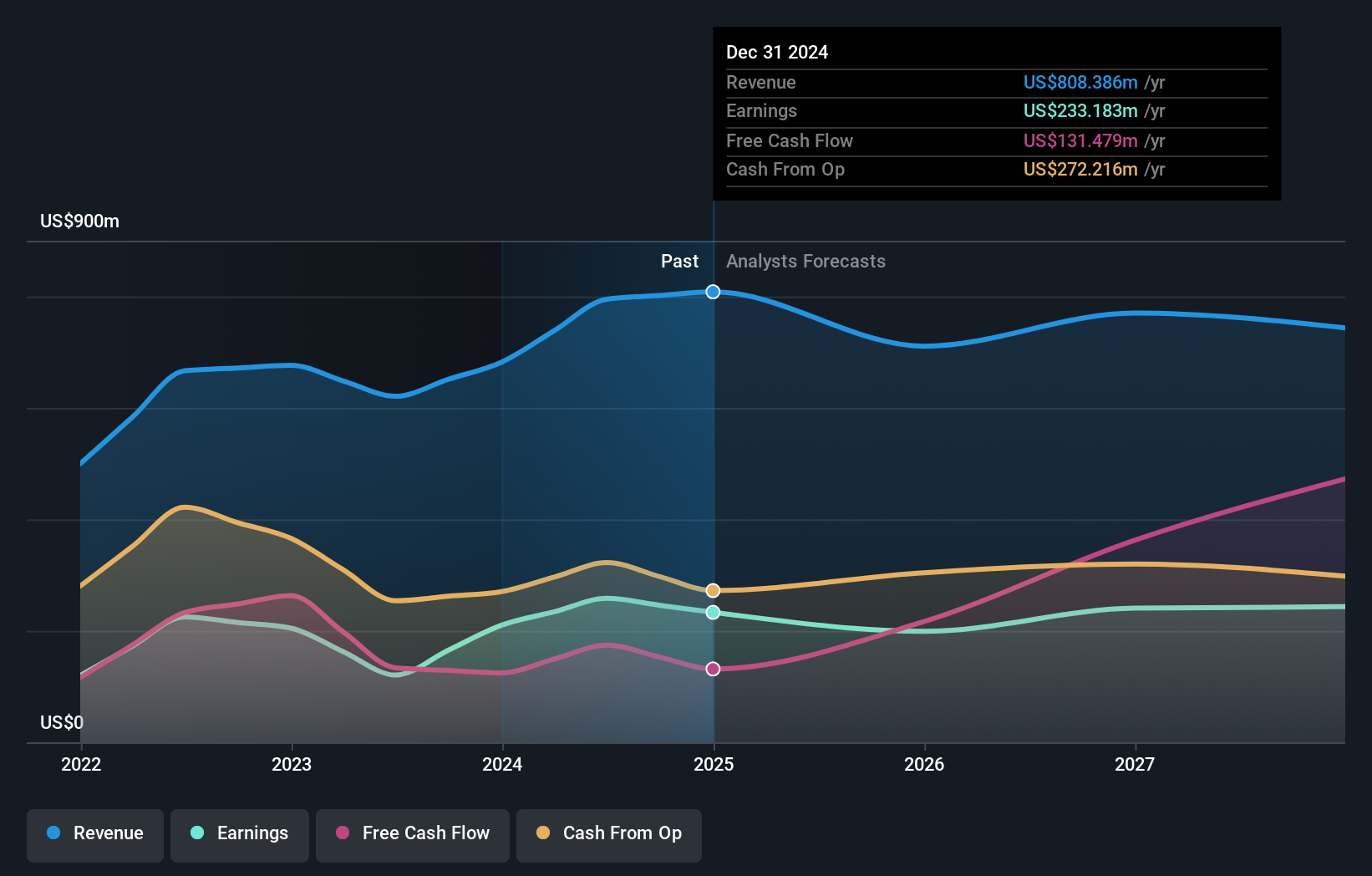

Etablissements Maurel & Prom, with its reduced debt-to-equity ratio from 61.4% to 17.9% over five years, has shown financial prudence. Earnings grew by 10.8%, outpacing the oil and gas industry's -29.9%. The company is trading at a significant discount of 87.5% below estimated fair value, suggesting potential upside for investors seeking value plays in energy markets. Recently, M&P announced a $150 million acquisition of a 40% interest in Colombia's Sinu-9 gas license, indicating strategic expansion efforts bolstered by sufficient cash resources and credit facilities totaling $260 million as of December 2024.

Key Takeaways

- Unlock more gems! Our European Undiscovered Gems With Strong Fundamentals screener has unearthed 353 more companies for you to explore.Click here to unveil our expertly curated list of 356 European Undiscovered Gems With Strong Fundamentals.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:FAE

Faes Farma

Researches, develops, produces, and markets pharmaceutical products, healthcare products, and raw materials worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives